Hive Digital plans to extend its hash charge 4 occasions by September 2025, probably inserting the scale into the highest 10 public Bitcoin miners. On the identical time, HPC has an ARR goal of $100 million. Is that this small miner a chance that’s typically neglected?

Hive Digital goals for growth and HPC income

The next visitor posts are posted by bitcoinminingStock.io, a one-stop hub for all of Bitcoin Mining Shares, Instructional Instruments and Business Insights. Initially revealed on February 27, 2025, it was written by Cindy Feng, writer of bitcoinminingstock.io.

For a very long time, the largest identify in Bitcoin mining has attracted all the eye, however what about small names? This yr I'm launching a brand new collection to highlight small miners who typically fly below the radar. A few of these firms may rise as future stars, whereas others wrestle to outlive. Understanding them now can assist you uncover hidden alternatives and be taught precious classes. This collection breaks down the basics of their enterprise, monetary, strategic orientation and market positioning. It offers you a transparent, unfiltered view of their strengths, weaknesses and potential investments.

First: Hive Digital Expertisea multilisted Bitcoin miner uncovered to each mining and excessive efficiency computing (HPC).

Firm overview

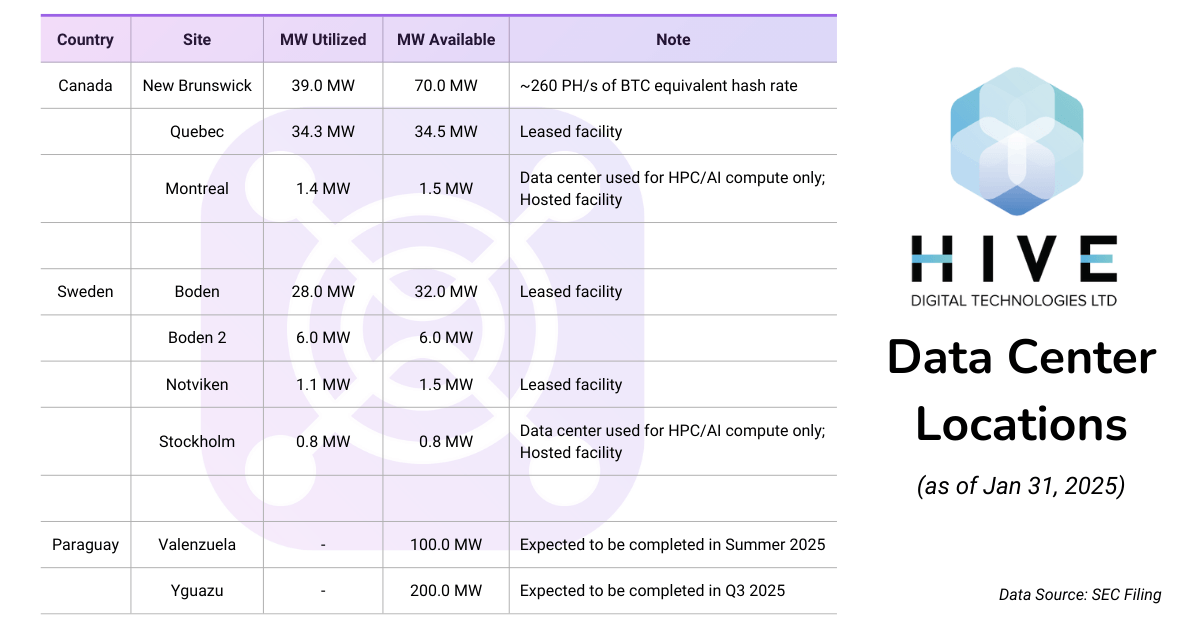

Hive Digital Applied sciences (TSX.V: HIVE; NASDAQ: HIVE) is a public information middle operator centered on digital asset mining and HPC. In December 2024, we introduced that our headquarters can be relocated. San Antonio, Texas, USA. The corporate has information facilities based mostly on a number of areas Canada, Sweden and shortly Paraguay. It’s identified for that Dedication to inexperienced vitality, It primarily makes use of hydroelectric energy and geothermal energy to advertise its operation.

Enterprise Arm

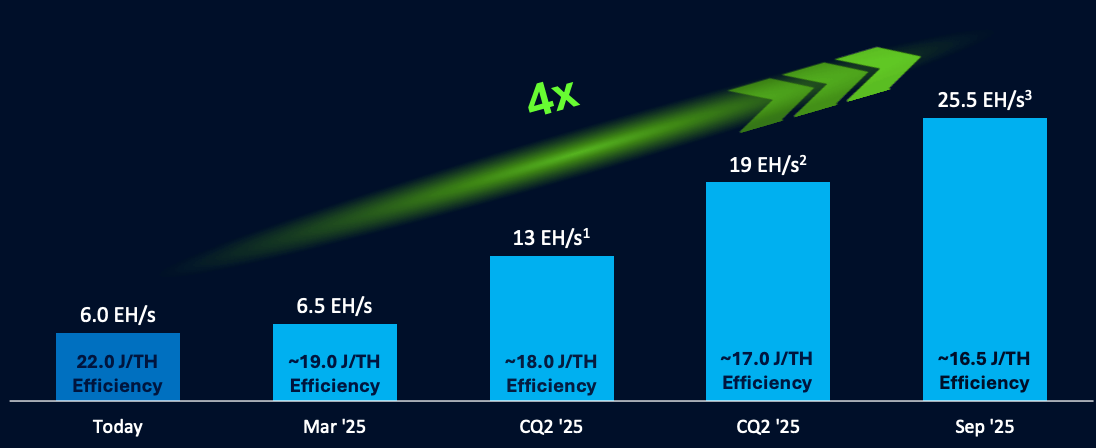

- Mining operations:We function the whole hashrate 6 eh/ss (as of January 31, 2025) there’s an aggressive growth plan to succeed in it 25 eh/s by September 2025.

Hive Plan for 4x Hashrate Development by September 2025 (screenshots from firm presentation)

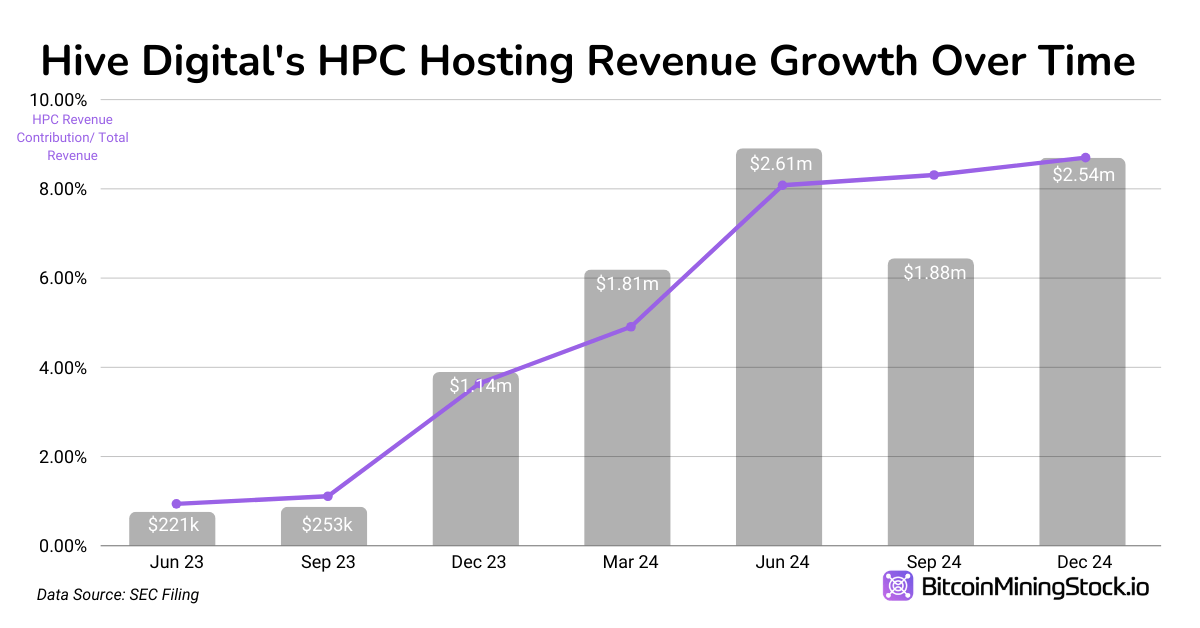

- HPC & AI Computing:Hive was one of many first public miners to pivot into HPC, leveraging their experience in GPU-based Ethereum mining. Already 2023the corporate reported income of $1.61 million from HPC Internet hosting. In the present day, HIVE continues to make use of present information centres in Montreal (Canada) and Stockholm (Sweden) for HPC companies. Moreover, the corporate will supply GPU server leases by Market Aggregators and discover new cloud service companies.

Monetary highlights: Declining income and rising profitability

Be aware: Hive presents monetary comparisons over varied durations inside it Newest Experiences. Earnings and Loss Assertion Following a typical comparability of the earlier yr (December 31, 2024, December 31, 2023), Stability sheet In the meantime, it will likely be in comparison with March 31, 2024 Money stream assertion Use a 9-month comparability (December 31, 2024, December 31, 2023). To make sure consistency and promote significant evaluation, this report focuses totally on out there year-over-year comparisons.

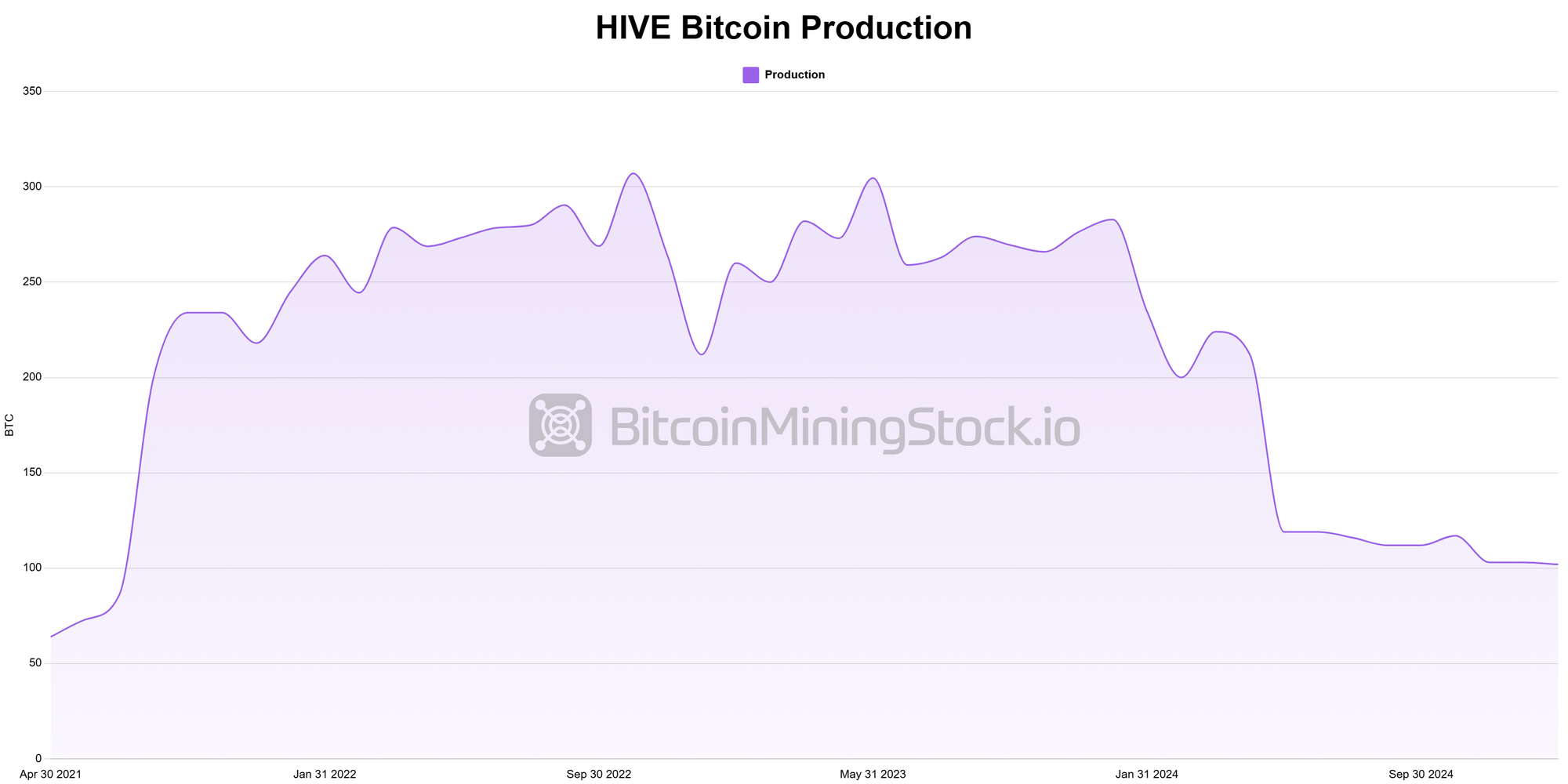

Hive Digital Applied sciences' third quarter of 2025 (October 1 to December 31, 2024) noticed a decline in income in comparison with the earlier yr. The primary purpose for the decline was low BTC manufacturing because of the Bitcoin Harving occasion in April 2024. Nevertheless, the corporate has undergone a serious shift in internet revenue ($1.27 million vs. $6.95 million), benefiting from rising Bitcoin costs, HPC enterprise and value optimization.

Key Earnings Assertion Indicators

- Income: $29.2 million (-6.5% year-on-year) vs. $31.3 million for the third quarter of 2024. This discount is Bitcoin mining income decline (beforehand -11.3%) Following Bitcoin Harving in April 2024, manufacturing is low (BTC vs. 830 BTC within the third quarter 2024). however, Bitcoin value rise And robust HPC Income Development (+123.6% reached $2.5 million within the earlier yr) offset the decline.

- Adjusted EBITDA: $17.3 million (vs. ($17.4 million for the third quarter of 2024).

- Internet revenue: $1.3 million (vs. ($7.0 million internet loss for the third quarter of 2024). The swing to profitability was pushed by a A $6.9 million improve in asset gross sales, Foreign exchange revenue of $5.7 millionenhancing cost-effectiveness regardless of decrease gross revenue margins than final yr.

- Whole margin: 21% (vs. 36% of the third quarter of 2024))is affected by a Quickly rising community problem (99.9t vs. 64.1t Yoy) and Larger vitality prices, In Sweden, particularly, modifications in tax coverage have led to elevated electrical energy prices.

- Bitcoin manufacturing: 322 BTC (-61% earlier than) vs. 830 BTC for the third quarter of 2024 Bitcoin Harving Occasion Decreased mining rewards regardless of improved total hashrate and effectivity of hives.

Public Bitcoin Miner historic information is accessible at bitcoinminingStock.io.

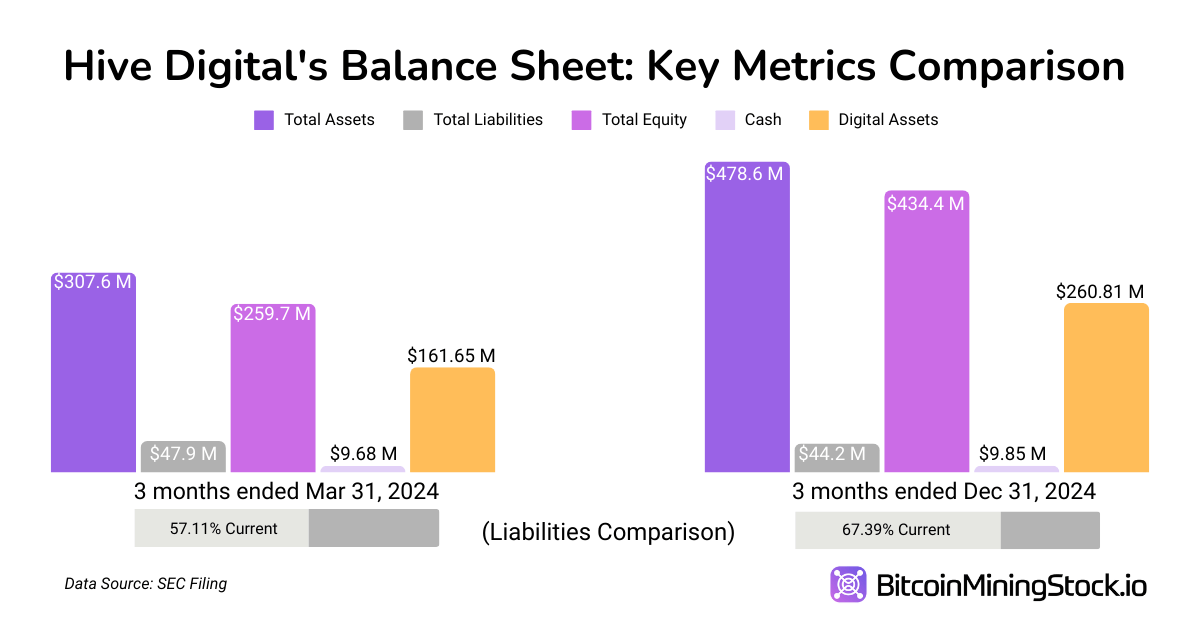

Key Stability Sheet Metrics (3 months ended December 31, 2024, 3 months ended March 31, 2024)

- Whole belongings: 478.6 million {dollars} (+55.6%) vs. $307.6 million. Elevated was pushed Larger Bitcoin Holding (2,805 BTC) and Steady funding in mining infrastructureparticularly Paraguay's fleet upgrades and new information middle growth.

- Present Whole Debt: 29.8 million {dollars} (+8.8% ) vs. $27.4 million. The rise is mirrored Larger short-term obligations associated to infrastructure funding.

- Lengthy-term debt: 14.4 million {dollars} (-29.8%) vs. $20 million. The decline is because of continued debt repayments and improves the Hive's monetary stability whereas sustaining adequate liquidity for growth.

- Shareholder equity: $434.4 million (+67.3%) Towards $259.7 million. Fairness progress was pushed by profitable inventory choices, larger asset valuations and sustained income.

- D/E ratio:0.10 (vs. 0.18). The corporate maintained very low leverage, Use Fairness Elevate Not debt to fund growth.

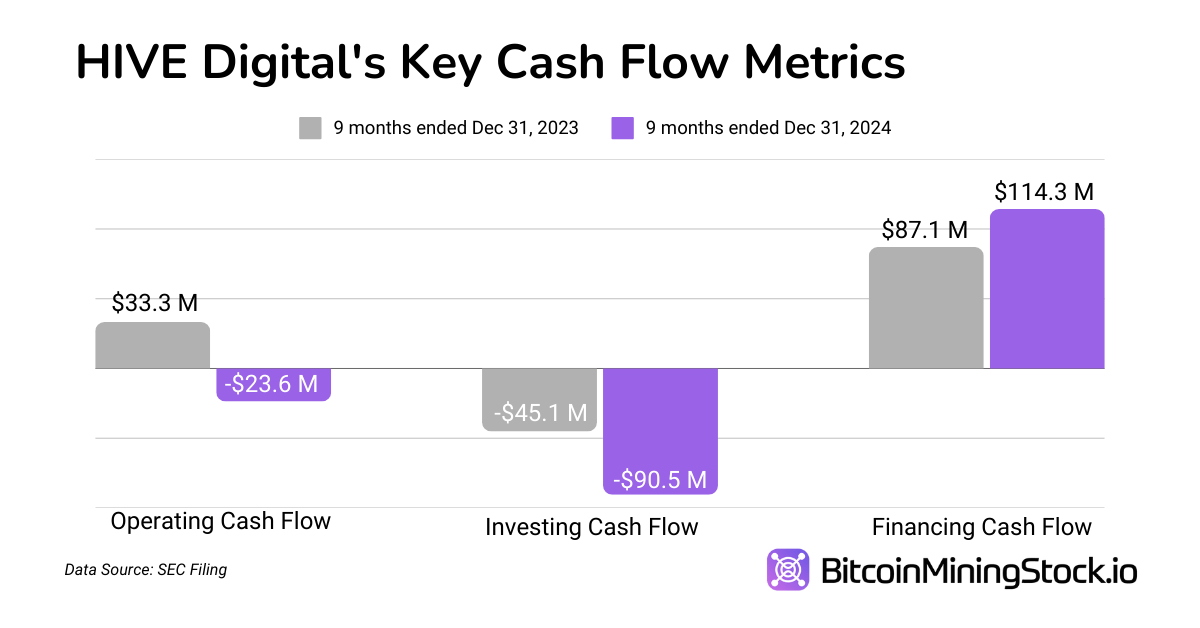

Key Money Move Metrics (9) (Months ended December 31, 2024, and 9 months ended December 31, 2023)

- Working Money Move: $23.6 million outflow (vs. (Influx of $33.3 million). This shift to destructive working money stream was as a result of decrease BTC gross sales and elevated working capital wants.

- Money stream funding: 90.5 million {dollars} of leaks (vs. – $45.1 million). Hive Double capital fundingallocates $59.6 million to new mining tools and acquires Sweden's Boden 2 information middle as a part of its long-term growth technique.

- Money stream financing: $114.3 million inflows (vs. $87.1m). Hive raised $110 million by inventory choices, repaying $3 million in loans, and sustaining a robust money job for future infrastructure.

Foremost metrics

Hive At present, the market capitalization is $385.4 million. (Advertising closure on December 31, 2024)). To higher perceive that valuation, we examine it with key monetary metrics.

- Enterprise Worth (EV): $158.97 million (market capital + debt – money and Bitcoin holdings). Hive buying and selling EVs per mined BTC of $89,834near the market value of BTC. As soon as Hive efficiently executes its growth and HPC technique, present underestimation affords potential reassessment alternatives.

- EV/evits ratio: 7.6x ($158.97m/$20.7m)

- Issued shares: 140.20m (+32%)

- EPS: $0.00988 (Improved from earlier – $0.0788)

- P/S ratio: 13.2x ($385.4m/$29.2m)

- BTC held per market capitalization: 67.5%, or most of that valuation, is straight linked to BTC reserves.

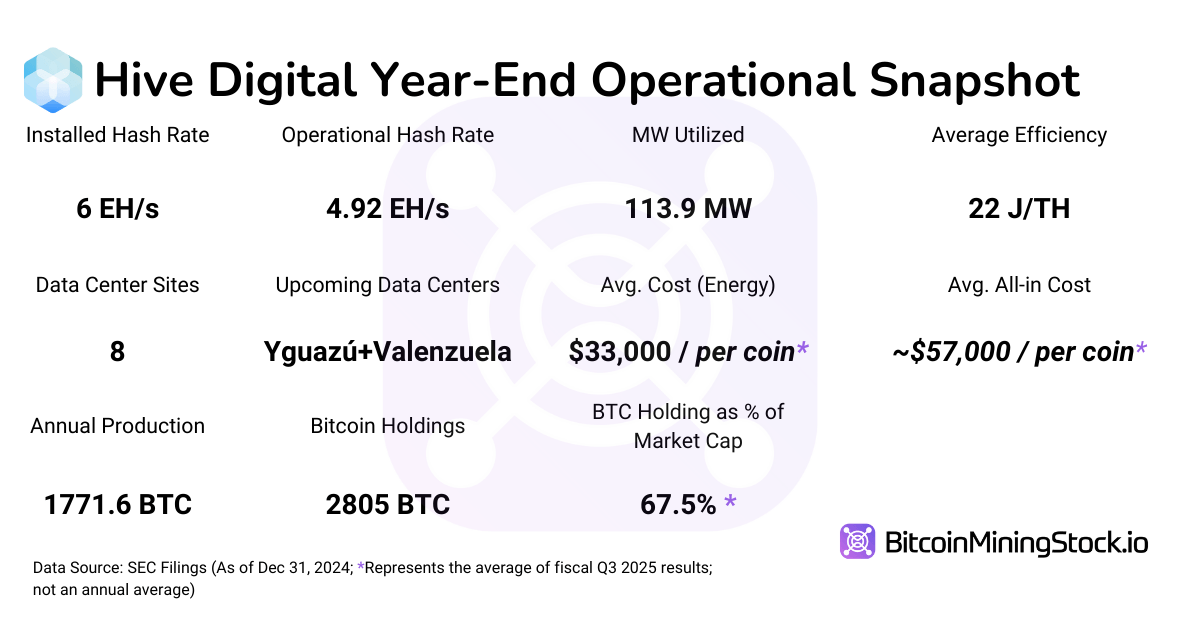

Operational Indicators: Hash Charges and Effectivity

Key hashrates and effectivity indicators:

- Hash charge: 6 eh/s, with goal 25 eh/s by September 2025.

- Fleet Improve: The 11,500 items of Avalon A1566 ordered in October and November 2024 (6,500 of which had been rolled out by February 11, 2025)

- Common effectivity: 22 j/thIt’s anticipated to enhance 16.5 j/th By September 2025.

- Direct vitality prices per BTC: $33,000

- Whole price per BTC (together with depreciation and financing): ~$57,000

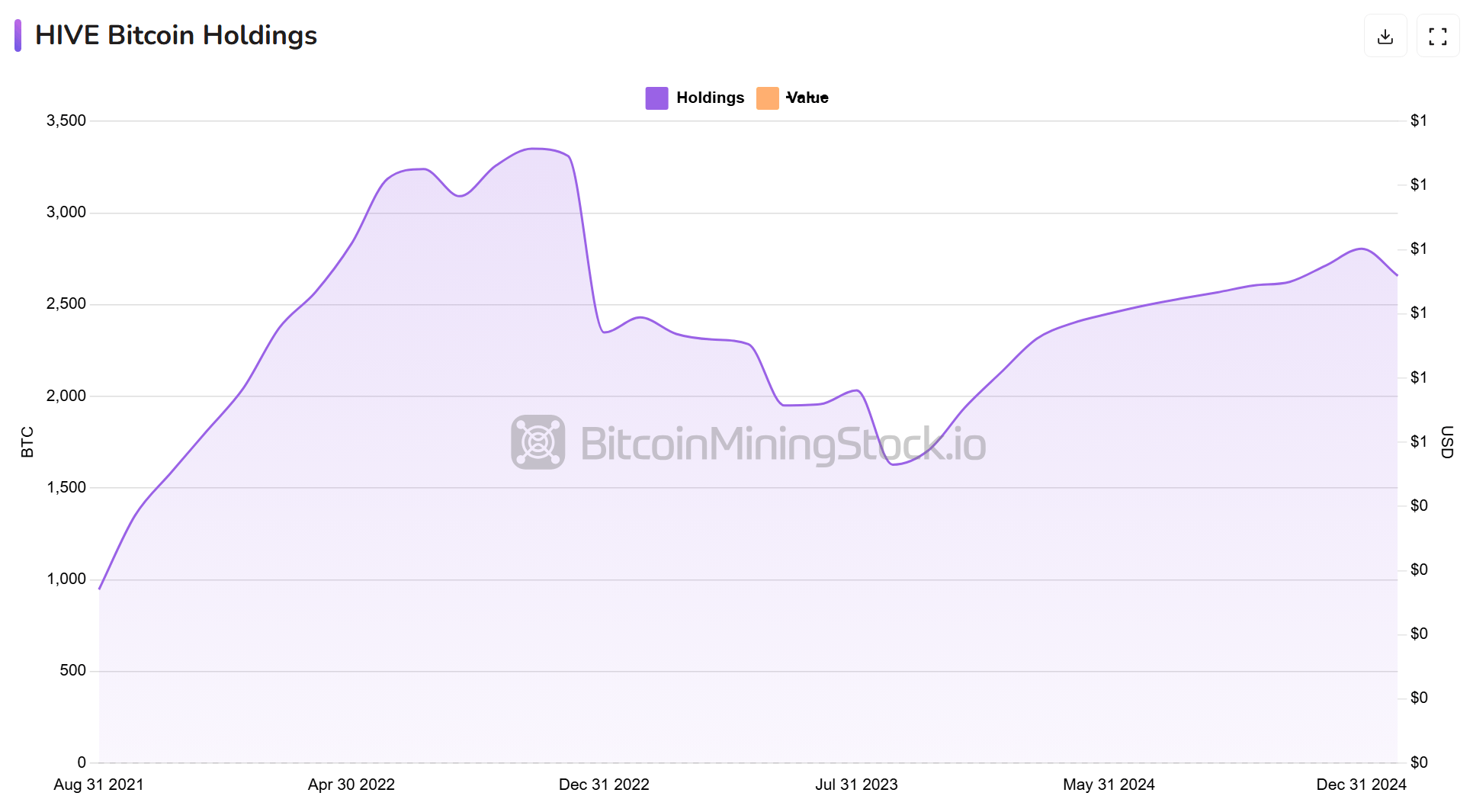

Key digital asset holdings and gross sales information:

- Whole Bitcoin was retained: 2,805 BTC (mining with clear vitality with out being disturbed).

- BTC was bought in the course of the quarter: ~$8.4 million vs 2023 ~$30.7m

- Funding work: Inventory funding of $121 million, not extreme BTC gross sales.

- Cash are saved at FireBlocks Inc., not exchanged

- There is no such thing as a pledge Or staking BTC Holdings

*Hive nonetheless has 371K price different cash (comparable to + others)

Strategic strikes

BitFarms Web site Acquisition at Paraguay: Core Development Engine

Buying the Bitfarm facility is “a formative step in the direction of a method of getting 25 EH/s by September.” Transactions embody a 200mw Hydroelectric energy era Mining Web site (nonetheless below building) In Iguaz, ParaguayUpon completion, the working capability of the Hive in Paraguay might be summed 300MWIt will likely be one of many largest Bitcoin mining companies in Latin America.

Administration can be strengthening this Paraguay stays the principle focus of scaling operations. As CEO Aydin Kilic stated, “We see alternatives within the US for a extra favorable regulatory setting, however our foremost focus is now counting on Paraguay's scaling operations.”

Growth Roadmap:

- 100MWYguazú Part 1 (April 2025): Added 6 eh/s.

- 100MW Valenzuela (June 2025): Added 6.5 EH/s.

- 100MWYguazú Part 2 (September 2025): Added 6.5 EH/s.

- Goal Fleet Effectivity: 16.5 j/th by September 2025.

Paraguay's HiveDigital growth roadmap (screenshots from the corporate web site)

Funding in HPC and AI infrastructure: Small however rising

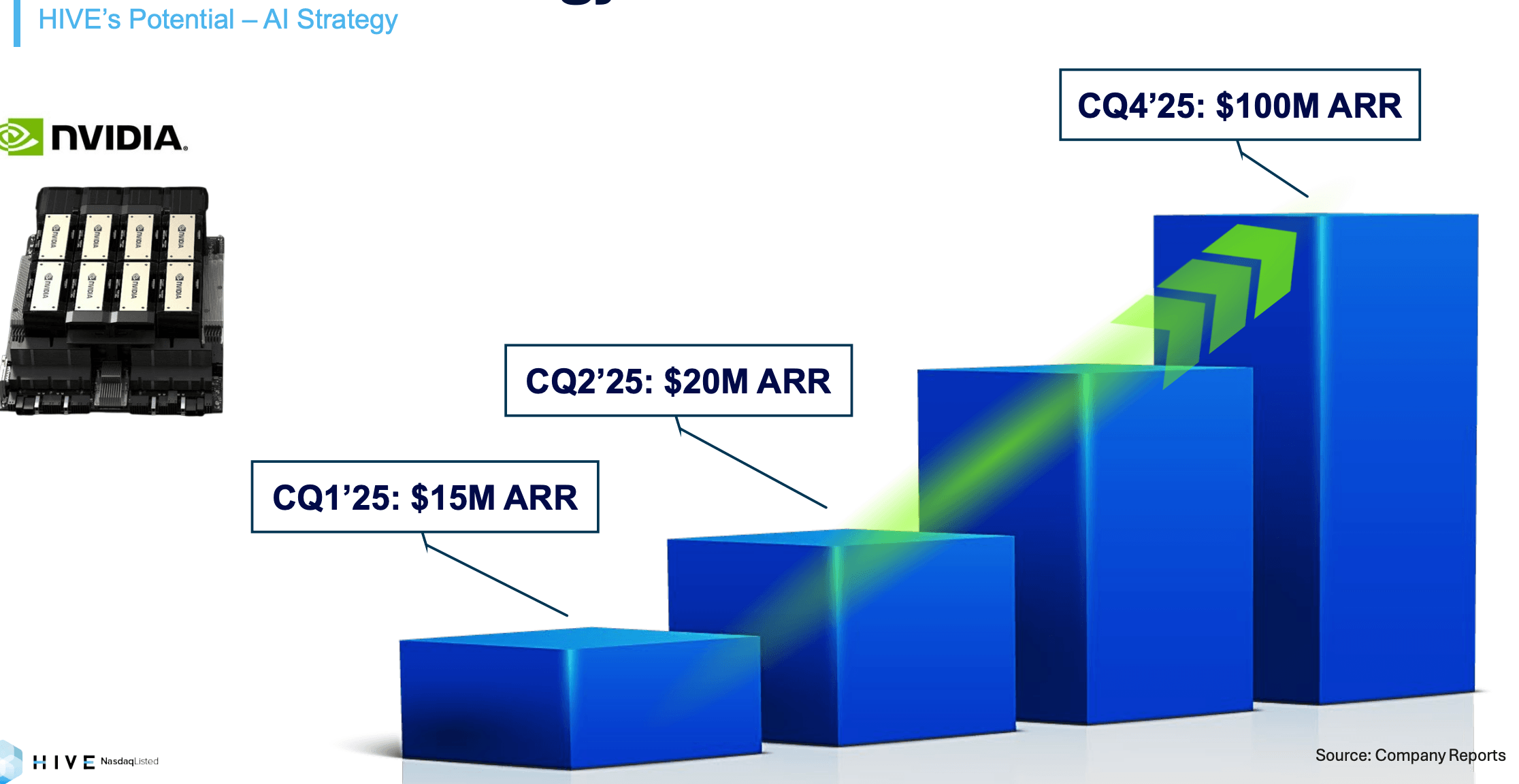

It's nonetheless small, however AI/HPC income is Grows quickly. The Hive has reached $2.5 million Income This can be a challenge that’s anticipated to succeed in the third quarter of 2025 (a rise of 124% from the earlier yr) from HPC operation. $20 million $100 million in annual revenues by the following quarter and the tip of 2025.

Hive's HPC/AI Income Development Projection (screenshots of firm shows)

Present infrastructure:

- 4,000 GPUs in use (together with NVIDIA A4000, A5000, A40, and H100)

- 508 NVIDIA H200 GPUs are anticipated within the first quarter of 2025 (added $9 million to topline income after rolling out)

- As preparation to place your self for the following era liquid-cooled nvidia blackwell GPU

- NVIDIA Cloud Associate standing has been ensured and dependable.

Not like friends that concentrate on partnerships with HyperSchoolers, HIVE plans to lease straight to finish customers for LLM calculations through on-demand market aggregators, along with providing HPC internet hosting. This enterprise phase continues to be developed and expanded.

Different notable modifications:

- foremost workplace switch To San Antonio, Texas. In keeping with govt chairman Frank Holmes, “Hive feels it operates safer within the US given the altering authorities's help for the independence of Bitcoin mining, blockchain networks and digital belongings.”

- I’ll transfer to US GAAP Report On the finish of the fiscal yr on March 31, we are going to enhance transparency and comparability with different Bitcoin miners. “Personally, I actually like this transfer as a result of it helps standardize monetary reporting and make inter-company evaluation extra dependable.

For instance, hive Newest Investor Shows It emphasizes “greatest at school ROIC” and “lowest firm G&A”, however my guide calculations give totally different outcomes. The primary distinction is that Hive makes use of adjusted non-IFRS metrics, excluding prices comparable to depreciation, stock-based compensation, and Bitcoin truthful worth changes.

To make sure goal comparisons, this report excludes such metrics and focuses on standardized monetary information. The transfer to GAAP ought to improve the readability of traders who worth the hive towards their trade friends.

Last ideas

Hive affords a Dynamic mixing of Bitcoin mining and HPC companiesPlace it for each vital progress and inevitable volatility. From a steadiness sheet perspective, the corporate stays financially conservative with a low D/E ratio; It depends closely on fairness rises Funding the Capital Intensive Growth Plan (4 occasions by September 2025). Growth in Paraguay may considerably improve mining capabilities, place them within the high 10 public miners by way of scale, and improve trade visibility. This transition could also be useful at the side of the US transition to GAAP reporting and the relocation of headquarters to Texas Appeal to traders who need regulatory readability and transparency.

Hive's Bitcoin mining enterprise demonstrates each strengths and challenges. The corporate is at present benefiting Decrease common Bitcoin manufacturing priceseven when in comparison with CleanSpark, one of the vital environment friendly miners. Elevated fleet effectivity, elevated scale and decreased energy prices in Paraguay may make its mining operations extra aggressive throughout the trade. however, Growth of the Paraguay website It’s topic to potential delays from surprising circumstances, and Bitcoin costs stay extraordinarily unstable. Given the present low gross revenue, A drop in Bitcoin costs can put a variety of strain on profitability.

On the identical time, hive HPC Enterprisethough he’s nonetheless a small contributor, he has gained traction, A significant income driver. The corporate is actively increasing this phase by introducing new cloud companies choices and scaling AI computing operations. If Hive efficiently attracts and reaches high-value AI prospects A $100 million annual income goal By the tip of 2025, HPC enterprise will present a secure marginal income stream and assist offset the volatility of Bitcoin mining. However this The goal may be very formidablethe corporate generated simply $8.84 million from HPC in 2024, so it must develop almost 10 occasions inside a yr.

For risk-resistant traders, significantly for traders who’re optimistic about long-term Bitcoin value tendencies and the evolving AI ecosystem, this might be a lovely, high-risk, high-reward speculative alternative. Nevertheless, its success relies on Bitcoin Value, Efficient execution The growth plan In Paraguay,and Development of HPC Enterprise. Traders have to carefully monitor these elements as they are going to be necessary in figuring out the long run efficiency of the Hive.