Bitcoin takes on round $81,966 to $82,126, directing a market valuation of $1.62 trillion and each day buying and selling quantity of $19.42 billion, oscillates between $81,287 and $83,340 in a downward trajectory seen at a number of intervals.

Bitcoin

The Bitcoin hour chart depicts a vivid portrait of decline, retreating from the current Zen from $87,481. The scary barrier to resistance is near $83,000, however instant assist is near $81,000. BTC's buying and selling actions assist this pessimistic perspective as sellers decide market dynamics. Speculators could discover quick positions throughout weaker gatherings and place protecting halts above current peaks. A important leap of over $84,000 with amplified exercise may counsel a development rejuvenation.

BTC/USD 1H chart by way of BitStamp on March 31, 2025.

Zoom into the 4-hour view and Bitcoin carves patterns of peak and trough discount, amplifying destructive feelings. Resistance continues solidly between $85,000 and $86,000, however assist almost $81,500 faces repeated trials. This collapse below the ground may improve downward momentum, however conquering $86,000 may infuse a brief bullish part. Commentary of exercise spikes stays necessary for detecting inflection factors.

BTC/USD 4H chart by way of BitStamp on March 31, 2025.

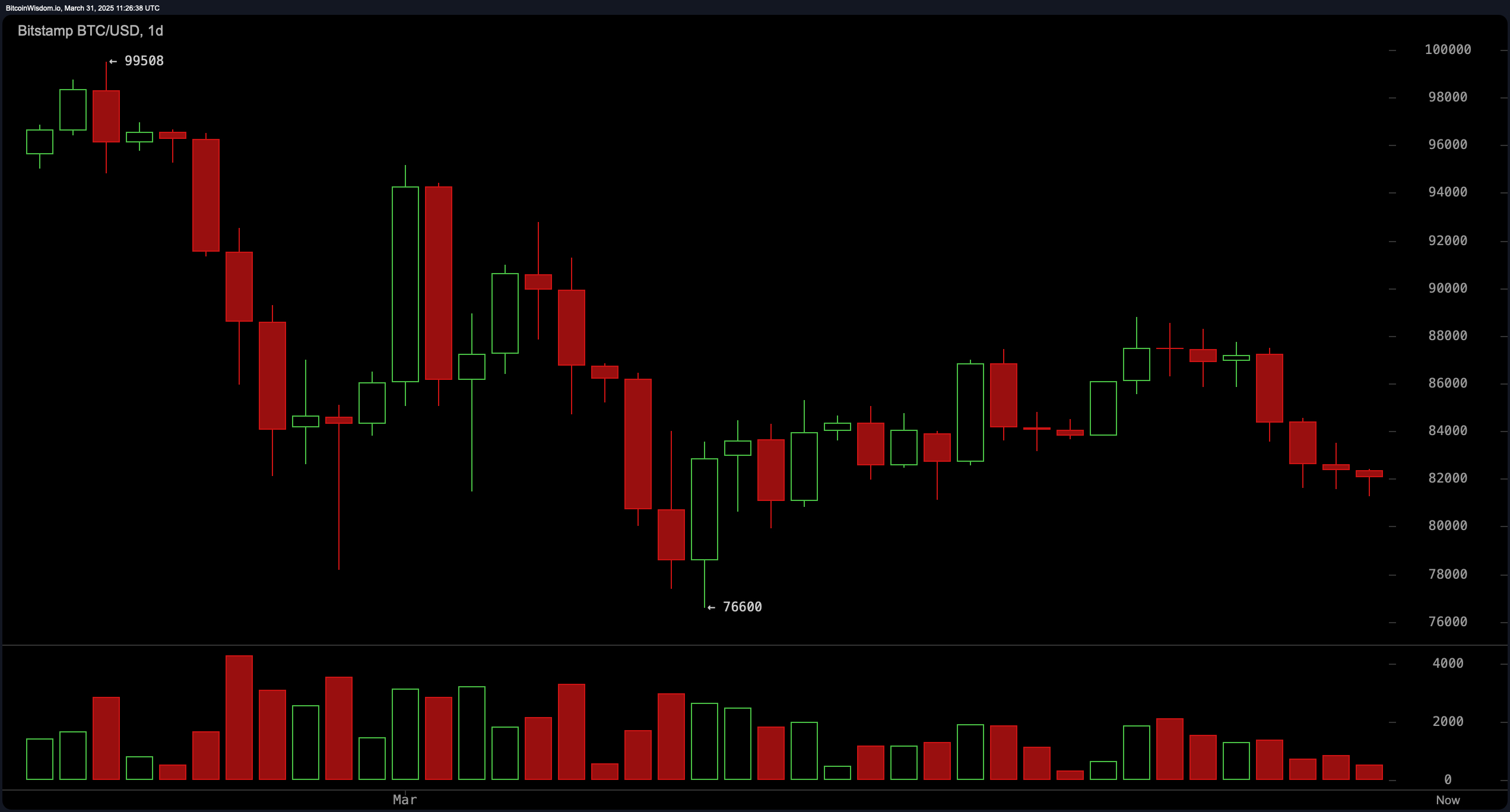

Bitcoin's each day lens reveals an growth descent hemmed with horrifying resistance of almost $90,000 and significant assist of almost $76,600. Consumers stay prominently absent, thwarting makes an attempt to reverse the slide. Cautious traders could undertake a cautious perspective, scrutinizing $76,600 in sturdiness or put together for a deeper loss. Solely the emphasised shut of over $90,000 will confuse the bearish story.

BTC/USD 1D chart by way of BitStamp on March 31, 2025.

A technical oscillator attracts a mosaic of conflicting alerts. The relative power index (RSI-43), likelihood concept (49), CCI (-32), ADX (23), and Superior Oscillator (656) collectively mirror equilibrium. Momentum (-3,954) stays in destructive terrain, whereas MACD (-831) suggests a possible lengthy alternative. Ambiguity has grow to be widespread, and individuals are keen to search out clues for clearer instructions.

Shifting Common (MAS) flashes evenly pessimistic alerts. It’s on sale by way of EMAS and SMAS (10-200 intervals, with tenth interval EMA at $85,196 and 2 hundredth interval SMA at $85,809. The bear will retain management on the worth remaining below all main averages, except a robust violation happens that exceeds the pivotal resistance.

Fibonacci's retracement highlights necessary thresholds. On each day scale, Bitcoin falls under the 50.0% mark ($88,054) and divulges its vulnerability to extra losses except it recovers the 61.8% stage ($85,350). On the four-hour chart, resistance converges close to $85,728 (50.0%), with a worth dancing at round $84,517 (61.8%) within the one-hour body. A important violation above these markers can inform you a change in momentum. Failure to carry $83,711 will result in additional erosion.

Briefly, bears blow powerfully at each interval. Lively merchants could assist strategic quick positions within the absence of a transparent inverted sign, however vigilant observations of exercise and resistance thresholds reveal potential turning factors.

Bull Verdict:

If Bitcoin surpasses main resistance ranges, notably $85,000 on the 4-hour chart and $90,000 on the each day chart, bullish momentum may regain management as it’s supported by robust volumes. A profitable violation is more likely to mark the tip of the present downward development, encouraging patrons to re-enter the market and will push costs as much as earlier highs. The constructive sign and elevated momentum from the MACD will additional strengthen the bullish outlook.

Bear Verdict:

A constant failure to interrupt by way of Bitcoin's resistance combines gross sales alerts from all main shifting averages with bear stress seen throughout all time frames to assist a bearish outlook. If the worth loses assist at $82,685 and falls under $81,287, there can be an extra draw back, with $76,600 serving as the subsequent necessary stage. Weak shopping for stress and ongoing destructive momentum counsel that merchants will proceed to assist quick positions in anticipation of additional declines.