A fast have a look at the numbers reveals that the Center East and North Africa (MENA) areas have skilled vital crypto-related development over the previous yr. This has decreased the sector's market capitalization to only underneath $3.8 trillion, thanks largely to a 120% rise in Bitcoin meteor (till 2024).

Throughout this upward development, the MENA area has turn into the seventh largest crypto market on this planet, accounting for 7.5% of the world's transaction quantity.

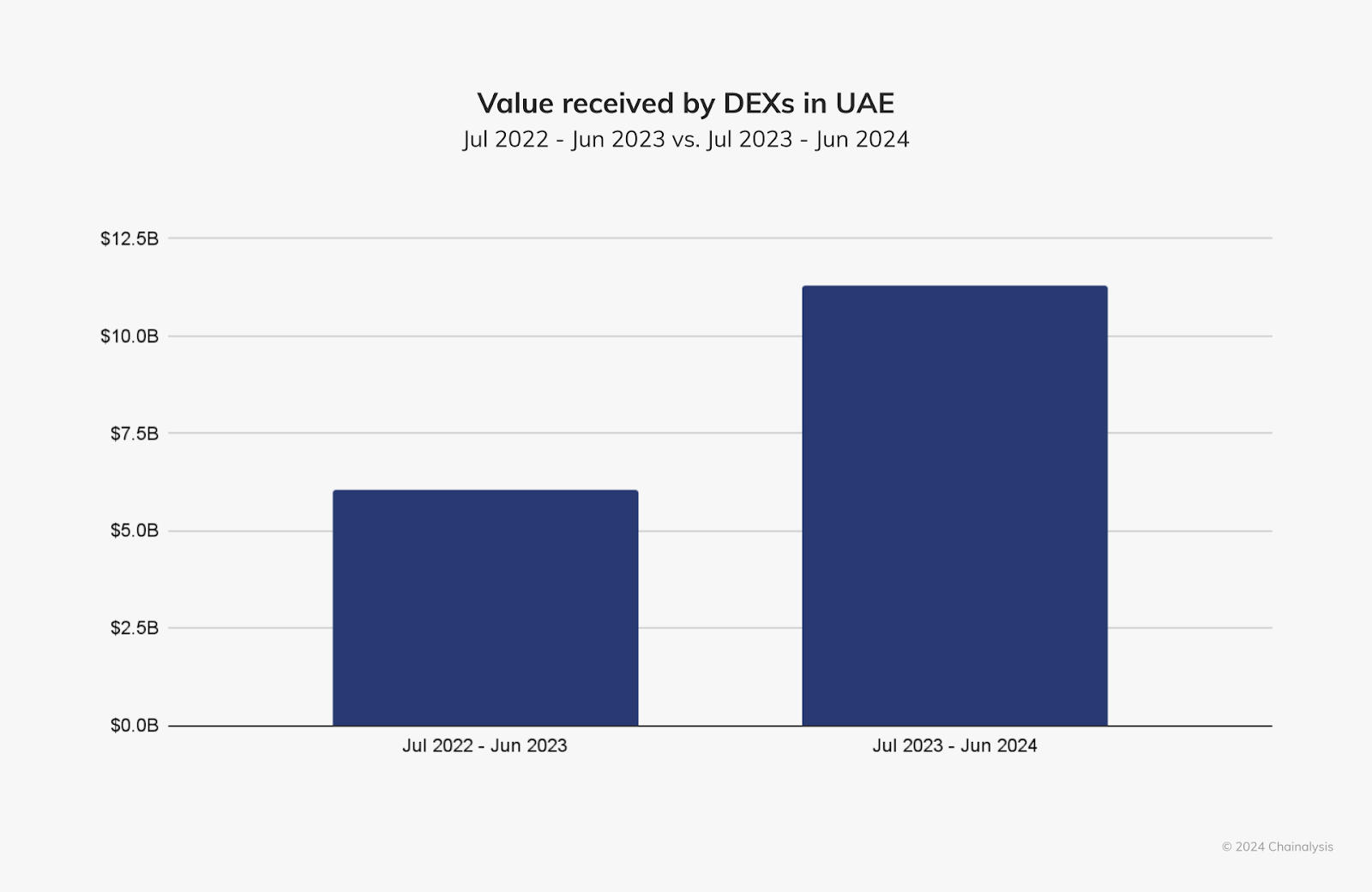

Moreover, figures recommend that crypto lovers are starting to maneuver quickly past centralized exchanges in international locations such because the UAE and Saudi Arabia, with regional monetary (DEFI) platforms growing vital traction within the area.

Trump's second season catalyzes Mena's code ambitions?

Searching, Donald Trump's return to the US White Home seems to have rediscovered the worldwide digital property wrestle that extends far past the US borders, significantly the Mena area.

Initially, Trump's dedication to establishing a transparent regulatory framework in the US encourages Center Japanese governments to strengthen their very own tips, making a extra predictable setting that draws substantial funding from each native and worldwide sources.

On the topic, COTI Group, CEO and co-founder of an Israel-based decentralized fee supplier, believes Trump's pro-crypto stance will ease, make it clearer and extra more likely to undertake among the uncertainty about Center East rules. He added:

“The American stance can typically information international regulatory fashions, and extra decisive methods from the US can increase Center Japanese regulators in shaping cryptocurrency rules.

On this regard, the response from main monetary establishments has been very optimistic as Wall Road giants like Goldman Sachs and JPMorgan quickly revise their cryptocurrency methods to align with the imaginative and prescient of the brand new administration, reverberating all through the Center East, urging regional banks and funding funds to develop extra complete digital asset methods.

Proof of this accelerated adoption has already been realized on a big scale, with Dubai's DMCC Crypto Heart reporting a noticeable 300% enhance in blockchain firm registration since Trump's reelection. In the meantime, Saudi Arabia has accelerated its central financial institution's Digital Forex (CBDC) initiative and launched a pilot program in collaboration with American expertise suppliers which are according to the Kingdom's Imaginative and prescient 2030 financial diversification targets.

The connection between the Trump administration and the Center East's crypto ambitions has been additional strengthened by way of high-profile help. For instance, late final yr, President Trump's Middleson Eric spoke on the Bitcoin Mena Convention in Abu Dhabi, explicitly acknowledging the UAE's management in fostering a blockchain-friendly setting, highlighting potential areas for cooperation between US and Center Japanese monetary entities.

We are going to construct a monetary oasis of tomorrow

The area seems to have been established as an important power within the digital property area, as MENA members dealt with the $338.7 billion chain worth between July 2023 and June 2024 alone. Of explicit word, 93% of those transactions are valued at over $10,000, indicating that institutional {and professional} buyers are key adoption drivers relatively than retail hypothesis.

Wanting forward, MENA's balanced strategy to decentralized innovation means that areas aren’t merely using on complete market volatility, however are attempting to construct sustainable infrastructure, making them a pacesetter within the subsequent section of the worldwide monetary revolution (which permits Trad-Fi and Digital Finance Programs to converge seamlessly with others).

Featured Photographs by way of ShutterStock