Ethereum costs crashed greater than 6% on Friday, persevering with the downtrend, peaking at $2,105 on March twenty fourth.

Ethereum (ETH) has dropped to its lowest degree of $1,880 since March 18th. It erased a lot of the earnings made previously two weeks.

After the US launched sizzling inflation knowledge, the ether crashed, stating increased rates of interest longer. The core client spending index rose from 2.7% in January to 2.8% in February. The headline PCE rose to 2.5%, increased than the two.0% Federal Reserve goal.

These numbers imply that inflation will stay sticky for a while, particularly after Donald Trump applied tariffs on his launch day. Excessive inflation means the Federal Reserve might maintain increased rates of interest for longer.

This explains why different harmful property have been eliminated after the PCE report. The S&P 500 index fell by 1.50%, whereas the Nasdaq 100 and Dow Jones crashed by 2% and 1.2%, respectively. Most cryptocurrencies, together with Bitcoin (BTC) and Cardano (ADA), have additionally crashed.

You would possibly prefer it too: Because of this BTC, SHIB, DOGE and ADA costs slipped after US PCE knowledge.

Ethereum costs crashed as indicators of worry and greed fell to 25 forward of Trump's tariffs. Economists warn that these tariffs might result in a recession, erasing among the development that occurred beneath Joe Biden.

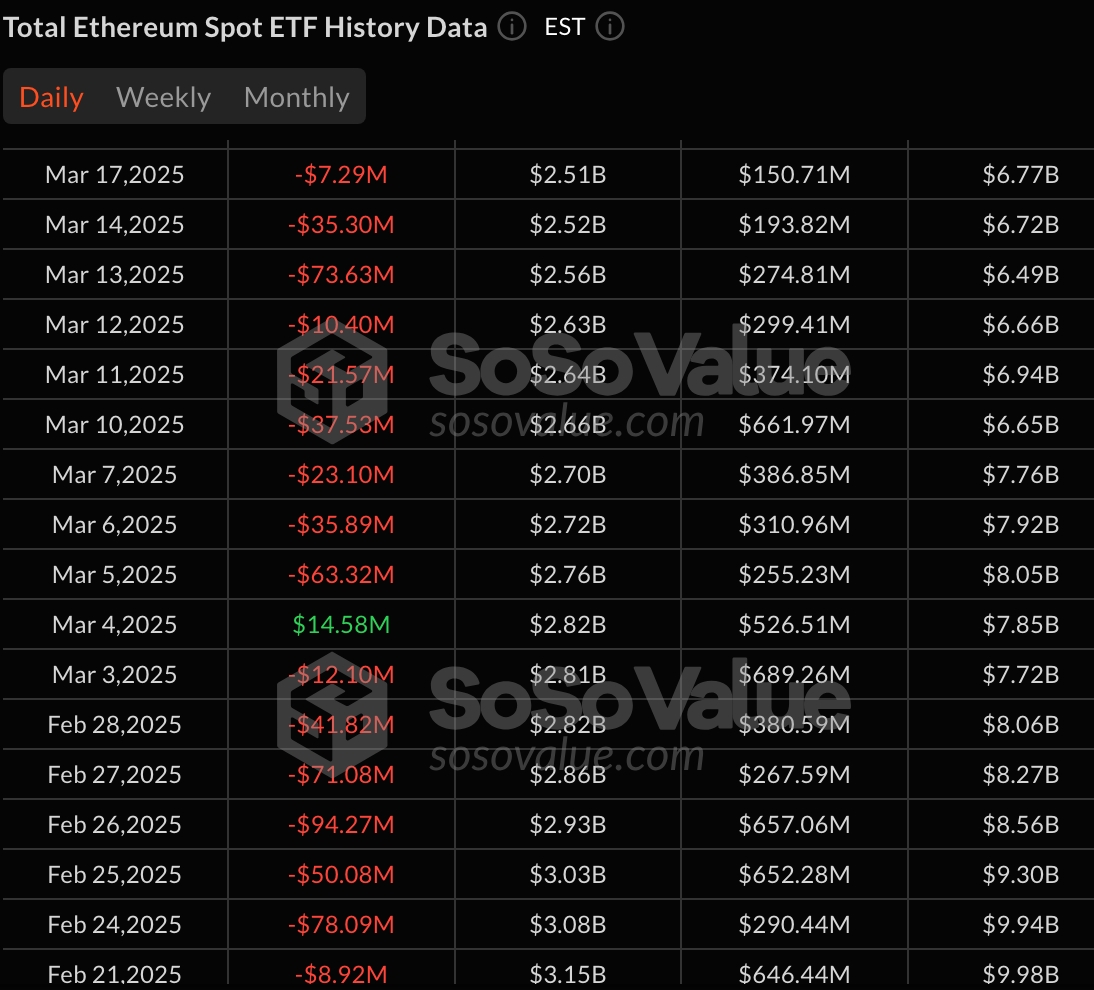

What's extra, Wall Avenue buyers stay on the sidelines as Ethereum challenges stay. Sosovalue knowledge exhibits that Spot Ethereum ETFs solely inflows as soon as in March. They added a internet price of $14.8 million on March 4th, and have since minimize their property, bringing their gathered property to simply $2.4 billion. All Ethereum ETFs have solely $6.866 billion.

Ethereum ETF inflows and outflows | Supply: SosoValue

Moreover, Ethereum continues to lose market share in main industries, together with decentralized finance, inappropriate tokens and decentralized exchanges. Misplaced shares of Layer-1 chains reminiscent of Sonic and Berachain, and Layer-2 networks reminiscent of Base and Arbitrum.

Ethereum worth know-how evaluation

ETH Value Chart | Supply: crypto.information

ETH costs additionally crashed resulting from technical causes. The weekly chart exhibits that it shaped a triple prime sample and a $2,130 neckline at $4,000, the bottom degree final August.

Ethereum fell beneath this neckline earlier this month and retested it this month. The break-and-retest sample is a well-liked continuation signal. It additionally kinds a bearish flag sample that features vertical traces and a few integrations.

Due to this fact, there’s a threat that the coin will collide with its lowest level, $1,537 on October ninth. A resistance degree of $2,131 will invalidate the bearish view.

You would possibly prefer it too: CNBC's Macheel:sec roundtable might “change Outlook” in Ethereum ETF