Ethereum is at present making an attempt to get well after months of bear strain, however key resistance ranges and liquidation dynamics recommend that warning continues to be wanted.

Technical Evaluation

By Edris Dalakshi

Each day Charts

On the each day charts, ETH can bounce off the $1,900 help zone and is at present pushing in direction of the $2,200 resistance space. Nevertheless, the belongings are effectively beneath the 200-day shifting common, at round $2,900, and proceed to function a significant hurdle.

The RSI is regularly climbing, however nonetheless not within the acquired territory. Except your ETH holds above $2,400, the downtrend construction stays intact, with the $1,900 and $1,600 ranges serving as essential help for viewing.

4-hour chart

The four-hour chart reveals Ethereum forming an ascending channel, which has just lately pushed in direction of the higher restrict of almost $2,150. The rally from the $1,900 help zone was sturdy, however the belongings are approaching the confluence of resistance ranges, together with the $2,200 zone marked with earlier breakdowns.

RSI additionally enters over-acquisition areas, suggesting attainable fatigue. Breakouts over $2,200 may bullish short-term bias, however rejection from present vary may pull ETH again into the $1,900 zone.

Emotional evaluation

By Edris Dalakshi

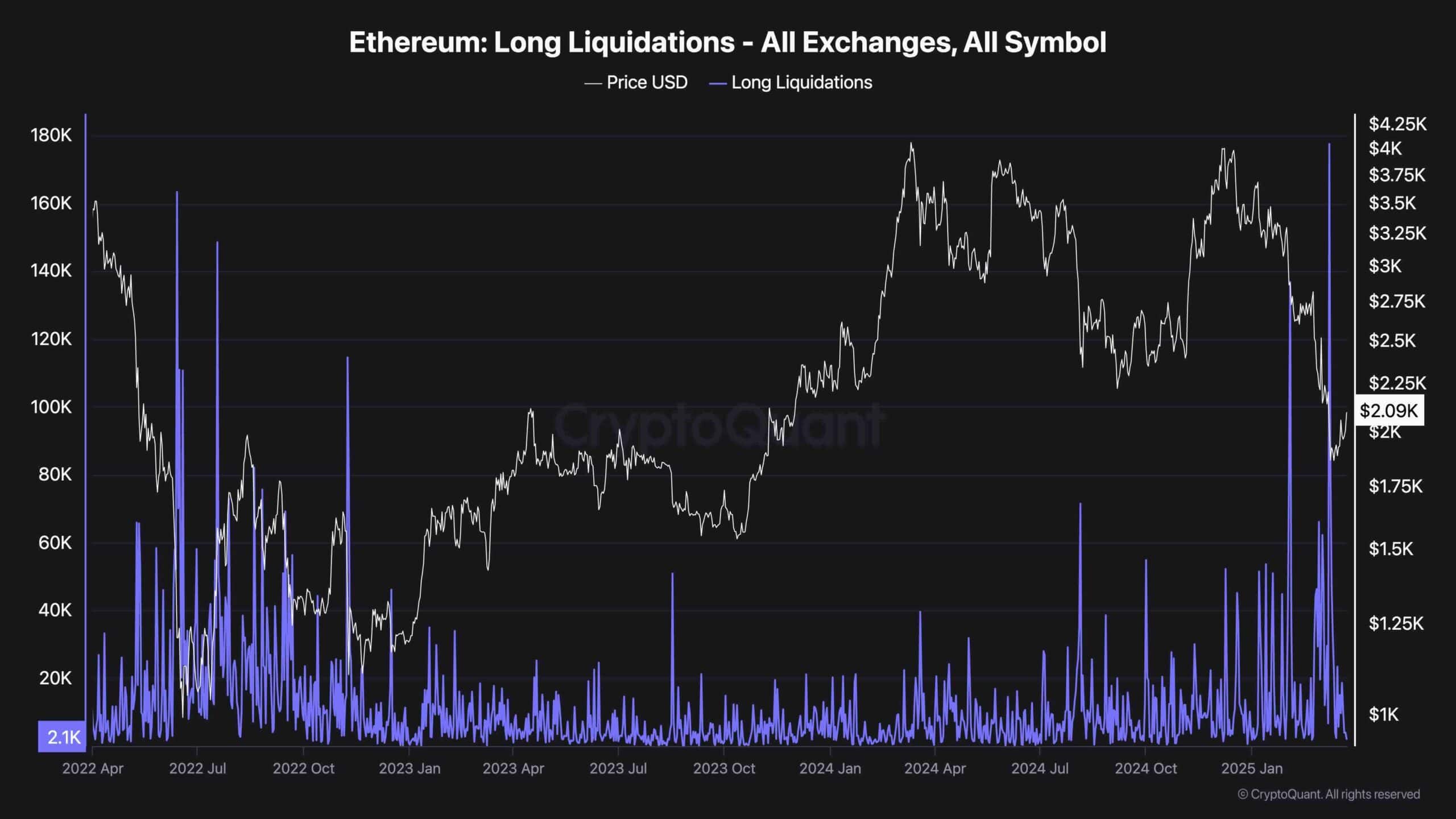

Lengthy liquidation

The lengthy liquidation chart has revealed sharp spikes in latest months, particularly when it falls beneath the ETH $2,000. These mass clearings worn out the leveraged size areas and contributed to elevated volatility. The liquidation occasion is at present being cooled, but when leverage accumulates once more, the market stays weak to sharp actions.

Earlier spikes have proven weak emotions amongst speculators, and sharp rejection within the resistance zone may cause one other cascade of lengthy liquidation and strengthen bear strain. Total, worth stability and sustainable restoration will lead to stronger demand for lowered leverage and spot-driven demand.