Bond yields for Japan's 40-year-olds attain 2.85%, dangerously near historic 3%. Japan's plight might trigger a trickle-down impact that permits us to give up and in the end ship the crypto market downwards spiral.

Japan's 40-year bond yield peaked at 2.85% on March 10, primarily based on estimates between business banks, in response to Buying and selling Economics information. The location says Japan's 40-year-old bond yields reached a 3% document excessive in January 2011, however Bloomberg mentioned it reached that degree in January 2024.

Japan is the world's largest holder of debt piles, greater than twice the $5 trillion economic system. To surpass that debt with the next yield, the next value is required, and the market might query its sustainability because the Financial institution of Japan owns round 70% of its authorities debt

For many years, Japan's financial coverage has stored their charges very low. Nonetheless, a surge in bond yields at 40 in Japan might point out modifications in inflation and rates of interest domestically. If yields proceed to rise and doubtlessly attain 3%, it might doubtlessly tempt Japanese traders again to home yields and transfer away from US yields.

For context, Japan is without doubt one of the largest overseas house owners of the US Treasury. As Japan's yields turn out to be extra enticing, Japanese traders might choose them over US debt, which affords decrease yields. This might scale back demand for the US Treasury, and will result in larger US yields because the US authorities tries to compete.

The rise within the US might imply a rise in borrowing prices for each authorities and personal corporations. Not solely that, however the rise in yields might strengthen the US greenback together with the US Treasury Division.

You would possibly prefer it too: How Trump's proposed tariffs will have an effect on crypto

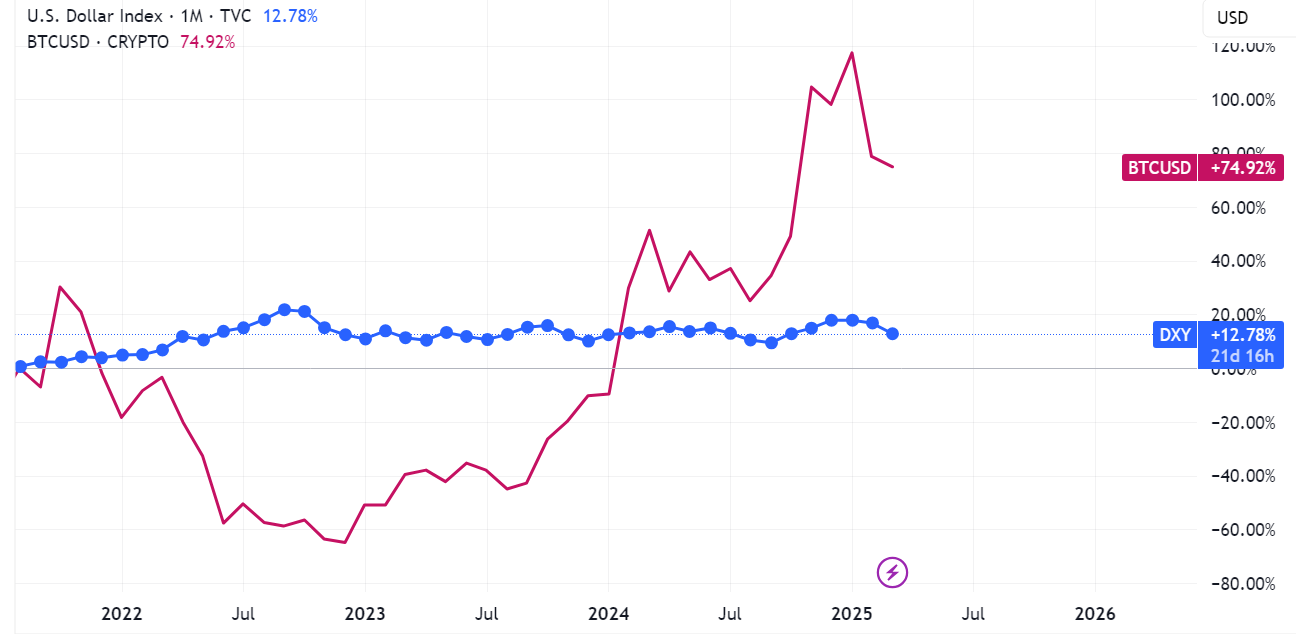

March 10, 2025, chart displaying the inverse relationship between US {dollars} and Bitcoin | Supply: TradingView

As will be seen within the chart above, the US greenback index and the crypto market (expressed by the worth of Staple Bitcoin (BTC)) have an inverse relationship. So when the greenback rises, the code tends to go down.

If conventional property just like the greenback or the US Treasury present higher returns, traders might flock to them and divert the cash from dangerous different property equivalent to shares and crypto markets. Moreover, rising authorities bond yields might additionally point out a way more extreme international liquidity.

In crypto markets that often profit from monetary phrases and adequate liquidity, this monetary change will be catastrophic. The crypto market is especially delicate to international liquidity and modifications in danger sentiment. Due to this fact, this shift might result in elevated volatility in crypto property and downward stress.

As traders are pulling their funds away from harmful property, they will in the end scale back the influx of crypto markets into cryptocurrencies, leading to a drag on cryptocurrency costs.

Total, Japanese 40-year-old bond yields might spell bother for the crypto market. The modifications in monetary circumstances led by Japan's 40-year-old bond yields might attain a 3% excessive, strengthening the greenback, strengthening international liquidity, and lowering investor capital flowing into dangerous property like crypto.

learn extra: The Japanese Prime Minister calls ciphers “crucial” forward of the 2025 crypto tax evaluation