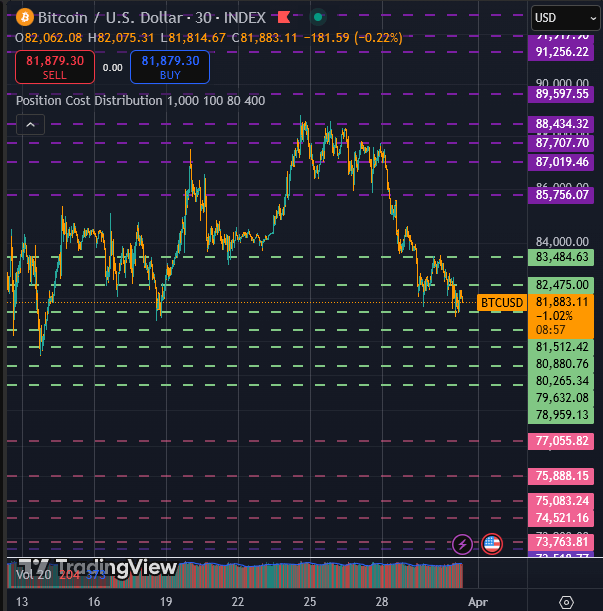

Bitcoin began the week at round $81,800, down 1.98% during the last 24 hours, persevering with its weekly downward pattern, exceeding 7% from its native peak of $88,400 on March twenty fifth.

The sustained decline prompted a liquidated crypto place of round $220 million, extending the low low on Bitcoin for seven days in a row.

Pullback coincides with wider losses throughout the broader digital asset market. World Crypto's market capitalization fell to $2.65 trillion, down 1.77% over the identical 24 hours, and day by day buying and selling quantity fell 1.4% to $57 billion.

Macroeconomic stress and tariff uncertainty erodes market belief

He raised nervousness forward of former President Donald Trump's “liberation day” on April 2, throughout which he was anticipated to disclose a drastic “mutual tariffs,” placing stress on crypto and conventional monetary markets. The forecast of aggressive commerce measures has led to a spinoff pattern throughout the spot market, decreasing demand, growing the variety of s for buyers.

A number of damaging macroeconomic indicators contribute to nervousness. Core PCE knowledge launched final week pointed to larger inflation than anticipated, however client confidence fell to its lowest stage in over a decade. In the meantime, Goldman Sachs has raised its recession forecast from 20% to 35%, citing rising geopolitical and financial dangers.

The decline in Bitcoin displays losses throughout the inventory market, enhancing its correlation with conventional dangerous property. The S&P 500 fell by greater than 6% this month, however the industrial averages for Nasdaq and Dow Jones fell by 9% and 4.7% respectively.

Bitcoin now fell 13% within the first quarter of 2025. That is the worst quarterly efficiency of an asset in two cycles. The revision exhibits an entire segregation of property, with gold rising to an all-time excessive of over $3,087.

Set to check market resilience

Future tariff bulletins may very well be a big inflection level for crypto and broader monetary markets. Trump's April 2nd “liberation date” guarantees a tariff hike, together with the targets that embody the European Union, South Korea, Brazil and India, as reported by CNBC.

Goldman Sachs predicts these obligations might increase inflation and unemployment whereas slowing down financial development. Their forecasts embody a possible enhance in tariff charges by 15 share factors, however sure merchandise and nation sculptures can scale back the efficient enhance to 9 share factors. In accordance with Reuters, the rapid market affect will rely upon whether or not different nations will reply in bodily kind, significantly on the width of tariff implementation and the timeline.

If retaliation happens, it might launch a suggestions loop for escalating commerce restrictions, which might enhance market volatility. Analysts imagine you will need to assess the sentiment of resilient buyers within the face of potential coverage shocks and lasting macro headwinds.

Bitcoin faces technical and emotionally pushed headwinds

The technical patterns of Bitcoin counsel additional damaging facet dangers, with value motion approaching key assist ranges. The property are testing the extent the place they will speed up the tempo of liquidation in the event that they break down and open the door for a short-term bearish continuation.

Bitcoin has repeatedly failed to keep up its purple value channel, returning to the Inexperienced Channel, the final historic channel earlier than the potential backside channel of the cycle, for $73,000.

Whereas some analysts count on Bitcoin to profit from the long-term inflationary pressures attributable to tariffs, the story stays speculative and disconnected from rapid promoting. For now, merchants seem like focusing extra on capital conservation amidst unclear macro indicators and escalating geopolitical dangers.