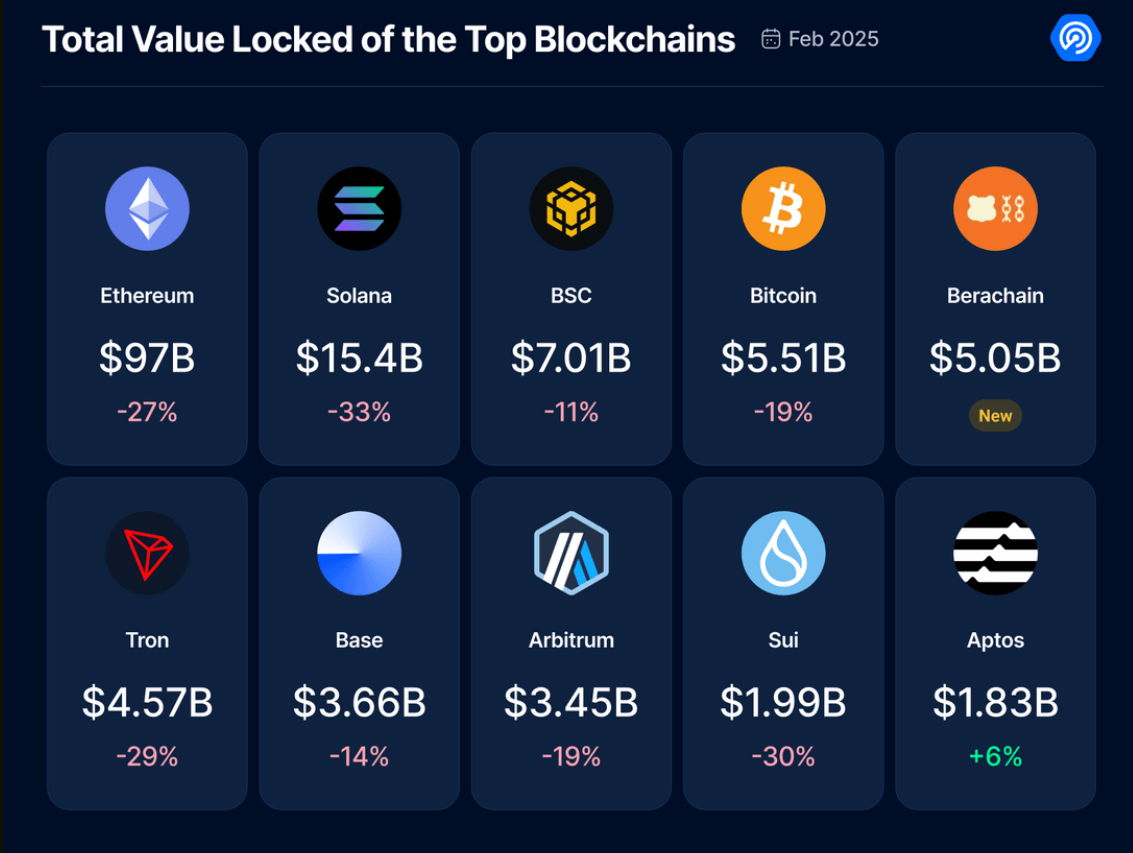

Ethereum complete quantity fell 27% to $97 billion in February. It’s because the broader distributed finance division fell from $217 billion to $168 billion amid liquidity spills.

The whole locked quantity of decentralized finance fell practically 23% in February, down from $217 billion to $168 billion, in keeping with Dappradar analyst Sara Gherghelas.

In a latest analysis report, Gherghelas famous that Ethereum (ETH), which owns practically 60% of Defi's liquidity, fell 27% to $97 billion in February, with TVL falling 27% to $97 billion. The decline was primarily as a result of low fluidity of liquid staking protocols, analysts famous. However regardless of its decline, Ethereum's domination on this discipline was “unchallenged” in keeping with Gherghelas.

Prime Community TVL | Supply: Dappradar

Solana (SOL) suffered its largest loss in February as TVL fell by greater than 30%, falling over $15.4 billion. The decline got here after a robust January and is probably going pushed by “returns and liquidity migration to a extra secure defi atmosphere,” Dappradar analysts stated. As well as, exercise has additionally slowed down on main Solana-based platforms resembling Crypto Alternate Jupiter and Raydium.

Information reveals that whereas most main chains confronted challenges, Bellachine (Bella) was one of many few winners, reaching a $5.05 billion TVL.

“The rise within the chain is pushed by its empirical mannequin of demonstration, which has attracted customers by gaining favorable liquid staking and farming incentives. As customers search increased returns regardless of the broader market decline, Bellachin has established itself as a key participant within the evolving defi panorama.”

Sarah Gaszcheras

You would possibly prefer it too: Ethereum's Pectra Improve on Sepolia encounters issues

The BNB chain (BNB) noticed a decline of 11% with the assistance of Stablecoin buying and selling. In the meantime, Tron (TRX) TVL fell 29%. That is in all probability because of weak demand for Tether (USDT) buying and selling. Aptos (APT) was additionally one of many uncommon winners, growing TVL by 6% to $1.83 billion.

The decline in TVL on Ethereum was because of a pointy decline in open curiosity in futures in main cryptocurrencies as nicely. As reported by Crypto.Information, merchants are starting to scale back lengthy positions, with open curiosity sooner or later declining amid issues over the commerce battle and the Fed's robust stance. Matrixport analysts consider many merchants are ready for a extra clear sign earlier than they’ll re-enter the market.

Future Pectra upgrades geared toward enhancing community performance and pricing effectivity might present a short-term increase, however it’s unclear whether or not these upgrades are ample to reverse the decline in Defi exercise.

learn extra: Crypto.com joins CF benchmarks to spice up Bitcoin and Ethereum indexes