Nigeria has lately confronted one of the crucial extreme financial crises. Inflation surged in the direction of the tip of 2024 to hit highs. Regardless of a point of easing, residents nonetheless endure inflationary pressures.

In the meantime, the Nigerian authorities is accelerating its efforts to control cryptocurrency buying and selling. Prospects say that interventions might improve the nation's revenue.

Nigeria faces inflationary strain

Nigeria, probably the most populous nation and largest financial system in Africa, has lengthy been affected by financial instability. Sources present that annual inflation fee surged to 24.48% in January 2025 earlier than falling to 23.18% in February.

The 1.3% decline means that authorities monetary tightening measures could also be starting to take impact. Nonetheless, the nation's Naira foreign money is considerably undervalued. Over the previous 12 months, we now have misplaced 230% of our price towards the US greenback.

“The decline in inflation charges is primarily as a result of rebase of the Client Value Index (CPI), not an actual decline in value ranges or inflation pressures,” one citizen emphasised.

It’s because the nation's import-dependent financial system is so weak to exterior shocks. In opposition to this backdrop, President Bora Tinubu's administration carried out daring financial reforms to stabilize the financial system.

Amongst them is the elimination of gasoline subsidies over a decade and the unification of a number of change charges throughout the nation. Nonetheless, these measures have had unintended penalties, together with a surge in gasoline costs and a extreme life disaster.

The affect of inflation is especially devastating in conflict-filled areas the place communities depend on meals subsistence agriculture.

Cryptocurrency as a hedge with new rules on the horizon

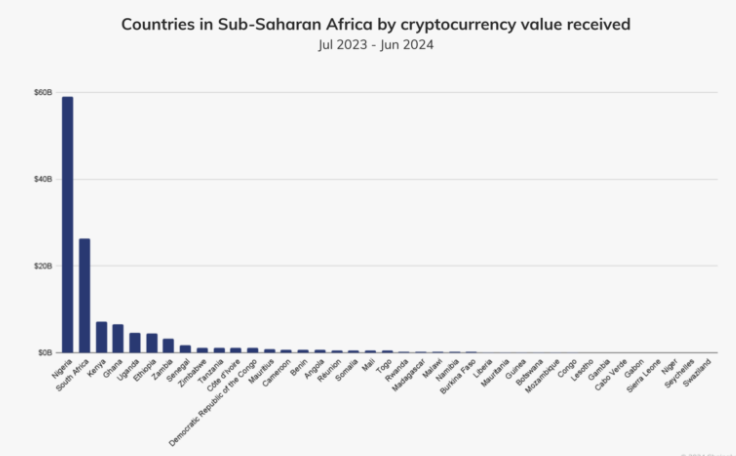

Amidst financial uncertainty, many Nigerians have turned to crypto as a hedge towards inflation and foreign money depreciation. Blockchain analytics agency Chain Orisis revealed that between July 2023 and June 2024, Nigerians traded about $59 billion in crypto property.

Nigeria will take the lead in crypto buying and selling in sub-Saharan Africa. Supply: Chain melting report

This surge in encryption displays the rising mistrust within the conventional monetary system. It additionally suggests a need for a extra steady and accessible monetary different.

Nigerian authorities have finalized new rules in response to elevated adoption of crypto. They need to combine digital asset transactions into a proper financial system.

The Nigerian SEC (Securities and Alternate Fee) has drafted a coverage to make sure that all eligible transactions on regulated exchanges are included into the nation's tax community.

The proposed invoice, which outlines tax insurance policies on crypto transactions and different digital property, is underneath legislative evaluate. A typical sentiment is to cross inside the first quarter of 2025 (Q1).

In the meantime, the Central Financial institution of Nigeria (CBN) is stabilizing its foreign money and regaining belief from buyers. Gov. Olaemi Cardoso introduced that the financial institution has cleaned up its $2.5 billion international change backlog, with one other $2.2 billion anticipated to be resolved quickly.

Nigerian President Tinubu additionally ordered the discharge of meals reserves and established a Commodity Committee to curb and stabilize costs.

Whereas the financial disaster in Nigeria has left tens of millions struggling, authorities intervention efforts, together with indicators that ease crypto taxes and inflation, counsel a possible shift. However it relies upon closely on how authorities successfully implement their insurance policies and whether or not the worldwide financial scenario is favorable.

On the identical time, the adoption of a rustic's cryptocurrency presents each alternatives and challenges. If correctly regulated, digital property might present Nigerians with monetary options that may assist them navigate financial instability.

However, balancing innovation and regulation ensures that cryptography stays a viable resolution somewhat than a supply of recent monetary threat.

“Nigeria presently requires massive investments in each formal {and professional} schooling. That is important to boosting the expert workforce and being able to as we speak's world digital financial system. Particular consideration have to be paid to the blockchain, digital property and Web3 shared by one person shared on X.