Whereas lots of his X's posts and different enterprise actions are controversial, the success of Robert Kiyosaki's funding portfolio in 2024 is unimaginable to controversy because it charges 62.38% inside 12 months.

Nonetheless, in 2025,Wealthy Dad and Poor Dad The creator's high decide trades both low or virtually horizontally, and Finbold determined to look into whether or not Kyoto cryptocurrency and product-centric methods proceed working simply all through the primary quarter (Q1).

Right here's what is going to return investments in BTC, gold and silver in Q1

His holdings are past the Massive 3 (Bitcoin (BTC), Gold, Silver) for many of his followers, however these are the primary belongings that come to thoughts when Kiyosaki's identify is talked about.

Apparently, BTC carried out the worst of the three in 2025, dropping 10.23% (YTD) from the beginning of the yr to a press-time value of $83,947.

Gold, in the meantime, has recorded a brand new excessive after the brand new excessive. Yellow metallic has risen 19.27% since 2025, altering palms at $3,129. It's removed from Kiyosaki's personal bold $70 goal, however Silver additionally labored properly, elevating 17.16% to the worth of $33.85 on April 1st.

In complete, which means the creator's $1,000 funding break up into equally divided belongings is extremely valued at $1,087.32, $299.23 in Bitcoin, $397.56 in gold and $390.53 in silver.

Robert Kyosaki Portfolio Efficiency in Q1 2025

Apparently, it is usually doable to discover the “wealthy daddy” portfolio, as it’s identified for its Ethereum (ETH), Solana (SOL), cattle and actual property transactions.

Sadly, because of enterprise operations, hire funds, illiquidity in sure markets, and huge variations between areas, Knowledge Tree Dwell Cow ETFs (CATLs) can be utilized as shorthand for cattle, however it’s unimaginable to precisely consider the final two belongings.

To start with, Ethereum has change into identified for its comparatively dangerous performances. ETH costs fell 44.22% in 2025, with cryptocurrency altering palms at $1,861 on April 1st.

Solana hasn't been that good both, as Solna has hit 32.77% since its launch in 2025.

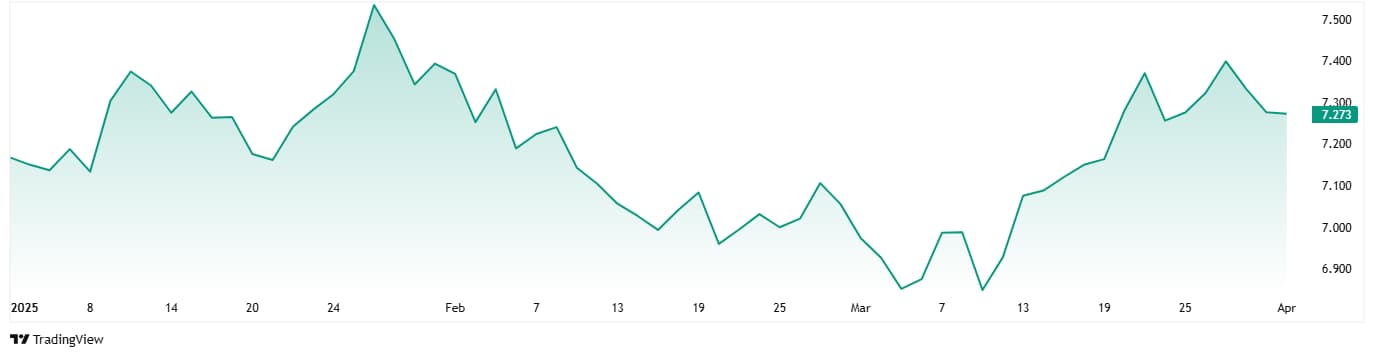

Lastly, the CATL Trade-Traded Fund (ETF) is buying and selling largely sideways because it scored 1.45% within the first quarter, rising from 7.169 euros (~$7.73) to 7.273 euros (~$7.84).

Monitoring the Hisazaki portfolio for the primary quarter would have been a dropping wager

On this state of affairs, it’s clear that investing $1,000 within the massive portfolio of Kyonosaki Portfolio originally of 2025 didn’t yield good outcomes by the tip of the primary quarter. If the allocations are equal, the portfolio shall be value $917.79 at press.

Wanting on the particular person belongings, the Bitcoin portion fell to $149.62, Ethereum to $92.97 and Solana to $112.05. The $166.67 positioned in gold rose to $198.79 and $195.27 in silver, with CATL largely remaining on the $169.09 stage.

Featured Photos through Ben Shapiro's YouTube