President Donald Trump's president is characterised by an ongoing stream of statements and actions. The day of liberation is ready to draw consideration not solely of individuals but additionally of the nation and market. Right here's what it is advisable to learn about how this extremely anticipated day shapes the crypto market:

On this information:

- What’s Trump's Liberation Day?

- How did Crypto reply to Trump's launch date?

- How will the discharge date have an effect on the market?

- Quick-term ache, long-term potentialities?

What’s Trump's Liberation Day?

In case you missed it, President Trump plans to implement some import taxes on April 2nd. That is known as the day of launch.

“You recognize, there's a liberation day on April 2nd, as a result of I'm not mentioning Canada, however many nations are utilizing us.

Trump's announcement stems from a earlier resolution to implement tariffs on sure nations, a lot of which have been postponed till April.

Primarily based on earlier statements, many individuals anticipate mutual tariffs, in step with charges in different nations, whereas the remaining might cowl key areas in manufacturing, manufacturing and different sectors. Customs duties set for “Freed Date” embrace:

- Prescribed drugs, semiconductors, copper, and wooden.

- Tariffs for 25% of nations importing oil from Venezuela.

- Separate tariffs between Canada and Mexico and “cease drug trafficking.”

- China's current 10% tariff plus 20% tariff.

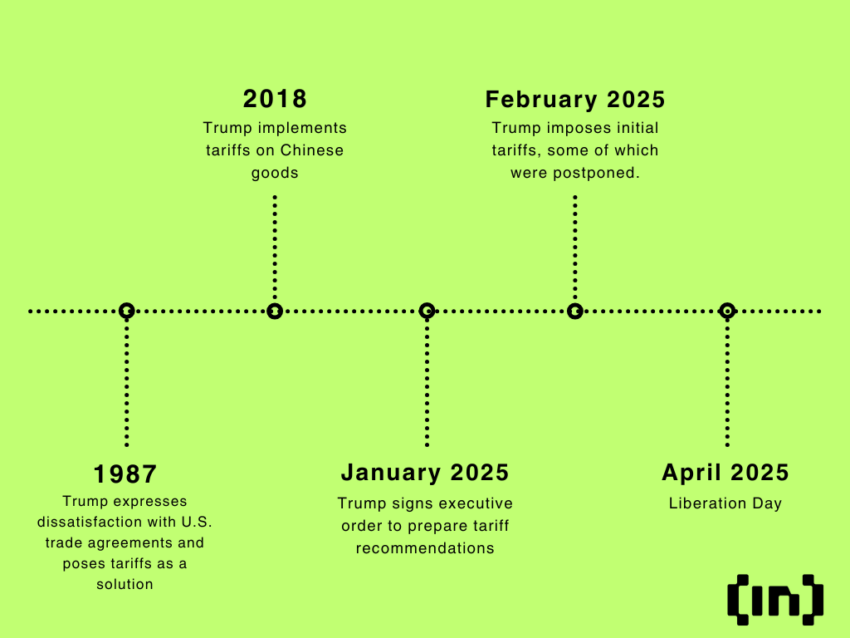

Trump's tariff historical past

Trump's Customs Coverage Timeline: Beincrypto

President Trump has been painted purple on tariffs because the Nineteen Eighties, when he publicly criticized commerce practices he believed to be dangerous to the USA.

Look in 1987 Rally King DwellTrump mentioned, “The very fact is that you simply don't have free commerce… Many individuals are bored with watching different nations tear the US aside.”

On January 20, 2025, Trump signed an government order to arrange tariffs. The primary wave of tariffs was scheduled to debut on February 4th, 2025. These included a ten% tax on all Chinese language imports and 25% tariffs in Canada and Mexico.

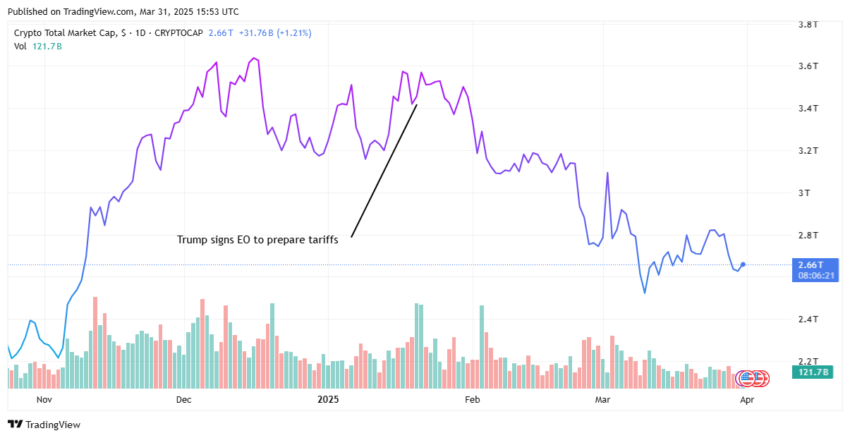

Whole crypto market capitalization: TradingView

How did Crypto reply to Trump's launch date?

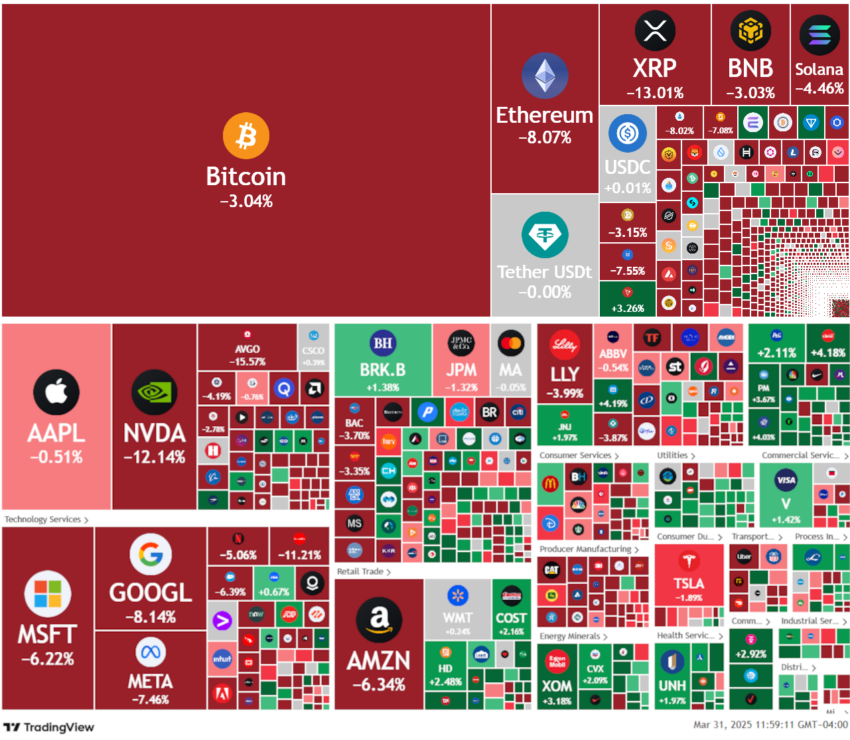

As soon as Trump's launch date was introduced, the crypto and inventory markets skilled a serious dip. Bitcoin (BTC) and ether (ETH) fell by about 3% to ~8% every week, respectively, whereas NVDA and GOOGL have been round 12% and ~8% respectively.

Crypto and Shares Heatmap: TradingView

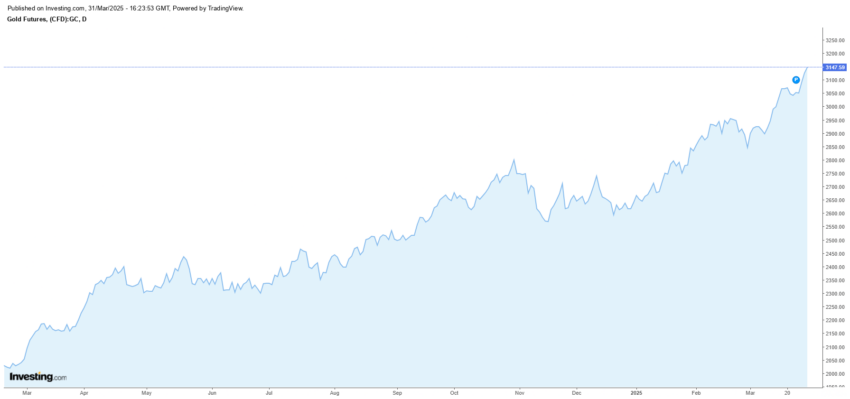

Many markets have been hits, however Gold is working very effectively. This may be seen as the opportunity of market flights to safer property amid the looming commerce battle between main economies.

Gold Futures: Investing.com

How will the discharge date have an effect on the market?

Many recommend that Trump's tariffs are a software for negotiating commerce and border safety. Others say revenues assist cut back the federal authorities's fiscal deficit.

The Federal Reserve is actually under-undermasTed the impression of tariffs and revised expectations for inflation. In the course of the March 2025 assembly, the Fed raised its 2025 core inflation forecast to 2.8%. That is up from the earlier 2.5% forecast.

Trump argues that these measures will cut back US dependence on overseas items and regain financial energy. Nonetheless, critics warn of elevated shopper prices and potential retaliation efforts from affected nations. Beneath are the potential impacts that the discharge date might have on the crypto and inventory markets.

I continued to chill out

It may be troublesome to foretell the potential outcomes of tariffs in crypto and different markets, however there may be already knowledge to collaborate with. Within the first quarter of 2025, all tariff bulletins brought on pullbacks to high-risk property. Right here's why:

- Tariffs improve commerce prices

- The US imports greater than exports (considerably)

- Meaning not solely luxurious but additionally requirements are at a excessive worth

If costs rise rapidly sufficient, folks will spend much less. It places stress on the corporate's income, particularly for multinational corporations with margins and excessive enter prices. Ultimately, massive cash leaves the chance away.

Crypto falls straight into its risk-on class. It thrives in an surroundings the place liquidity is robust and buyers chase their advantages.

Different situations

Some different situations may very well be bullish for crypto, however they’re unsure, particularly given President Trump's pure resolve to renegotiate commerce offers.

First, Trump is thought to shift the course with a drop of drop. Due to this fact, it’s potential that he might fully get rid of tariffs or not less than some tariffs in sure nations. This might create a short-lived rally.

Nonetheless, given the vulnerability of worldwide liquidity and charge reductions from central banks, the underlying situations persist. Tariffs is probably not ample to offset the bigger macroeconomic panorama.

Second, if tariffs have a ample impression (e.g., lowered liquidity, discretionary spending, and so on.), this, together with different situations, might result in a recession within the US.

If a recession happens or is more likely to happen, you might even see a discount in rates of interest from the Fed or authorities stimulus or aid to backstop the economic system. This might result in an elevated demand for threat property, which might result in potential bull markets that crypto would probably take in.

Quick-term ache, long-term potentialities?

Trump's Liberation Day is a part of an ongoing technique to renegotiate commerce relations and negotiate with main US buying and selling companions. Nonetheless, this “America First” coverage has sparked a commerce battle with many main economies. In anticipation of continued inflation and the opportunity of recession, many buyers are taking dangers from property like Crypto. Tariffs are most probably to have an oblique detrimental impact on crypto within the brief time period, In the long run, the position of Bitcoin as a hedge in opposition to such measures might improve, particularly when inflicting financial instability. Conversely, this might enhance the crypto market.

Within the brief time period, ensure that your portfolio is absolutely expanded and also you're solely investing in what you may afford to lose. By no means be in a scenario the place it’s a must to lose the market and depart.