As April approaches, merchants are carefully watching whether or not Bitcoin can keep its present momentum or face one other spherical of volatility. Main cryptocurrencies are buying and selling at $87,208, and have been specializing in a ten% improve over the previous two weeks.

With a wider market restoration underway, demand for BTC may very well be strengthened in April, with its costs steadily recovering and retesting the $90,000-95,000 vary.

Bitcoin market backside? In keeping with analysts, the present degree signifies bounce

Bitcoin (BTC) kicked off in March with a powerful bullish momentum and had surged to a excessive of $96,484 by March 2nd. Nonetheless, market sentiment grew to become bearish and earnings have been strengthened, dragging the principle coin to a four-month minimal of $76,642 on March eleventh.

Since then, Bitcoin has staged a restoration pushed by wider market rebounds and up to date demand. Cash are presently traded inside parallel channels in ascending order. This can be a sample that reveals a gradual surge in BTC costs as momentum will increase.

BTC rising parallel channel. Supply: TradingView

We confirmed this bullish outlook in an unique interview with Beincrypto with Julio Moreno, the top of analysis at Cryptoquant.

“The worth of Bitcoin may bounce again in April as gross sales pressures eased from merchants,” Moreno stated.

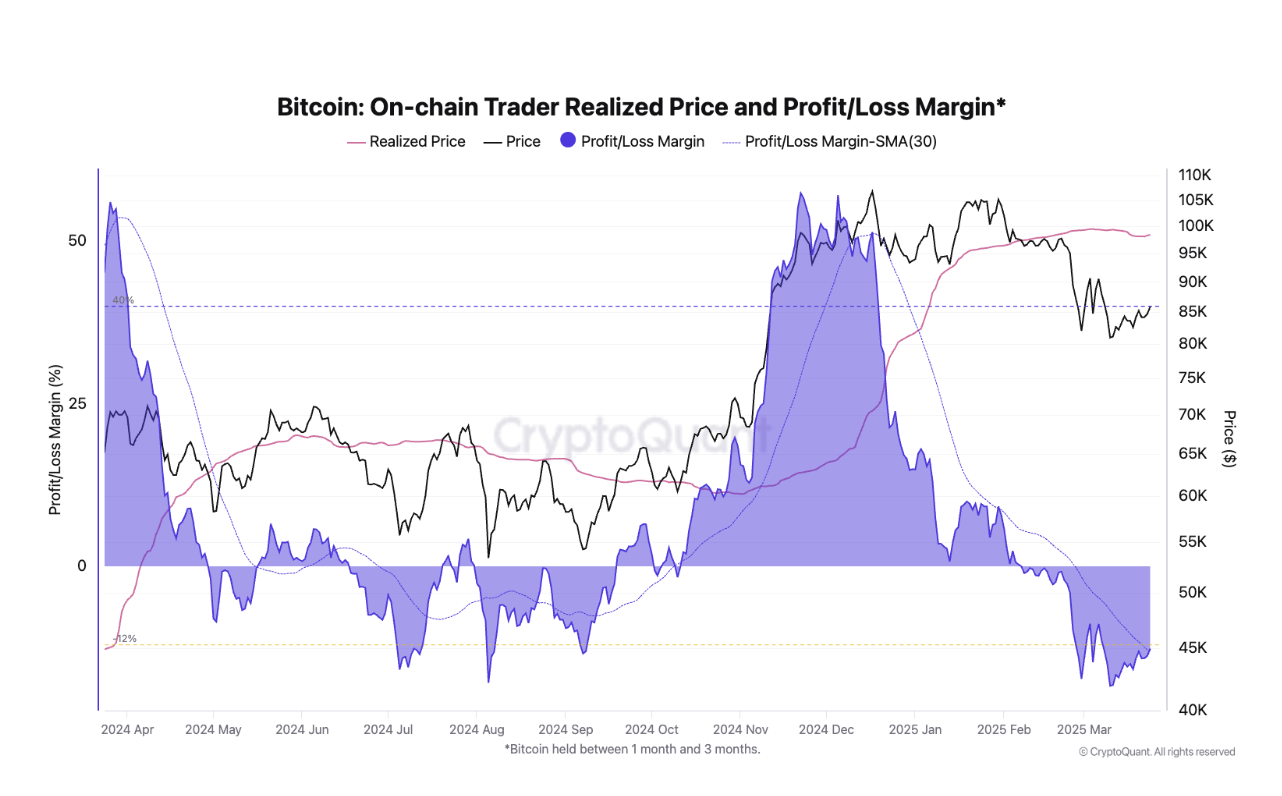

Moreno assessed the realised revenue/loss margins of BTC and located that it had been steadily lowering because the starting of the yr. As this metric drops, the general profitability of BTC cash spent on the chain is lowering.

BTC has achieved revenue/loss margins. Supply: Cryptoquant

This implies buyers will acknowledge much less earnings or undergo losses, decreasing their incentives to promote. Over time, this pattern will steadily ease gross sales strain within the BTC market and lift costs within the coming weeks.

“Bitcoin costs have skilled a 23% drawdown from earlier file highs, so merchants solely expertise losses when offered. This case often signifies that there’s much less gross sales strain for Bitcoin.

Gross sales strain can surge as feelings worsen

Bearish sentiment stays essential amongst merchants, particularly because the markets attempt to get better.

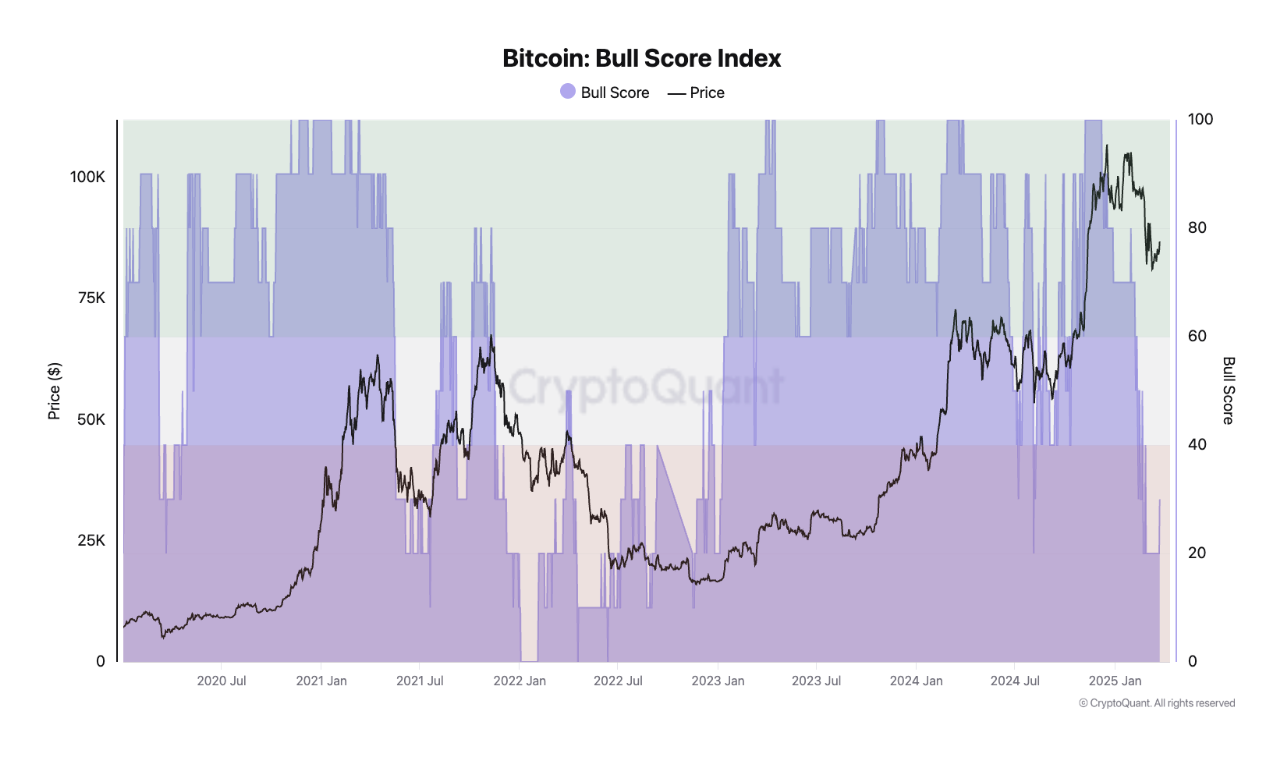

“As you possibly can see in Cryptoquant's Bullscore Index, total market sentiment stays bearish. We touched on 20 a number of days in the past – displaying the bottom market scenario since January 2023.

He additionally added that traditionally, Bitcoin has solely skilled a sustained value rise when its bull rating is above 60, with constant measurements under 40 being linked to the bear market.

BTC Bull Rating Index. Supply: Cryptoquant

The studying from the code's worry and grasping index displays this outlook. On the time of press, the index was 40 years previous, suggesting that the market is presently afraid.

Code worry and greed index. Supply: Various.me

If merchants worry this manner, they trigger a rise in gross sales strain, a lower in BTC buying and selling quantity, and value triggers.

Will Bitcoin maintain above $87,000 or will it drop to $77,000?

BTC traded at $87,208 at press time, up 2% final week. On the BTC/USD one-day chart, the Coin's relative power index (RSI) stays barely above the impartial line of 51.48, indicating a gradual revival of recent demand for King Coin.

The RSI indicator measures the market circumstances for asset acquisitions and overselling. It ranges from 0 to 100. Values above 70 counsel that the asset is over-acquired and paid for a value drop, whereas values under 30 point out that the asset is over-sold and will witness a rebound.

At 51.48, with a slight uptrend, BTC's RSI suggests a rising bullish momentum out there. If demand is strengthened, the coin may very well be pushed to $89,434. A profitable violation of this resistance may result in a rally to $93,478.

BTC value evaluation. Supply: TradingView

Nonetheless, as soon as Selloffs resumes, BTC costs may drop to $77,114.