Bitcoin's open curiosity in centralized trade and CME has returned to election ranges in November 2024, signaling market stabilization as BTC rebounds to $83,400 following its latest low of $76,600.

Bitcoin bounces again to $83,000 amid open curiosity, normalization of futures bases

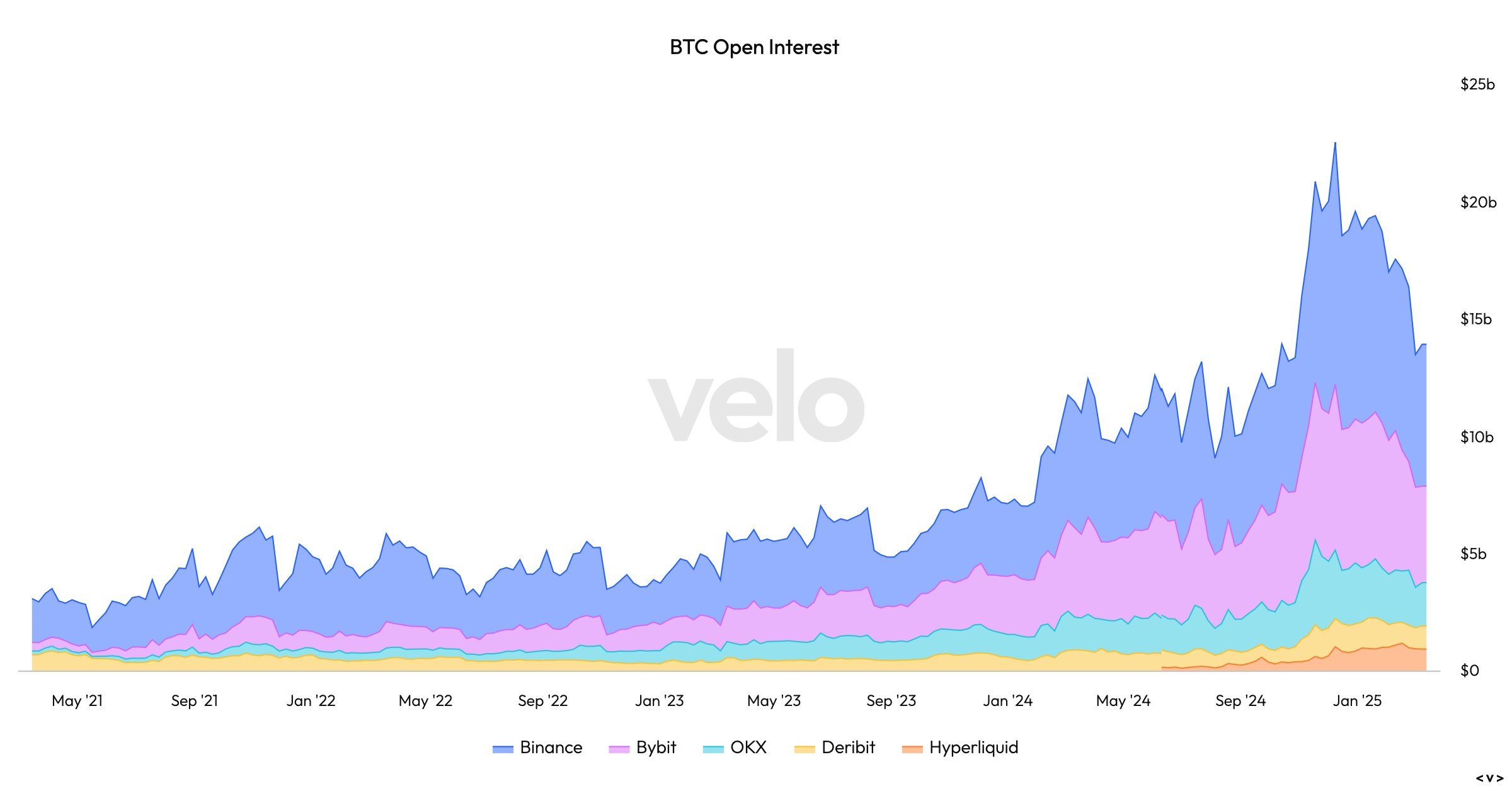

Current knowledge exhibits indicators of stabilization as Bitcoin market exercise returns to ranges seen earlier than the most important 2024 occasions. Open Curiosity – Complete of Unstable Futures Contracts – Centralized Change (CEXES) and Chicago Mercantile Change (CME) boosted this month, ALIGNumbers for the US presidential election earlier than November 2024

Bitcoin Open Curiosity (OI) on March 14th, 2025 by way of velo.xyz.

Equally, Bitcoin's futures base (the hole between futures and spot costs) has been normalized to zero close to the extent of settlement noticed in January 2024 earlier than Spot Change Commerce Funds (ETFs) permitted by the US Securities and Change Fee (SEC).

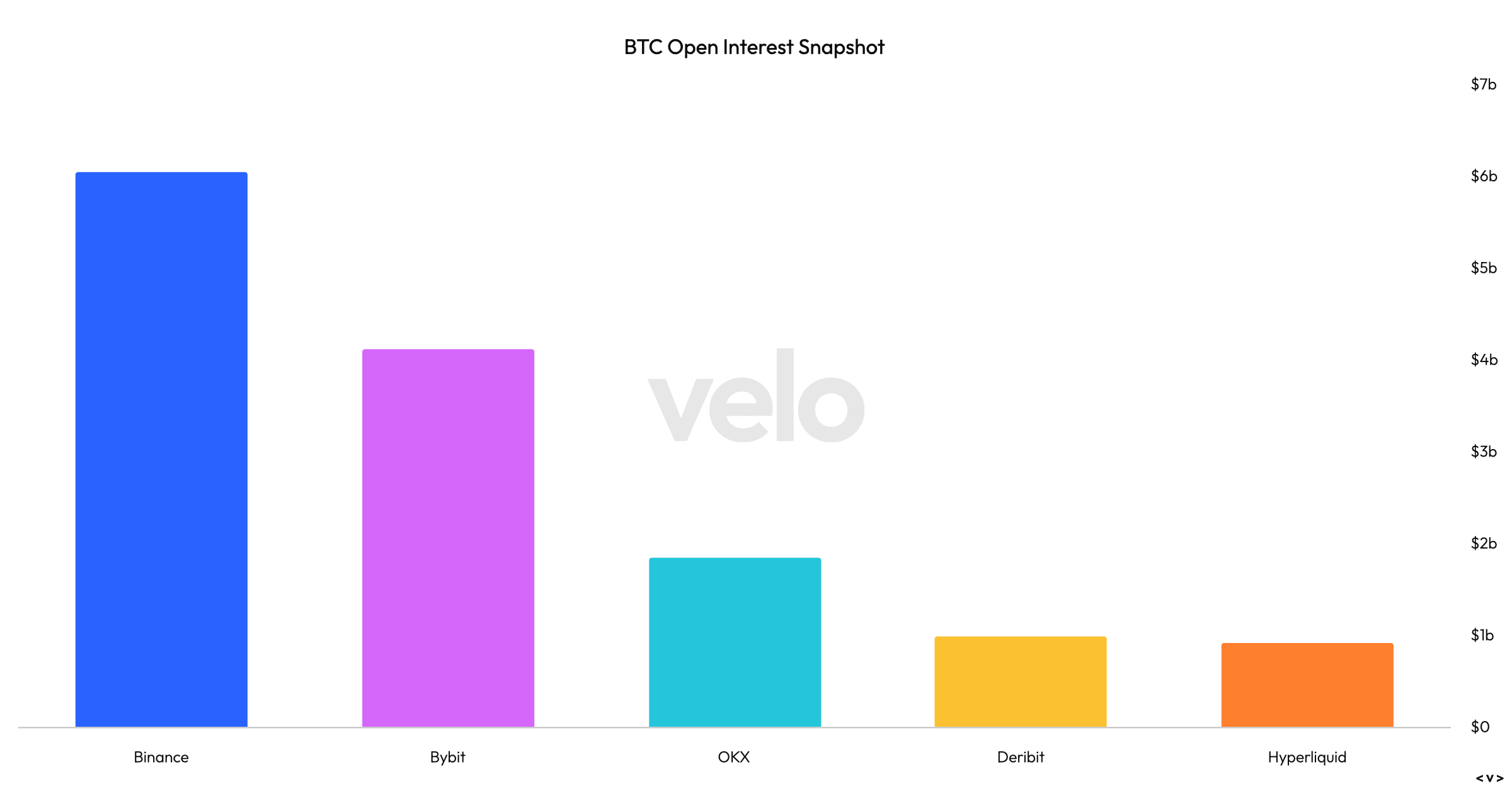

Bitcoin Open Curiosity (OI) snapshot on March 14th, 2025 by way of velo.xyz.

Earlier than the ETF, the bottom hovered at about 0.556%, however decreased the discount after approval as institutional inflows elevated liquidity. The present basis displays the restored worth effectivity between the spot market and the spinoff market.

BTC/USD Spot Value by way of BitStamp on March 14th, 2024, by way of Bitcoinwisdom.io.

On March 14th, 2025, Bitcoin worth restoration reached $83,400. It contrasts with the $76,600 drop final week, displaying resilience regardless of latest volatility and Trump's tariff threats. Specifically, spot costs stay considerably greater than the $42,265 Pre-ETF degree per Bitcoin, suggesting {that a} wider vary of macroeconomic or regulatory elements will have an effect on the valuation.

Altcoin's open revenue benefit has additionally declined from its peak, indicating a decline in speculative exercise in non-Bitcoin belongings. This may be attributed to BTC and ETH prioritization among the many stabilization metrics. Market members view open curiosity and normalisation of futures requirements as constructive indicators. A return to pre-event ranges may cut back sudden worth fluctuations and supply a extra predictable surroundings for in-house and retailers.

The $83,400 BTC spot worth ignores expectations set by normalized metrics, however consultants cite ongoing macroeconomic traits as potential drivers, together with inflation cooling and regulatory advances from the Trump administration. For now, the power of Bitcoin to readjust after main occasions have proven their evolving maturity as an asset class. Primarily speculative forces have been faraway from the market.