Coin Metrics' newest State of the Community Report reveals that amid the dangers of geopolitical provide chains, the steadiness between secure revenues from {hardware} upgrades and renewable vitality adoption with sustained payment pressures via {hardware} upgrades and renewable vitality adoption.

China tariffs, Texas renewable vitality, and AI: 2025 transformation of inner bitcoin mining

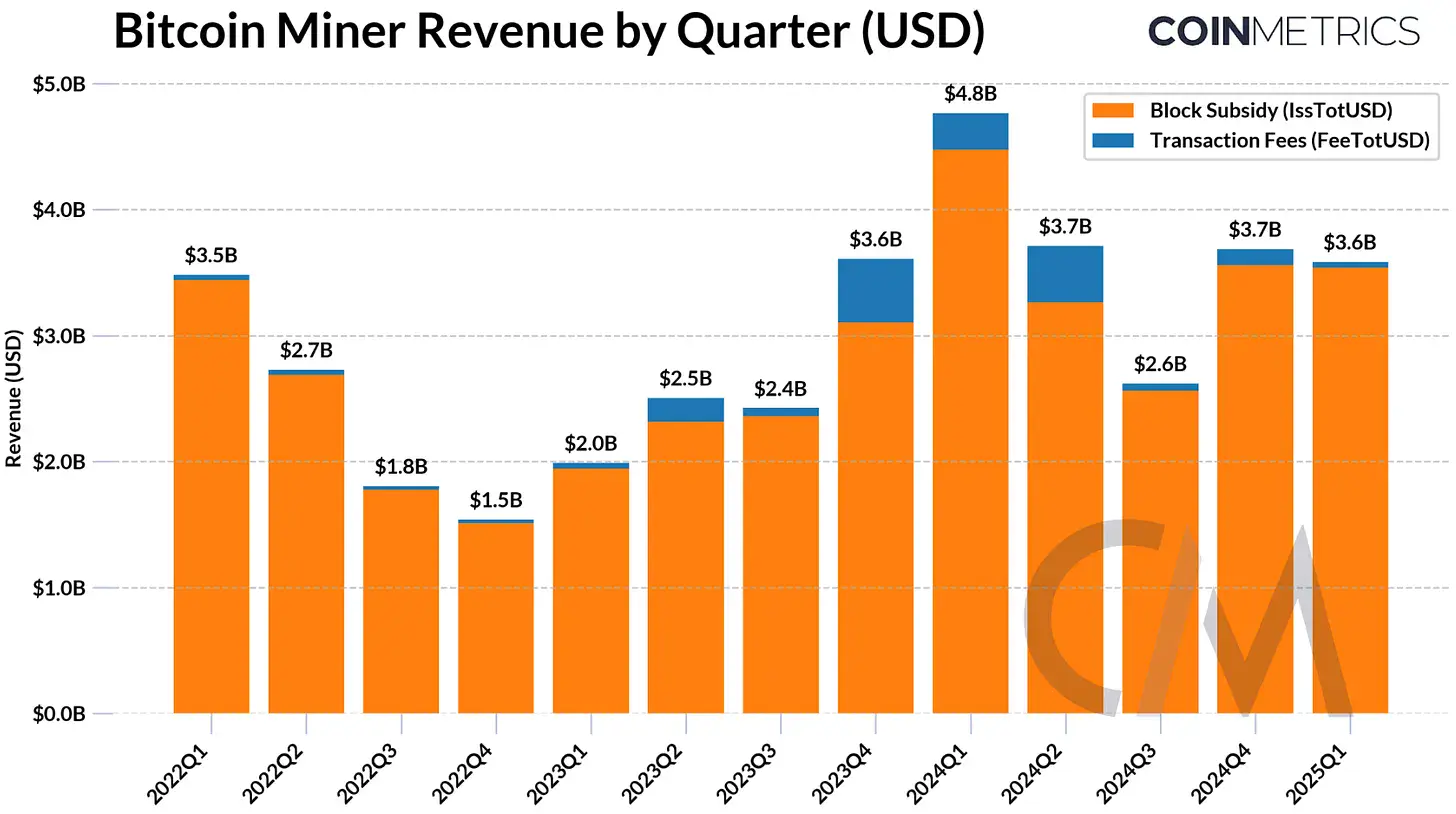

The state of the Coin Metrics 'Q1 2025 Community Report highlights secure Bitcoin mining revenues, following half of 2024, however underneath 2% of complete income, it might problem long-term incentives, however regardless of sustained low buying and selling charges, miners' complete income reached $3.7 billion within the fourth quarter of 2024. It is a quarterly enhance of 42% because of elevated operational effectivity and a restoration in Bitcoin costs. Coinmetric knowledge reveals that the typical 30-day hashrate rose to 807 EH/s in early 2025, reflecting sustained community progress.

The report notes that mining operations are more and more adopting energy-efficient ASICs and relocating to areas with low-cost renewable vitality, resembling Texas, Africa and elements of Latin America. Massive, capitalized corporations diversify income streams, and Coinmetric cites examples resembling Core Scientific pivots utilizing 200 MW of current infrastructure.

The report notes that mining operations are more and more adopting energy-efficient ASICs and relocating to areas with low-cost renewable vitality, resembling Texas, Africa and elements of Latin America. Massive, capitalized corporations diversify income streams, and Coinmetric cites examples resembling Core Scientific pivots utilizing 200 MW of current infrastructure.

Coin Metrics' analysis highlights considerations about {hardware} centralization, with Bitmain manufacturing ASICs, together with the S19 sequence, estimated between 59% and 76% of Bitcoin's hashrate. This belief creates provide chain vulnerabilities which might be exacerbated by geopolitical friction. Particulars of the report illustrate the dangers related to delays within the cargo of bitmain {hardware} to US miners in early 2025 because of Chinese language import duties, and intensive manufacturing.

Using Bitcoin as a medium of trade stays restricted per coin metric, and its position is more and more skewed into worthwhile purposes. Nonetheless, Layer 2 (L2) options resembling sidechains resembling Lightning networks and stacks are aiming to revive transaction utilities. The report states that Lightning Community Channels fell to 52,700 within the first quarter of 2025, whereas secure channel liquidity (4,500-5,000 BTC) suggests a rise in effectivity.

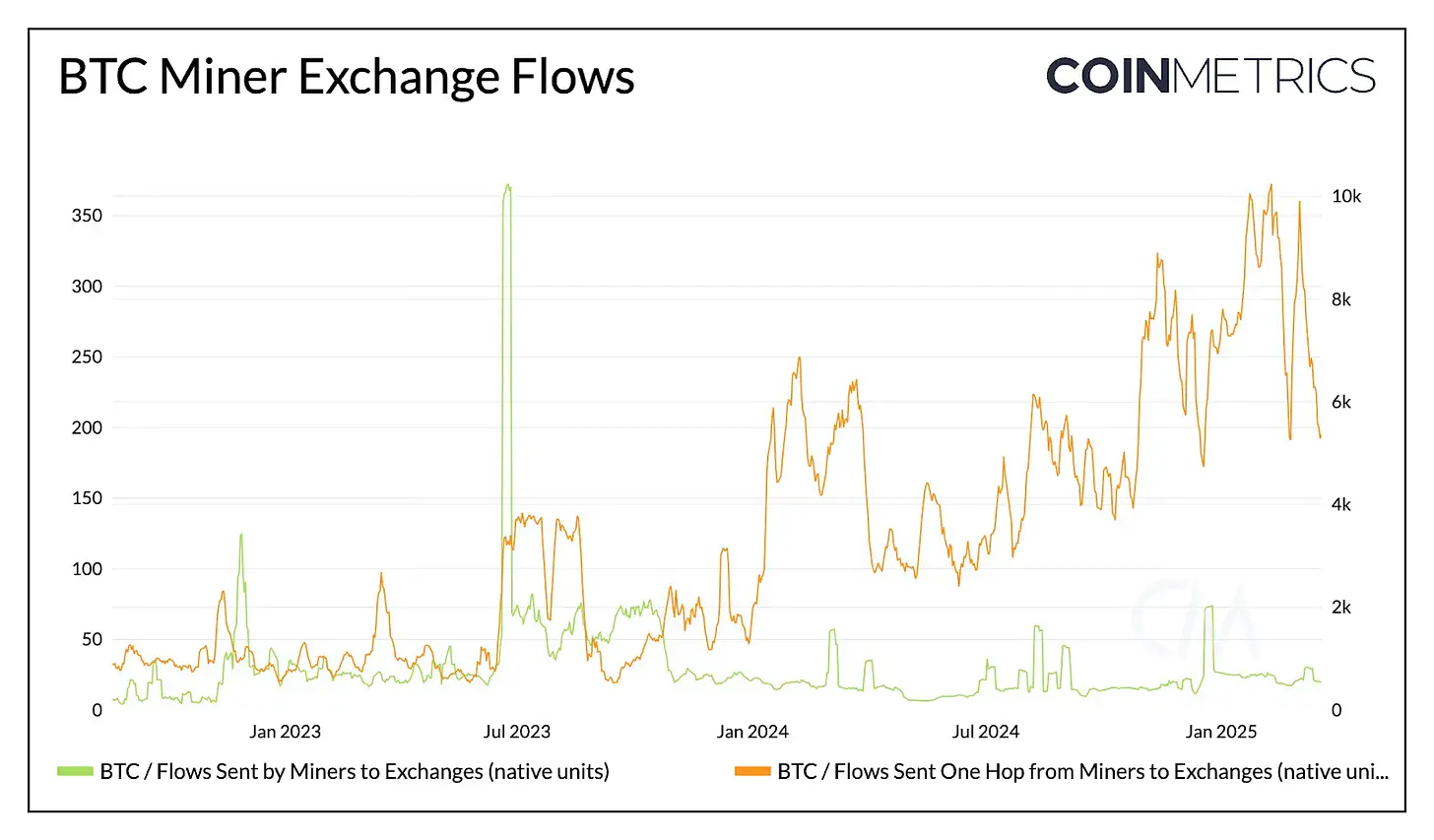

Coinmetric Alternate Movement Knowledge reveals a switch to exchanges that remained progressively rising because of secure (0 hop) transfers from miners. Smaller miners look like liquidating their holdings in phases, however bigger operations optimize monetary administration amid volatility.

The report concludes that as block rewards lower, it’s probably that greater transaction charges will probably be required by L2 recruitment and block house competitors to keep up miners' incentives. Coin Metrics highlights the continued dangers to {hardware} centralization and community decentralization from geopolitical disruption, encouraging steady adaptation of your entire mining ecosystem.