Hayden Davis, the notorious Crypto con man Interpol wished, has launched one more Meme Coin, $Wolf, regardless of dealing with a world arrest warrant and fraud investigation. $Wolf surged to a market capitalization of $40 million, with the intention to crash inside days after being promoted by the Wallstreetbets (WSB) neighborhood.

On-chain analysts at Bubblemaps revealed proof of insider operations, displaying that 82% of the entire provide is managed by a small group of wallets, elevating considerations about Lagpur.

On-Chain Knowledge exposes Hayden connections to $Wolf

Hayden has a historical past of failed meme cash, resembling $libra and $melania, each of which ended up with big losses for traders. His newest venture, $wolf, follows the identical sample. In keeping with Bubmembaps, Hayden hides his id, however left a trajectory of on-chain transactions that hyperlink on to multi-million greenback crypto disasters.

The Wallstreetbets account promoted $Wolf Meme Coin earlier than crashing. Supply: Bubblemaps (X/Twitter)

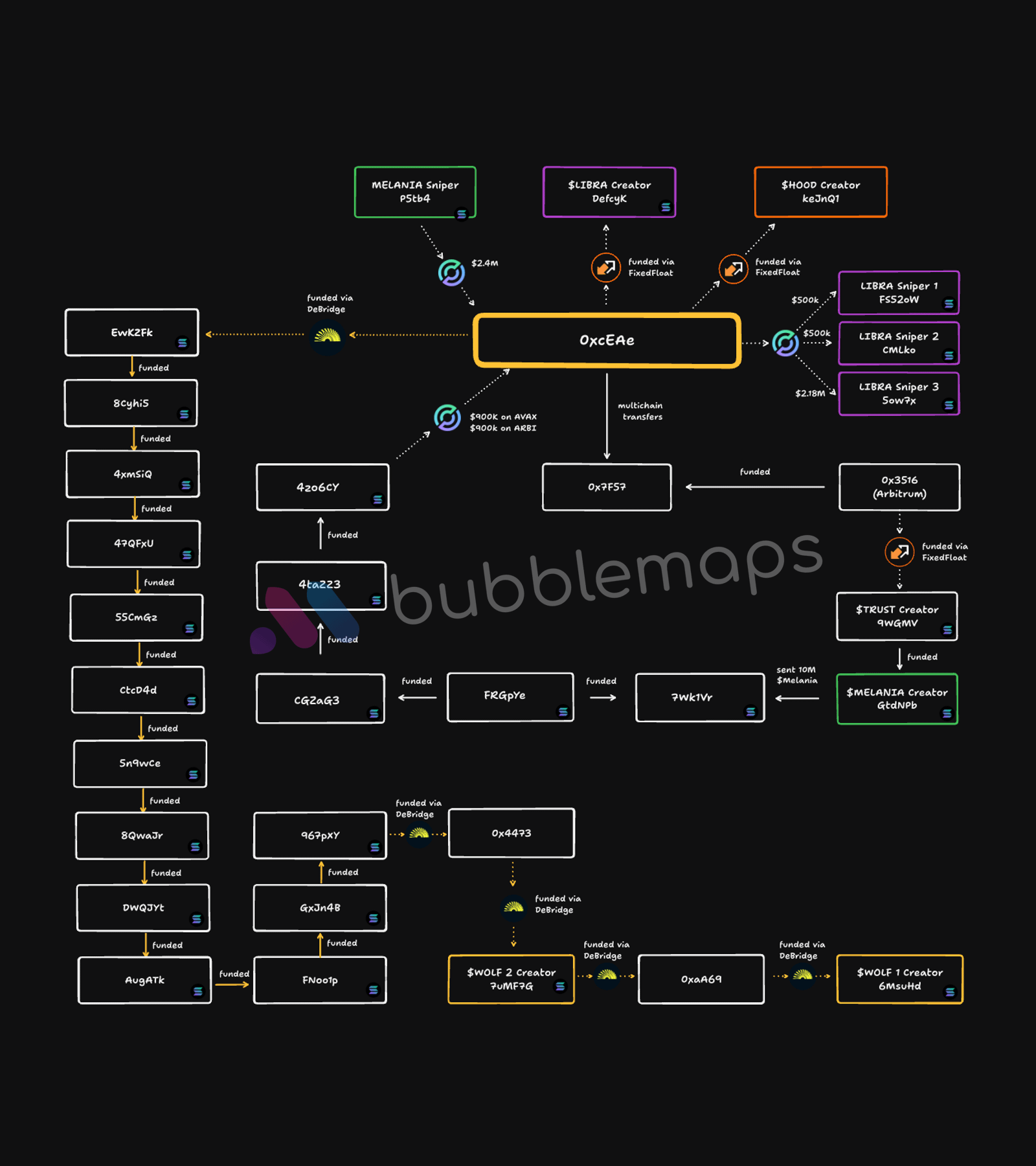

Bubblemaps, alongside Crypto investigator Coffeezilla, tracked $Wolf's transaction historical past and recognized Hayden because the mastermind. Bubblemaps particulars how they adopted 17 addresses and 5 cross-chain forwarding, all main to at least one deal with.

In a put up on X, Bubblemaps stated: “Beginning with $Wolf Creator 6MSUHD, I adopted a funding transmission spanning 17 addresses and 5 cross-chain transfers. Every little thing led to a single deal with: oxceae. The identical one owned by Hayden Davis!”

Bubblemaps tracked 17 addresses and 5 cross-chain forwardings to at least one Oxceae deal with. Supply: Bubblemaps (X/Twitter)

Hayden's $Libra is likely one of the largest lag pulls in latest cryptography historical past. The memecoin was closely promoted by Argentine President Javier Mairei.

Buyers rushed, pushing $Libra's market capitalization over $1 billion, then crashing in a single day, erasing liquidity of $99 million. Over 10,000 traders misplaced a complete of $250 million, however Hayden is alleged to have cashed practically $100 million earlier than the crash.

Following the collapse of $Libra, Argentine lawyer Gregorio Dalbon referred to as for a direct arrest of Hayden and requested an Interpol Purple discover on fraud and monetary crimes. Regulators all over the world are at the moment intently monitoring his transfer, however as you may see, he has to this point circumvented regulation enforcement and continues to fireside new meme cash underneath pretend id.

Hayden's small hustlers to world fugitives

Hayden's background is much from regular. He was a university dropout, promoting vitality drinks and Oreo as a youngster to pay payments. On LinkedIn he as soon as listed “Hustling Professional” as considered one of his vital abilities. He’s at the moment 28 years previous.

His enterprise capital agency, Kercia Ventures, is run by his father, Tom Davis. Tom Davis is a convicted felon who ran a beforehand controversial Christian adoption nonprofit earlier than switching to entrepreneurship and enterprise teaching.

In 2023, Kelsier moved the enterprise from the US to Dubai, the place he invested in crypto startups and offered advertising providers for NFTs, exchanges and memecoin.

On the time, Tom Davis was removed from a cryptocurrency skilled. Beforehand, he had struggled to develop a verify, he informed the Christian broadcasting community and pleaded responsible to the theft, in response to regulation enforcement information. He went to Bible Faculty, grew to become an entrepreneur, and invested in brick and mortar shops resembling Skrimp Shack, a series of seafood eating places within the US and the Center East.

Tom Davis was the founding father of Kelsier, however Hayden was the face. A fellow trade teammate who labored with Hayden stated he was a easy speaker and a pure deal maker.