CleanSpark supplied monetary quarter, however its market efficiency didn’t mirror the identical energy. This evaluation categorizes key monetary, operational insights and strategic instructions for understanding the large image.

CleanSpark Govt Overview: Highly effective execution amid market ambivalence

The next visitor posts are posted by bitcoinminingStock.io, a one-stop hub for all of Bitcoin Mining Shares, Academic Instruments and Trade Insights. Initially revealed on February 20, 2025, it was written by Cindy Feng, writer of bitcoinminingStock.io.

Through the survey of the Bitcoin Mining Annual Report in December 2024, CleanSpark highlighted a number of key metrics. Complete margin, Hashrate enlargement, M&A actions, and fleet upgrades. On the time, I believed that the corporate was in a powerful yr. Bitcoin costs continued to maneuver upward.

Screenshots of the Annual Report (co-authored with NICO SMID, a digital mining resolution)

Nonetheless, following Cleanspark's funds Q1 2025 Income Name February 6, 2025, the corporate Inventory costs remained flat and even fell. This market response raised me a number of questions: Which numbers stunned buyers?? Did the corporate present investors-related steering? Take a better have a look at the numbers and break down what's happening.

Monetary highlights: income and profitability have skyrocketed

CleanSpark's funds The primary quarter of 2025 (October 1 – December 31, 2024) was a financially excellent quarter.demonstrates sturdy income development and powerful profitability as a result of rising Bitcoin costs and elevated operational effectivity.

Key revenue assertion indicators:

- Income: $162.3 million (+120% year-on-year) vs. $73.8 million within the first quarter of 2024. That is primarily Bitcoin costs will riseoffset by the low variety of bitcoins mined by the April 2024 Harving Occasion

- Internet revenue: Within the first quarter of 2024, $246.8 million (+854% year-on-year) vs. $205.9 million, dues for Bitcoin revaluation.

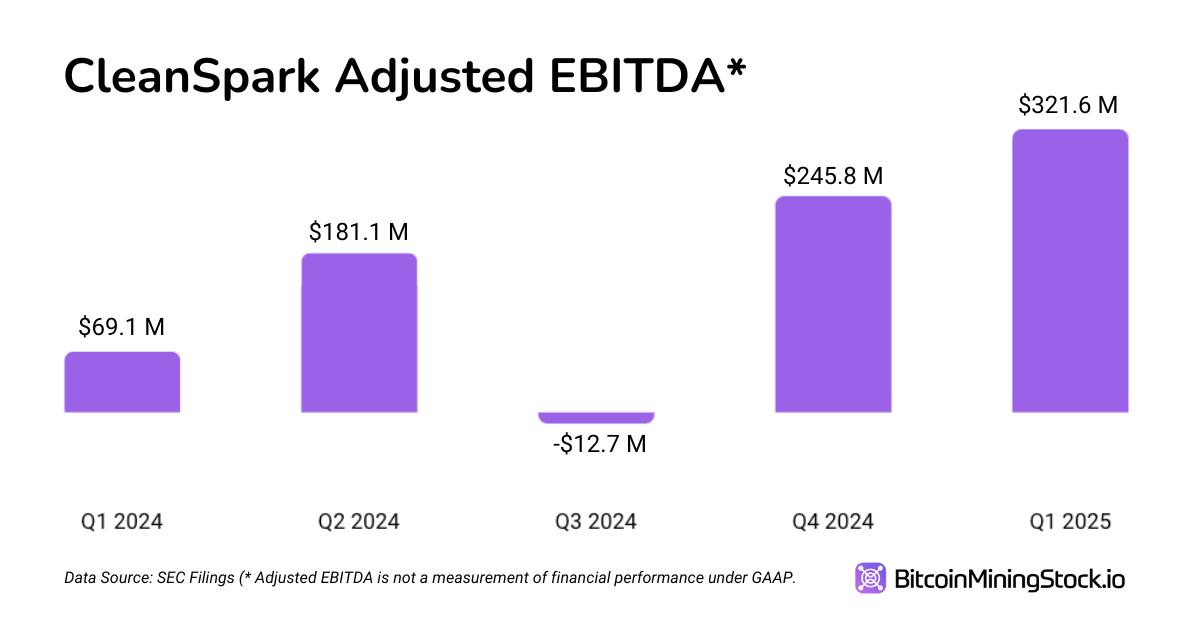

- Adjusted EBITDA: Set new information, starting from $69.1 million to $321.6 million. (*This reported quantity features a honest worth incomes of $228.2 million)

- Complete margin: 57%, lower than 60% year-on-year as a result of elevated operational prices (notably elevated vitality prices and mining infrastructure).

- Bitcoin manufacturing: 1,945 BTC, barely down from 2,020 BTC within the first quarter of 2024 because of the Bitcoin Harving occasion in April 2024.

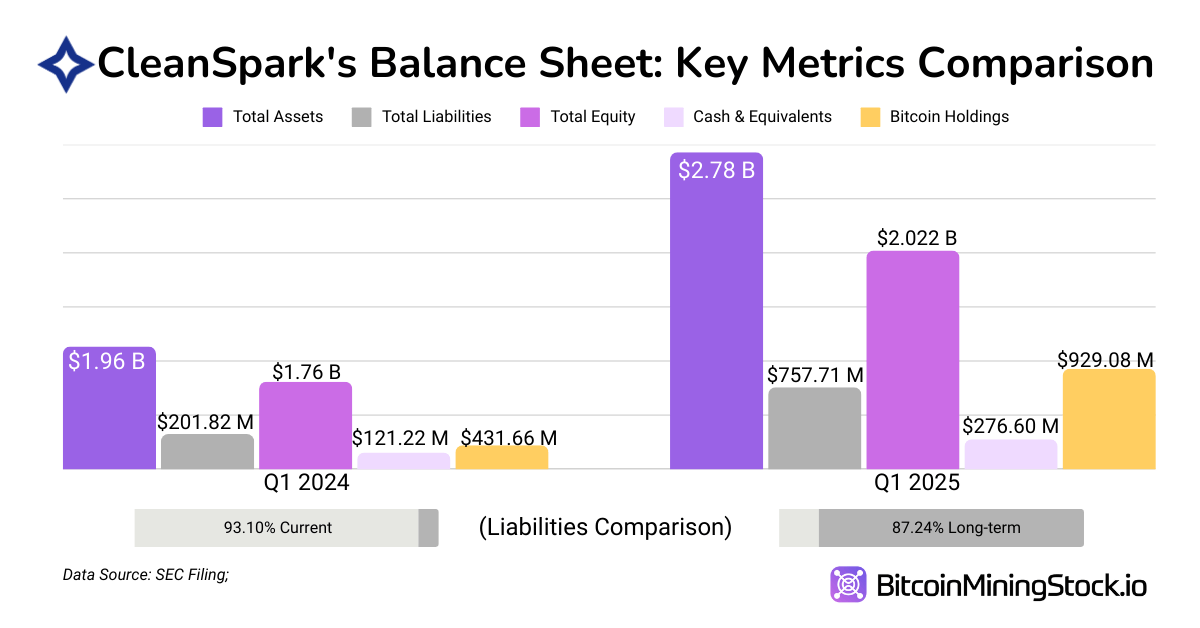

Key Steadiness Sheet Metrics

- Complete property: $2.78 billion (+41.6%) for the primary quarter of 2024 vs. $1.96 billion. It’s primarily pushed by the enlargement of Bitcoin Holdings and information facilities and the rise in new mining infrastructure.

- Present Complete Liabilities: A lower of $96.7 million from $187.9 million, primarily as a result of mortgage repayments ($522 million repayments).

- Lengthy-term debt: $641.4 million ($7.2 million) primarily because of the issuance of recent convertible money owed

- Shareholder equity: $2020 million (+14.8%) for the primary quarter of 2024, $1.76 billion

- D/E ratio: 0.32 (vs 0.08), This exhibits that CleanSpark has considerably elevated leverage over the previous yr by enterprise extra debt to fund development.

Key Money Stream Metrics

- Working Money Stream: $119.5 million web money utilized in operations

- Funding money circulate: $255.9 million used (together with $126.9 million for brand new miners and $57.4 million for mounted property)

- Money circulate funding: $531.1 million inflows (+$635.7 million in mortgage income together with $186.8 million in inventory choices – $145 million in Treasury inventory repurchase)

- The corporate expects money, BTC holdings and operational money circulate to be ample Over 12 monthsNonetheless, additional enlargement might require funding.

Analysis Metrics and Enterprise Worth

CleanSpark's Presently, the market capitalization is $2.6 billion (Advertising and marketing closure on December 31, 2024)). To raised perceive that valuation, I’ve put collectively a number of key monetary metrics.

- Enterprise Worth (EV): $2.16 billion (market capitalization + debt – money and Bitcoin holdings).

- EV/evits ratio: 6.71x ($216 million/$321.6m). That is comparatively low in high-growth Bitcoin miners.

- P/E ratio:10.57x ($261B/$246.8M). It means that the corporate is buying and selling at a reduction in comparison with high-tech development shares.

- BTC is held as a share of market capitalization: 35.6%, or greater than a 3rd of that score, is supported by Bitcoin Holdings alone.

I'll come again and examine it with different miners who’ve comparable operational scales when the information is accessible.

Operational Indicators: Bettering Hashrate Development and Effectivity

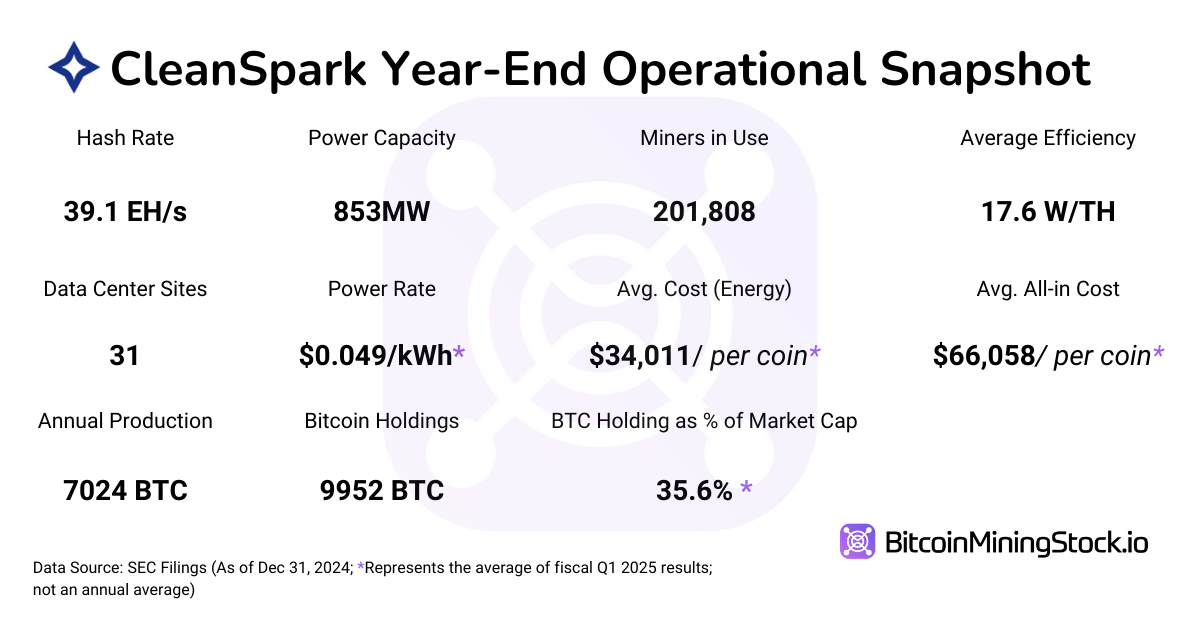

Key hashrates and effectivity indicators:

- Hashrate: 39.1 eh/s (4.87% of world hashrate), a quadruple improve within the earlier yr (first quarter 2024).

- Working Minor: Since 201,808 and 88,559, when it’s in operation.

- Common effectivity: Improved from 17.6 w/th and 26.4 w/th.

- Bitcoin manufacturing price (direct vitality prices per BTC on the property):$34,011, from earlier than $12,808.

- Complete price per BTC (together with depreciation and financing): Beginning at $66,058, beginning at $24,429.

Vitality Price Evaluation and Mitigation Technique

- Energy Price: $0.049/kWh (vs. $0.044/kwh yoy).

- 40.4% of Bitcoin's revenues are used for vitality prices, up from 35% year-on-year.

- Hurricane Helen has resulted in momentary operational cuts and diminished effectivity.

- Vitality mitigation technique:

- Numerous geographical enlargement: New websites in Wyoming, Tennessee and Georgia have low energy charges.

- Extremely environment friendly mining rig: The S21 XT Immersion Unit can be deployed for low energy attracts.

- Versatile energy contracts: A contract that optimizes vitality utilization and prices, however stays uncovered to cost volatility

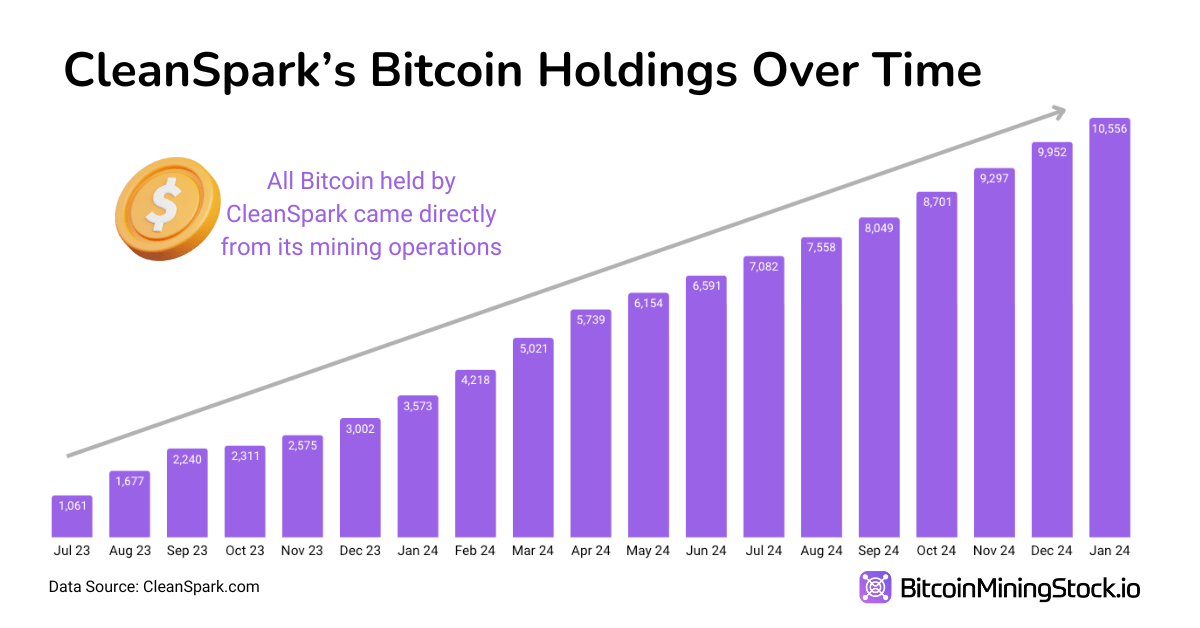

Bitcoin Holding and Monetary Technique: HODL Over Promote

BTC Ministry of Finance:

- Complete Bitcoin was retained: 9,952 BTC (values $929 million from 6,819 BTC in comparison with the earlier quarter).

- 99% of BTC in chilly storage and 1% of sizzling wallets.

- BTC was offered in the course of the quarter: 3,413 BTC (equal to $3.4 million) in comparison with 43,300 BTC ($43.3 million) within the first quarter of 2024

- BTC used as collateral (To Coinbase): $8.86 million was transferred and $129.18 million was acquired from the collateral account.

- Funding work: As an alternative of BTC gross sales, it relied on exterior financing (a conversion obligation of $635.7 million).

- No BTC lending or yield methods have been reported.

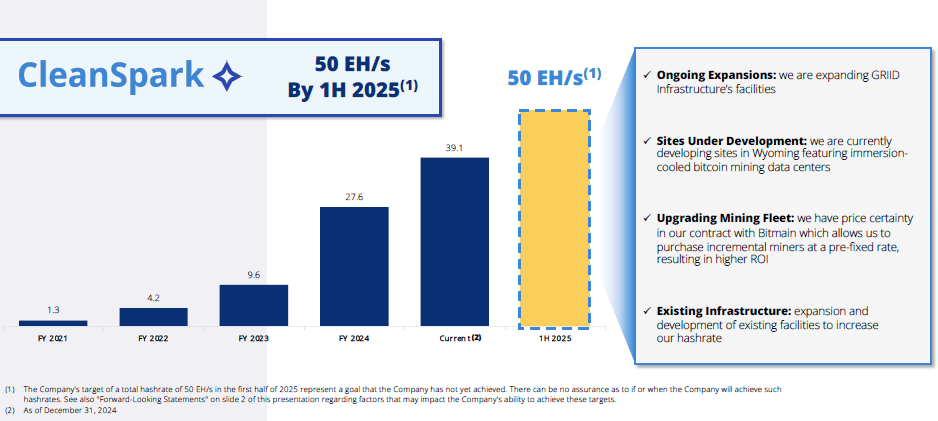

Growth & M&A: Scale as much as 50 EH/s

Development and enlargement plans:

- purpose: 50 Eh/s by mid-2025there are potential expansions 60 eh/s.

- New mining websites acquired:

- Tennessee Website: $29.9 million funding.

- Mississippi Website: $2.9 million in infrastructure along with $3 million funding.

- Fleet Development:

- 60,000 S21 miners securedan possibility to purchase 100,000 at $21.50/TH, 37% under the market value.

- Owned by 285,098 miners~83,290 are pending deployment.

CleanSpark's Hash Price Development Roadmap (Screenshots of firm displays)

Ideas: Huge image and vital concerns

Wanting on the figures within the monetary report, we imagine that CleanSpark holds a powerful place within the Bitcoin mining sector. The corporate holds its place as a US Bitcoin miner that would doubtlessly have an much more benefit beneath the present US administration.

However my predominant concern stays the Bitcoin value switch. Traditionally, CleanSpark's inventory value has carefully correlated with BTC's efficiency. If Bitcoin surges, CleanSpark might be extra engaging. Nonetheless, if BTC stagnates or dips, CLSK might face a large sale.

One other vital issue to contemplate is How CleanSpark manages income throughout totally different market cycles. In contrast to AI/HPC diversifying friendsCleanSpark is dedicated to Bitcoin mining. Its CEO continues to be skeptical of HPC. Assertion“Reusing Bitcoin mining amenities for high-performance computing is rather more difficult than it appears,” reinforces Clear Spark's long-term deal with Bitcoin as an environment friendly, confirmed, scalable enterprise mannequin. This means that it’s unlikely that the corporate will instantly pivot like its friends.

That mentioned, the corporate might discover a method to strategically leverage its BTC holdings. Maybe via a monetary technique that minimizes counterparty threat whereas rising monetary flexibility.

In the end, CleanSpark boasts one in all its greatest mining operations: high vary effectivity, disciplined capital administration, wonderful execution (past annual hashrate targets), and impressive enlargement plans. I at the moment haven’t any sturdy motive to be weak about CleanSpark So long as Bitcoin mining continues to be a viable trade.

Even when we speak about present traits Bitcoin Monetary TechniqueCleanSpark will be a beautiful funding alternative. In comparison with Technique (MSTR), probably the most well-known proponent of this technique, CleanSpark retains vital advantages. Mining permits you to get Bitcoin at a considerably cheaper price (all-in-cost: $66,058 per coin). As folks say “In case you can mine at a cheaper price, why would you purchase it?”