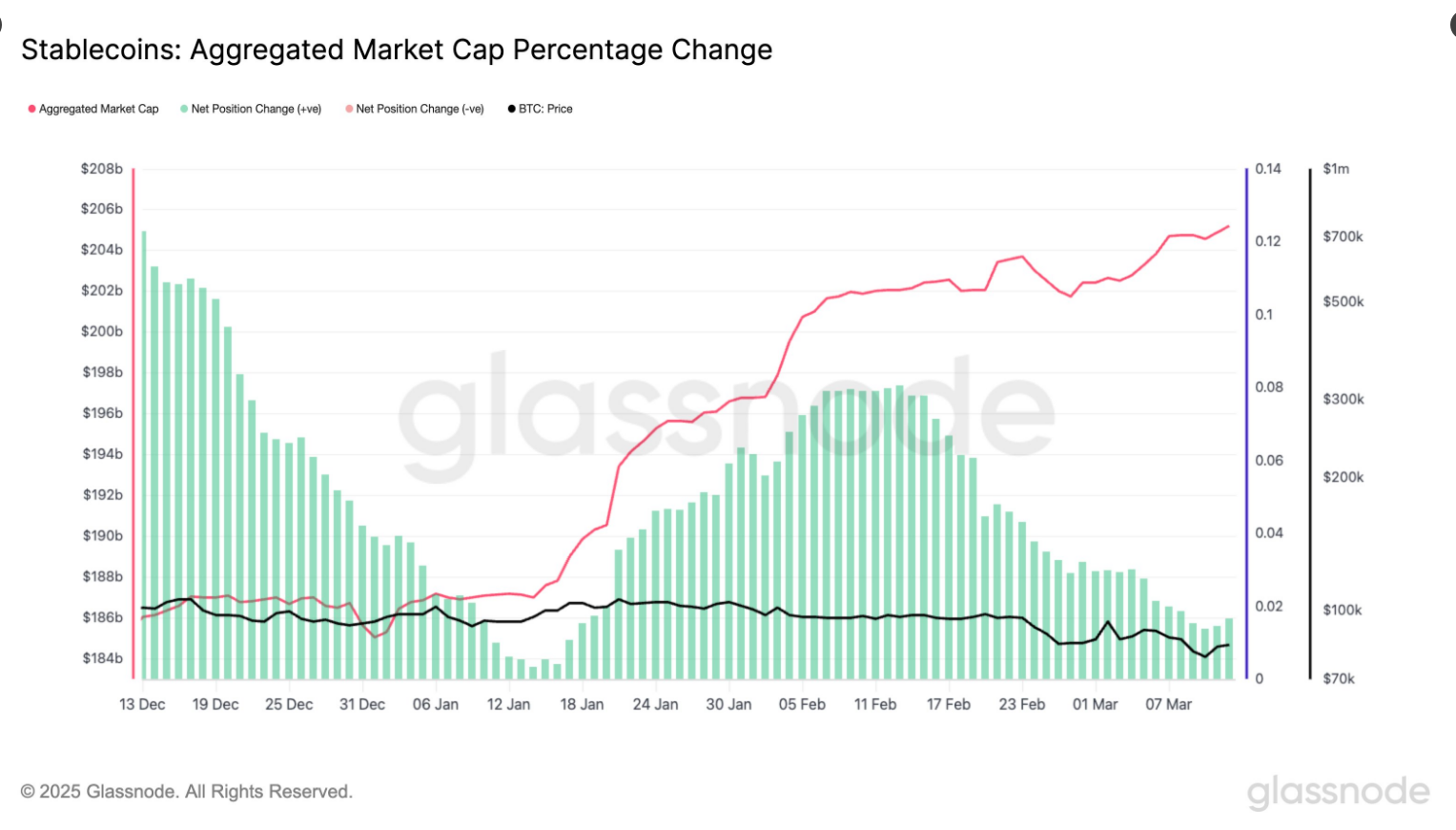

In early 2025, the Stablecoin market surged considerably, with complete provide rising by $20 billion. It has grown 10% since January, so the full provide is now virtually $25 billion. In line with GlassNode knowledge, Spike will come after DIP after Stablecoins provide fell from $187 billion to $185 billion in late 2024.

Stablecoins see robust rebounds

To commerce cryptocurrency, Stablecoins like USDT and USDC usually function preparations for traders who anticipate the appropriate time to purchase property akin to Bitcoin. The current rise exhibits a surge in investor curiosity, notably contemplating final 12 months's slowdown.

Since January 1st, the general #Stablecoin Provide has grown by 20.17B (+10.9%), reaching greater than $20.5 billion.

For comparability, the December peak was recorded at $187 billion, however within the final two weeks of 2024, provide truly contracted, dropping to $185 billion by January 2025. pic.twitter.com/gqbdmedisb

– GlassNode (@GlassNode) March 13, 2025

Contemplating the earlier fall, this comeback is especially noteworthy. For many of 2024, the market has misplaced stubcoins. Nevertheless, this development has not too long ago been reversed. Previous patterns counsel that Bitcoin costs may very well be affected, however it’s unclear whether or not this enhance will result in a rise in cryptocurrency purchases.

Bitcoin traders are watching fastidiously

A rising steady provide is usually seen as an indication of Bitcoin's bullishness. Traditionally, Bitcoin costs have risen alongside the Stablecoin depend. The reasoning is straightforward: changing into extra steady implies that extra potential capital is ready for it to enter the market.

Some analysts imagine this contemporary injection might push Bitcoin excessive. Nevertheless, not all stubcoins are used for buying and selling. Many are held as remittances, funds, or hedges towards inflation, particularly in international locations with unstable native currencies.

As of at this time, cryptocurrency had a market capitalization of $2.65 trillion. Chart: TradingView

Stablecoin Change Holdings fell by 21%

Though complete provide is on the rise, solely 21% of stubcoins are at the moment sitting in change. This has dropped considerably since 2021, when over 50% of provide was accessible for quick buying and selling, GlassNode disclosed. This shift means that whereas new cash are being issued, they don’t seem to be all being deployed instantly into the crypto market.

This might confer with considered one of two prospects. Both stubcoins are getting used extra steadily exterior of exchanges, or traders are nonetheless ready for the appropriate second. If the latter proves appropriate, the influence on Bitcoin could also be much less pronounced than anticipated.

What does this imply for Bitcoin's future?

The Stablecoin market is at the moment experiencing a revival. That is usually a good growth for the cryptocurrency sector. Nevertheless, it’s unclear whether or not it will result in a short-term rise in Bitcoin costs. Using Stablecoin is variable and extra financial variables contribute to this growth.

On the time of writing, Bitcoin was buying and selling at 82,264, 1.1% and 6.9% on every day and weekly frames.

Warwick Enterprise Faculty featured pictures, TradingView charts