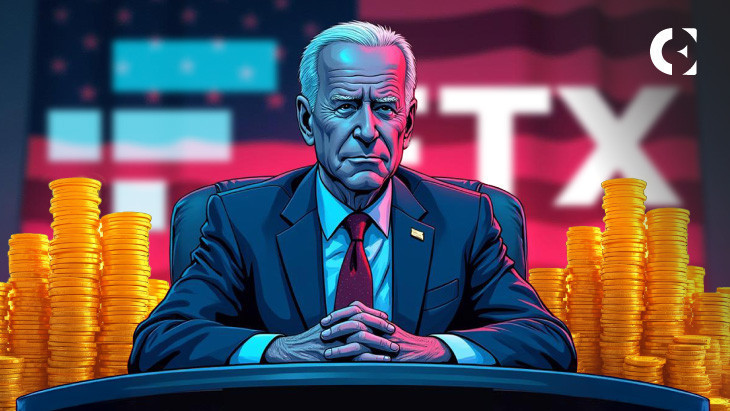

The collapse of FTX continues to encourage severe questions on whether or not regulators have been favored and politically affected. As Crypto's lawyer John E Deaton factors out, FTX's shame founder Sam Bankman-Fried (SBF) allegedly used a $10 million donation to the Biden administration to realize additional entry to regulators.

This calculated transfer seems to have allowed him to domesticate relationships with key officers, together with these with the Commodity Futures Buying and selling Fee (CFTC) and the Securities and Change Fee (SEC).

Coinbase Requests Reply on SEC Enforcement Bills

In the meantime, SEC Chairman Gary Gensler, when he met with the SBF a number of instances, actively pursued enforcement measures in opposition to different crypto firms.

This exhibits that Coinbase is searching for transparency round SEC's enforcement spending, and a brand new name to accountability has emerged.

Right here's what we all know: @SBF_FTX paid the Biden administration $10 million to “get entry to regulators,” and people made it work. He met @CFTCBEHNAM and others a number of instances at CFTC, and after SBF examined the whole lot, he gave a kiss that was blown away from @RepMaxineWaters.

– John E Deaton (@Johnedeon1) March third

SBF's political donations have opened doorways to regulatory authorities

SBF's monetary contributions reportedly helped him meet repeatedly with regulators, giving him a bonus over others within the crypto business. For instance, he met with CFTC Chairman Rostin Behnam on a number of events, elevating questions on whether or not FTX is receiving particular therapy.

Associated: SEC clears the trail of Consensy after dropping authorized battles with Coinbase, Gemini and others

Along with the doubt, Home Rep. Maxine Waters acted surprisingly warmly in opposition to the SBF, additional growing hypothesis about political help. The report says Gensler has met with the SBF at the very least twice, suggesting that he’s approaching an settlement that advantages FTX.

Stolen buyer funds might have inspired donations

Moreover holding regulatory conferences, the supply of SBF's political donations provides much more controversy.

Reviews present that the funds come from stolen FTX buyer property. If that is confirmed, it signifies that FTX prospects unconsciously funded political contributions. These contributions might have protected the SBF from regulatory surveillance whereas his alternate was illegally operated.

Coinbase seeks SEC transparency by means of FOIA requests

Coinbase is at present requesting solutions on SEC's enforcement priorities below Gensler. The corporate has submitted a Freedom of Info Act (FOIA) request.

The request seeks detailed information of investigations and litigation in opposition to crypto firms from April 2021 to January 2025. This consists of details about SEC workers, working hours, funds and budgets used to implement cryptocurrency.

Taxpayers deserve transparency, says Coinbase Clo.

Coinbase Chief Justice Officer Paul Grewal firmly acknowledged that taxpayers deserve transparency within the actions of the SEC.

Associated: FTX collectors will probably be repaid from February 18th, however at 2022 all-time low costs

The aim of this request is to look at whether or not an company's aggressive method to crypto enforcement is motivated by politics or by real issues about investor safety. The SEC has not responded but, however this request signifies a rising demand for regulatory accountability.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version is just not chargeable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.