Tron founder Justin Solar asks the crypto neighborhood what's occurring with Ethereum towards the backdrop of the liquidation that reached $2.1 billion within the final two weeks. On Monday, Solar identified the problem of high-leverage buying and selling within the community. We thought this is able to trigger losses in decentralized monetary protocols utilizing blockchain.

As of Thursday's early Asian buying and selling session, ETH was $1,880, a 51.63% decline over the previous three months, hitting $3,888 within the December Bull Run. The bear has dropped its cipher by 30.6% within the final 30 days, pushing its almost 18% per Coingecko over the previous week.

Market Watchers are contemplating the battle for Ethereum

Solar's questions obtained appreciable responses from the Crypto neighborhood. This consists of Alexander, founding father of the bogus intelligence Crypto Finance System Postfiat, who famous that Ethereum has been unable to maintain significant buying and selling development since its peak in 2017.

Alexander beat the community to keep away from deflation when transferring from Proof of Work (POW) to the Sport-of-Stake (POS) mannequin, noting that essentially the most actively used parts of blockchains, equivalent to arbitrum (ARB) and base, are extremely inflated or centralized.

“So please ask me a query… What’s the level of a series the place the reply is: It's the identical as all different blockchains. It's fairly suppressed to maneuver the tether and “protect the worth.” ” he mentioned.

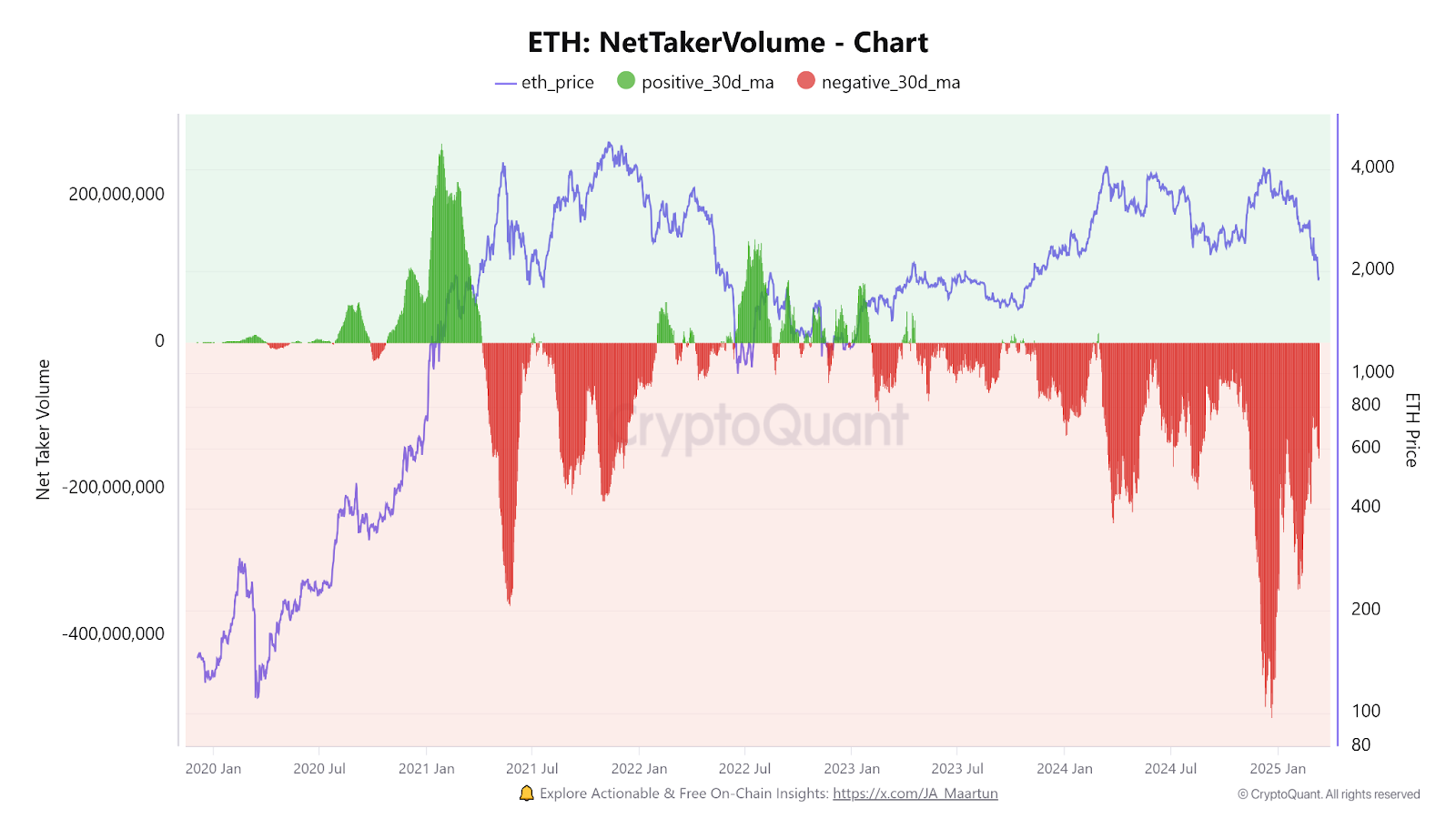

On the X Publish on March thirteenth, encrypted CEO Ki Younger Ju shared a chart exhibiting report gross sales stress on Ethereum over the previous three months. On-chain knowledge was revealed final week to be the $1.8 billion price of ETH ETH ETH ETH ETH ETH ETHITED change, the most important leak since December 2022.

Ethereum value 30-day transferring common. Supply: Cryptoquant

In line with the charts, ETH final had a constructive 30-day transferring common on February twenty sixth, when Bitcoin value fell to $82,000. Coin's 24-hour Coinbase Premium Index has additionally been trending in pink for the previous seven days, weakening shopping for stress from US merchants.

Ethereum's buying and selling quantity rose 38.17% to $368.2 billion, and the favorable curiosity (OI) on futures additionally fell 2.61% to $18.05 billion, suggesting extra merchants will take the exits than opening new ones.

Crypto-retention knowledge additionally reveals that the amount of choices fell by 7.43% to $663.71 million, whereas open curiosity on choices elevated by 2.17% to $5.777 billion, indicating a rise in demand for long-term spinoff positions as merchants wait the place the worth of ETH goes.

Will Ethereum recuperate?

Ethereum value motion appears largely bearish for now. The bull slowly arms the bear to the market, additional lowering the worth of the crypto. In line with Coinglas, Eth Futures liquidation has reached $43.12 million within the final 24 hours.

Of this complete, $26.94 million was a protracted liquidation, whereas $16.18 million comes from shorts, indicating that the market lacks a transparent course.

Analysts outlined two attainable eventualities for Ethereum's subsequent transfer. The bearish breakdown might trigger ETH to fall beneath the $1,440 threshold and additional decline to the $1,000 mark. In the meantime, a restoration above the resistance stage of almost $1,960 will assist the coin acquire constructive momentum.

Technical indicators such because the 32.1 relative power index (RSI) and the 25.1 stoch oscillator (Stoch) are gaining bearish momentum as they’re approaching overselling territory. Failure to carry past the $1,750 psychological help zone might improve gross sales stress, however decrease than $1,700 a day might override integration makes an attempt and speed up the downward pattern.

One dealer on social media found the historic ETH three years of stochastic RSI tendencies.

A historic ETH sign has been triggered!

Ethereum's 3-year likelihood RSI hits oversold ranges.

Each time this occurred, there have been large gatherings! pic.twitter.com/xzdtiw5ol7

-Merlin The Dealer (@merlijntrader) March 12, 2025

Nonetheless, the forecast was rejected by the commenter, saying:

“Two earlier instances, beware the way it was throughout Peak Bear. It's very anticipated. However now it's occurring throughout Mid Bullrun. That's actually a foul factor. It's not imagined to occur, my man.”