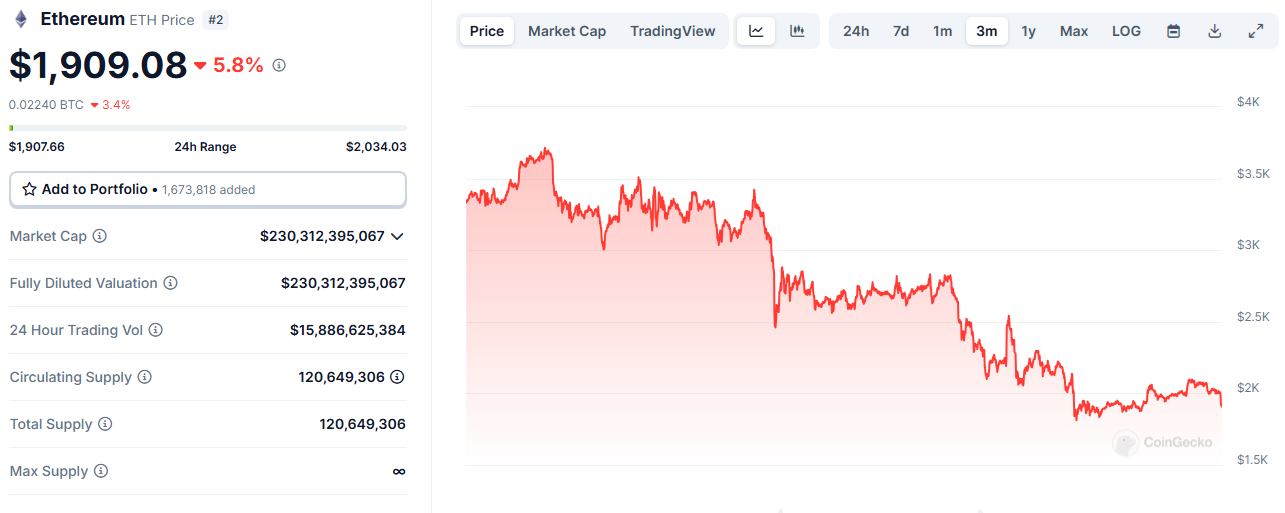

Ethereum (ETH) once more fell beneath $2,000, shedding greater than 5% in a single day. ETH solely had a deeper crash than Bitcoin (BTC) and returned to $86,000.

Ethereum (ETH) crashed once more, sinking beneath $2,000 after a hunch within the normal market. The token has not achieved its promised breakout and is buying and selling at 0.022 BTC. In Fiat's phrases, ETH was traded at $1,917.21, near the low vary of three months.

Ethereum (ETH) trades close to a 3-month low, however there are indicators that whales are accumulating at ranges beneath $2,000. |Supply: Coingecko

ETH sentiment remained impartial, with open curiosity all the way down to $9.9 billion. Spinoff merchants accumulate liquidity on the $2,040 and $2,100 ranges, however ETH can immerse themselves within the $1,800 vary to settle lengthy positions earlier than returning to quick squeezes.

Whales accumulate lower than $2,000 ETH

Regardless of the market drawdown, ETH nonetheless invitations whales to purchase dip. Tokens are nonetheless required for defi, buying and selling or different utility functions, or as collateral for Defi loans. ETH stays at a crossroads, with 45% of holders within the cash, 51% holding unrealized losses and small impartial subsections.

The story for ETH is contradictory, with some tales of tokens changing into out of date or falling right into a low vary. However just lately Whale accumulation The token signifies that at the very least a aid gathering is taken into account doable.

Particular person Whale Additionally they commerce ETH, like within the case of a single purchaser who received a $108 million ETH. Earlier instance reveals a Whale acquisition ETH from retailers on a number of orders from the earlier quarter.

Though ETH shouldn’t be instantly uncommon, whales accumulate cash which are simply accessible for buying and selling and short-term income. Holding ETH in a self-controlled pockets continues to be helpful, together with staking, lending, and offering liquidity.

ETH can also be seeing gross sales stress from hackers

ETH stays probably the most extensively used token for parking income from hacks and exploits. Among the ETH from Bibit Exploits should still be washed via distributed providers.

Not too long ago, two addresses obtained 14,064 ETH from Thorchain and Coinflip. They rapidly traded tokens on Dai for over $27 million on the worth of ETH $1,956. One of many addresses continues obtain ETH from Torcaine because the origin of the funds stays unknown.

Hacker merchants are extraordinarily aggressive and use decentralized liquidity swimming pools to little consideration for slippage in costs or costs. In contrast to dealer whales, hackers use the primary proper second to promote and transfer funds.

Ethereum costs stay close to document lows

Ethereum costs stay nearing an all-time low, indicating low demand for community providers. As a result of just a few providers are extensively used, the common transaction is as little as $0.02.

Most of Ethereum's gasoline goes to Stablecoin transfers, in addition to Uniswap Common Routers. The final ETH relocation and USDT motion burns round 58 ETH per day from charges, and is the 2 most necessary actions on the community. Different sorts of swap, bridging, or NFTS mint slows down, and fewer initiatives have been required to prepare airdrops with level farming.

The decentralized swap will drop to a worth of $0.28, debt borrowing charges will likely be $0.23, and bridging will likely be $0.09. However, community exercise has slowed considerably, with retail customers not returning.

Ethereum Community is communicated 310k Each day Energetic Pockets is at a stage that you just received't see after September 2024. On the identical time, extra addresses are Obtain ETHreveals spikes from wallets over 203k.

On account of declining exercise, Ethereum inflation continues to rise, splitting at 0.80% for the primary time in months. Low however persistent inflation implies that the community generates 948K further ETH in a single 12 months. This might proceed to decrease costs and shift tokens to a decrease vary.