The 2022 transition from Ethereum's Proof of Work (POW) to Proof of Stake (POS) was marked as a serious technological change. We have now diminished the community's vitality consumption by greater than 99%.

Nonetheless, Meltem Demirors, a normal associate at Crucible Capital and former Coinshares government, argues that the transition is a pricey mistake.

Ethereum missed a trillion greenback alternativey

Based on Demirors, Ethereum's transfer to POS devalued the community by permitting for the expansion of Layer 2 (L2) options. She believes that the L2 scaling answer is diluting the core Ethereum ecosystem. In her opinion, if Ethereum had stayed at POW, it might have been a trillion greenback protocol and will have leveraged a robust vitality computing ecosystem much like Bitcoin.

In distinction, if Ethereum had held its POW mannequin, it might have pushed innovation in GPU computing. She likened this to how Bitcoin Miners have pushed advances in {hardware} know-how.

“Proof of curiosity was a mistake. Ethereum might have been a trillion greenback protocol with its personal sturdy vitality for calculating the ecosystem. As a substitute, MEV extracts billions of {dollars} from customers and apps,” she defined.

Her argument means that beneath the POW, Ethereum might have maintained a stronger, extra centralized Layer-1 (L1) community with out the fragmentation launched by the Layer 2 scaling answer.

In 2022, Ethereum achieved “Zero Web Issuance” 55 days after the merge, making a headline as ultrasound cash. Following the London Exhausting Fork in 2021, we launched the EIP-1559, burning among the transaction charges and decreasing our whole ETH provide over a protracted time period.

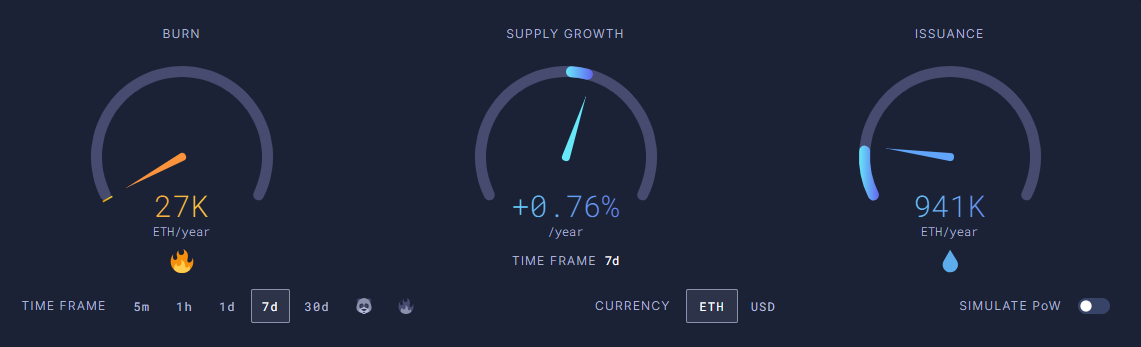

Nonetheless, current knowledge means that Ethereum has been experiencing its longest interval of inflation since its transition to POS. Based on ultrasound gold, Ethereum's annual inflation price reached 0.76%. On the time of writing, the community is barely burning 27,000 ETH per 12 months, whereas publishing 943,000 ETH per 12 months.

Ethereum provide and burn price. Supply: ultrasound.cash

This contradicts the earlier deflationary narrative that positioned ETH as a extra priceless repository than Bitcoin.

“On the present price of community exercise, Ethereum is not going to be deflationary once more. The 'ultrasound' story will doubtless have died or require a lot greater community exercise to come back again to life,” Cryptocant analysts just lately emphasised.

Has Ethereum been meant to be cash?

Just lately, Peter Szilagyi, the lead of a serious Ethereum workforce, stated ETH was by no means meant to be cash. This assertion challenges the elemental narrative of Ethereum's transition to POS.

“ETH was by no means meant to be cash. ETH was meant to assist a decentralized world. It includes worth ETH. It stated that ETH didn't need ETH to make it cash. It produced tar and feathers.”

If ETH was not supposed to be cash, what would its final function be? Critics argue that this lack of clear imaginative and prescient undermines Ethereum's long-term worth proposition. Regardless of these adjustments, Ethereum Community has witnessed vital scaling actions.

Vince Yang, CEO of Zklink, stated the EIP-4844 improve will stay helpful for Ethereum, particularly for layer 2 networks.

“Scaling exercise at Ethereum exploded from 140 to 285 TP in comparison with earlier this month attributable to a major discount in gasoline prices to carry out Layer-2 transactions,” Yang instructed Beincrypto.

This scaling exercise is vital for growing new blockchain purposes and strategically deploying Layer 2 and Layer 3 options.

ETH value efficiency. Supply: Beincrypto

Beincrypto knowledge reveals that ETH has traded at $1,971 on the time of this writing, down greater than 2% over the past 24 hours.