The BTC (Bitcoin) market was extremely unstable final week and is underneath robust weak point. Throughout this era, Bitcoin fell to $ 80,000 at a low worth of greater than 15%. Apparently, GlassNode, a blockchain evaluation firm, offered in -depth evaluation of the investor's conduct resulting from this worth drop that emphasizes cohort with the most important losses resulting from this worth drop.

BTC 1 ~ 1 week holder is main market liquidation strain.

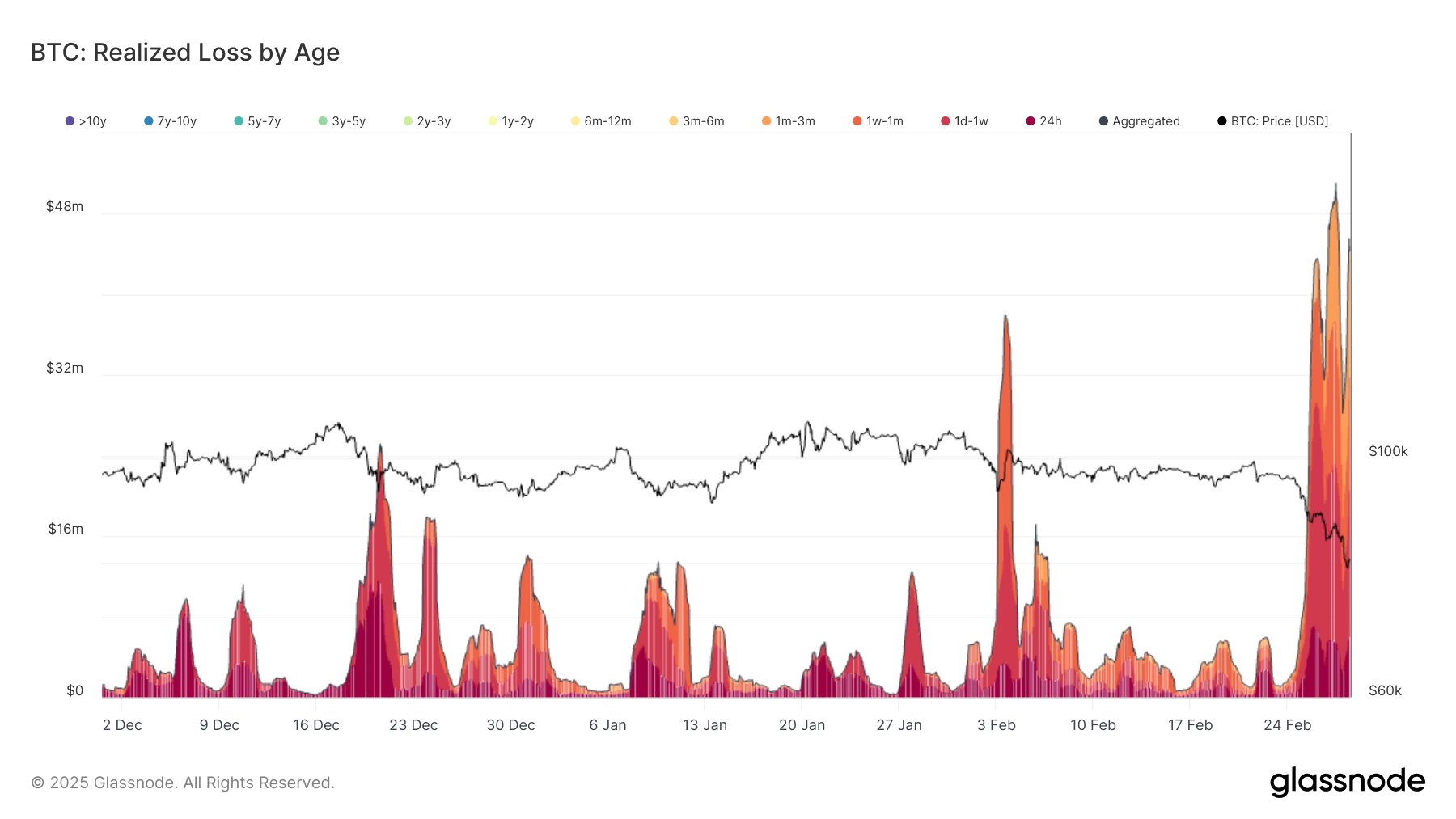

On Friday, February 28, Bitcoin reached the final worth degree in November 2024 and fell to lower than $ 80,000. In consequence, the BTC market recorded a realization of $ 665 million along with $ 21.6 billion along with $ 21.6 billion between February 25-27. Not too long ago, GlassNode analysts have entered the market promoting on Friday, indicating that this current give up is principally concentrated between brief -term holders (STH), which realizes losses at a lot larger pace than lengthy -term holders.

Within the report of GlassNode, STH's most affected Cohort was a brand new market participant final week, as proven subsequent week. One week to 1 week to 1 week, 1 to 1 month to $ 18.7 million, 3 months to $ 13.2 million ($ 13.2 million) ($ 24 million). Nonetheless, it’s price noting that holders of the final three to 6 months have skilled important surge in realization. The group recorded $ 12.7 million resulting from a loss that was realized on Friday, up 95.4% of yesterday.

Additional, GlassNode's report realized that on Friday, the value quickly deepened the common ratio of Bitcoin losses to $ 57.1 million per hour. The pace of realization per cohort, which occupies a lot of the market loss, is as follows. One to 1 week holder for 1 week/hour per week, 1 month to 1 month to 1 month -13.9 million {dollars} ($ 13.9 million), 1 month to three to 24 hours consumers ($ 8.04 million/hour).

As anticipated, the cohort is a dominant drive in inducing fluid strain for one to 1 week, and the lack of loss is sort of twice that of the subsequent largest group.

Bitcoin lengthy -term holders keep a agency state

Based on extra knowledge from the GlassNode report, the long-term Bitcoin long-term holder of the final 6-12 months has proven a minimal lack of losses regardless of a variety of market cap.

This growth is a robust belief in lengthy -term buyers, indicating that there are not any rumors of current gross sales and worth modifications. Bitcoin is traded at $ 85,200 after the value restoration on Friday. Nonetheless, weekly losses stay at 11.34%, indicating the present weak point out there.

Chart of TradingView, the primary picture of getty photographs