As Bitcoin is traded for $81,626 (shy at $82,000 mark), the gap in mining prices for big public corporations exposes important operational variations, with some corporations extracting Bitcoin at only a fraction of the community's estimated common.

Do you mine Bitcoin for revenue? It is determined by who pays the electrical energy invoice

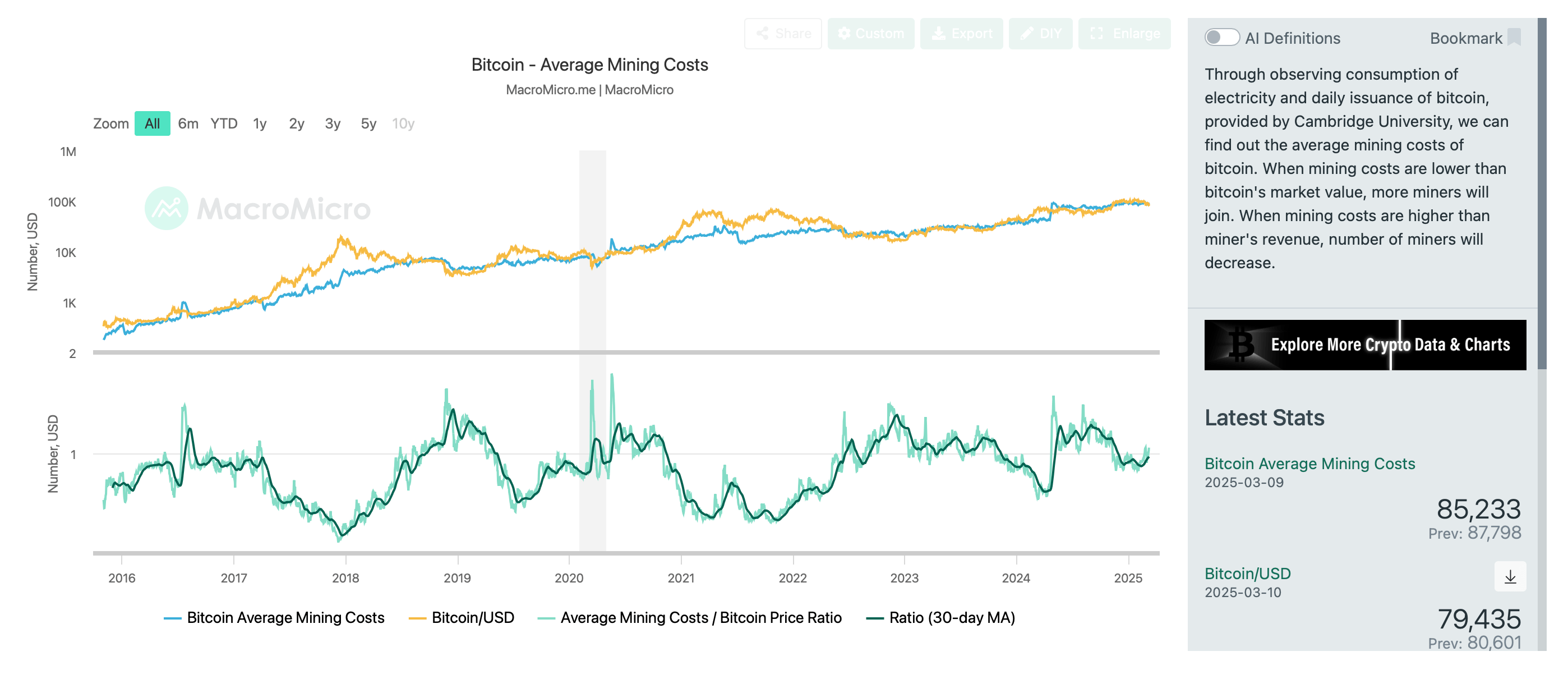

On March 11, 2025, spot costs for Bitcoin settled at a low of $81,626, specializing in mining profitability. Information supplier Macromicro.Me has positioned one BTC at a median price at $85,233 as of March ninth, a determine based mostly on the ability consumption mannequin. Nonetheless, this estimate is in stark distinction to self-reported spending by main publicly traded mining corporations, with prices various considerably from $21,000 to over $48,000 per Coin. This price vary ranges from $21,000 to over $48,000, and is derived from an evaluation of roughly 280 totally different stories and monetary disclosures.

MacRomicro.ME price statistics are at some point behind.

Nonetheless, MacRomicro.ME makes use of the Cambridge Bitcoin Energy Consumption Index to derive estimates and calculations. By making use of this fee to Bitcoin's annual energy consumption, the platform estimates the price of electrical energy solely per BTC – 176.69 hours of terawatts hour – 176.69 hours. Nonetheless, this calculation excludes vital working prices comparable to {hardware}, labor, and upkeep sorts, offering a slender view of the full mining prices.

The $85,233 determine reported on March 9 most likely displays a really broad operational outlook, with the positioning's reliance on each day information lag and restricted metrics diminishing relevance to particular person corporations. Many miners are beneath this threshold. Mara, the business's largest publicly traded mining firm, revealed its manufacturing prices per coin, $28,801 in its fourth quarter 2024 income, on account of its market capitalization. The figures raised from US Securities and Trade Fee (SEC) purposes and income calls mirror the effectivity gained via vitality procurement methods and expanded operations.

In distinction, Hive Digital Applied sciences reported first quarter 2024 mining prices of $48,308 per BTC, highlighting monetary shares related to high-cost operations. Of the 12 public mining corporations surveyed, solely a handful, together with Mara and riot platforms, supply clear price collapse. For companies that didn’t disclose direct mining prices, we utilized a BTC estimate of $25,000 based mostly on aggregation of 280 information factors, together with income stories and Kanack Code's 2025 mining sector evaluation.

These estimates encapsulate the standard prices of enormous miners, however don’t bear in mind company-specific components comparable to vitality contracts and geographical advantages. Mara's $28,801 price, outlined within the fourth quarter's 2024 report, displays investments in energy-efficient infrastructure. Riot Platforms reported prices per coin in submitting in June 2024 of $21,482, benefiting from Texas-based electrical energy credit and immersion cooling know-how. In the meantime, the Hive's $48,308 price (calculated from first quarter 2024 income and manufacturing information) creates difficulties in balancing renewable vitality commitments and operational spending.

For the remaining corporations, estimated prices starting from $25,000 to $30,000 point out a reasonable profitability margin on the present worth of Bitcoin. For instance, CleanSpark reported a price per coin for an entirely owned facility in its 2024 report, however extra company prices may very well be increased efficient prices. This price hole reveals the basic hole. Miners beneath $25,000 per BTC keep a cushty buffer, whereas these above $30,000 are competing for slender margins.

Bitcoin buying and selling is beneath 2.3% beneath MacRomicro.ME's $85,233 estimate, however profitability in the end is determined by operational self-discipline because it far outweighs the precise prices of many corporations. For instance, marathons and riots can stay worthwhile even when Bitcoin drops to $28,000, however Hive and several other different miners will want costs above $48,000 to keep away from losses. As of the second week of March, the info makes one factor clear. Vitcoin mining stays an business of harsh financial distinction.