Ethereum Costs for Freefall: Brutal Actuality Examine for 2025

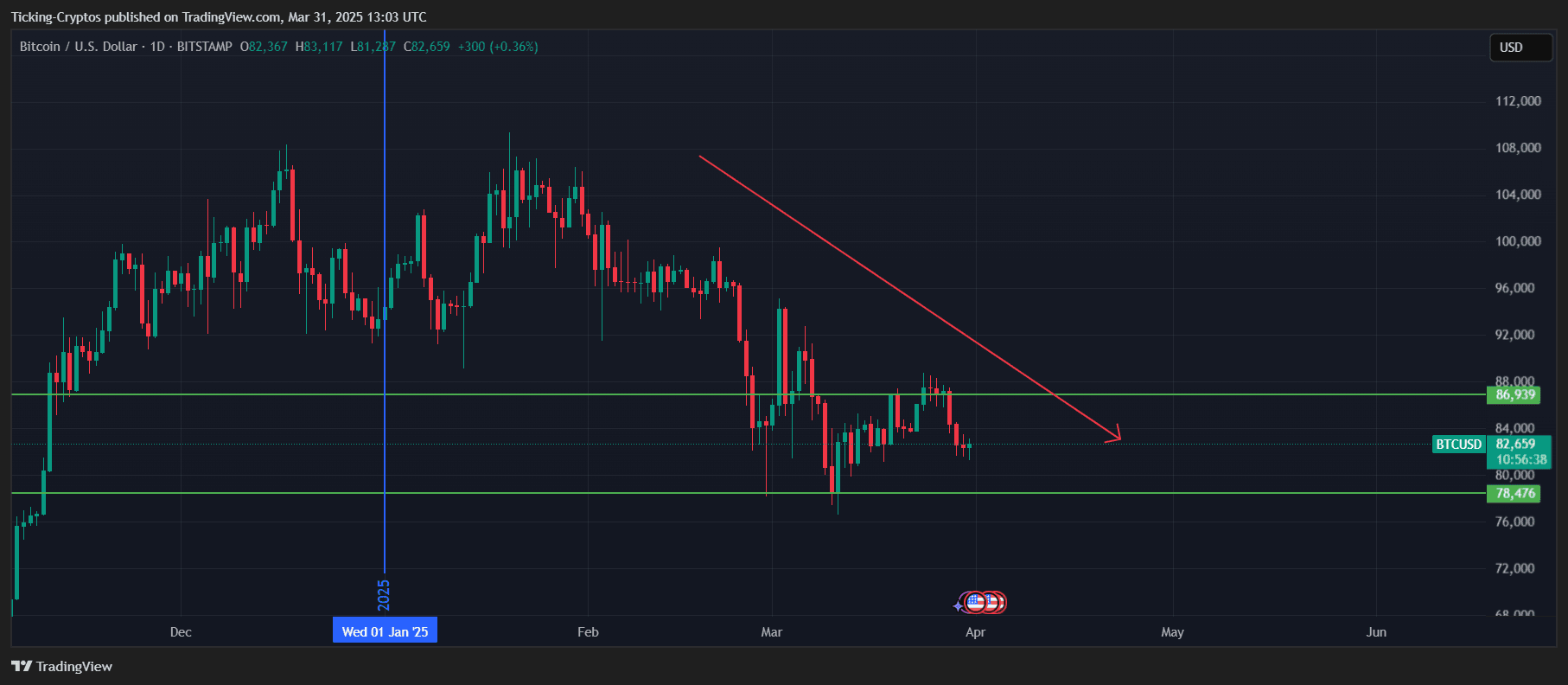

The crypto market has been bleeding crimson over the previous few weeks, with its whole market capitalization plunging by greater than 20%. In the meantime, Bitcoin made headlines by quickly pertaining to its all-time excessive of $109,000, earlier than retreating violently to round $81,000.

BTC/USD 1 Day Chart – TradingView

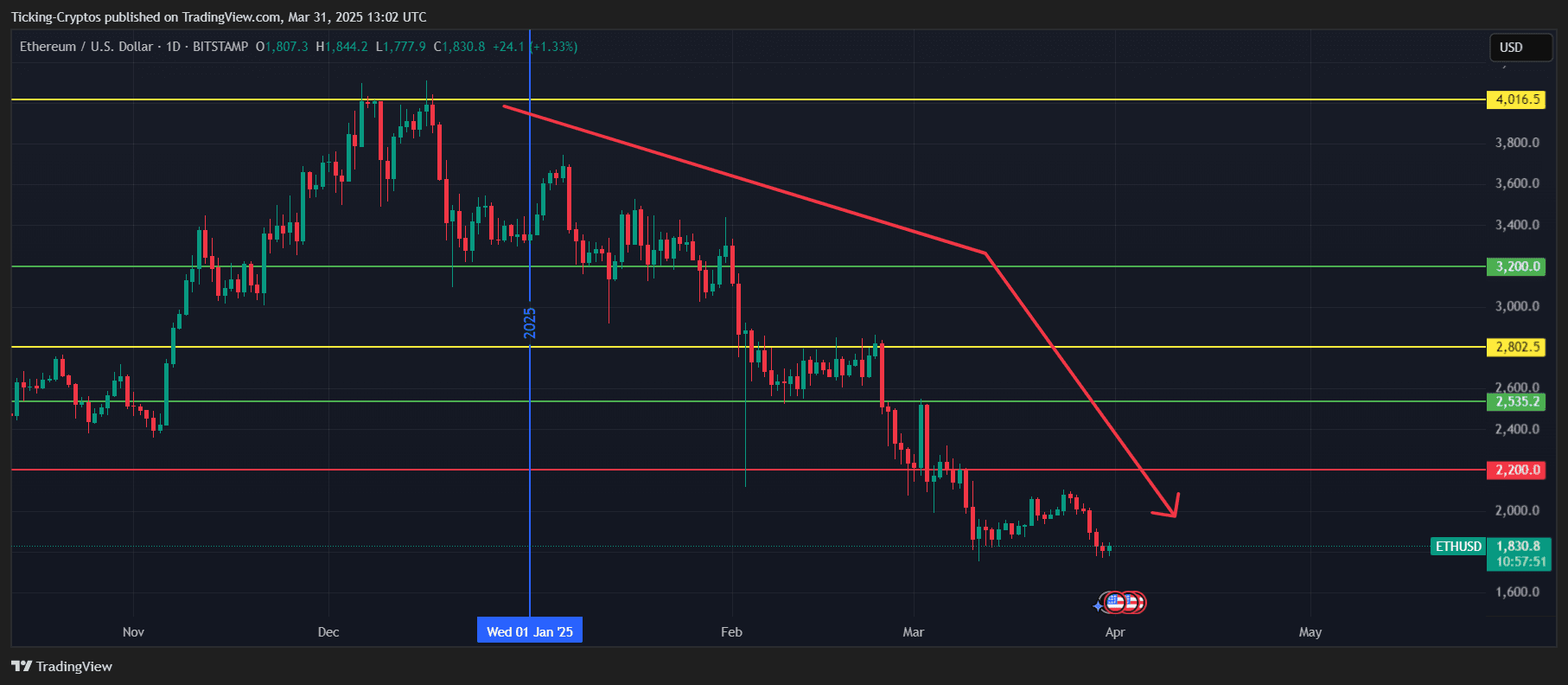

The value efficiency of Ethereum in 2025 is nothing wanting depressing. ETH crashed greater than 50% for the reason that begin of the 12 months, plunging from its highest value of $4,000 in December 2024 to only $1,820. This dramatic downturn led many Ethereum followers to query their funding selections and desperately searched Ethereum value prediction steering.

ETH/USD 1-Day Chart – TradingView

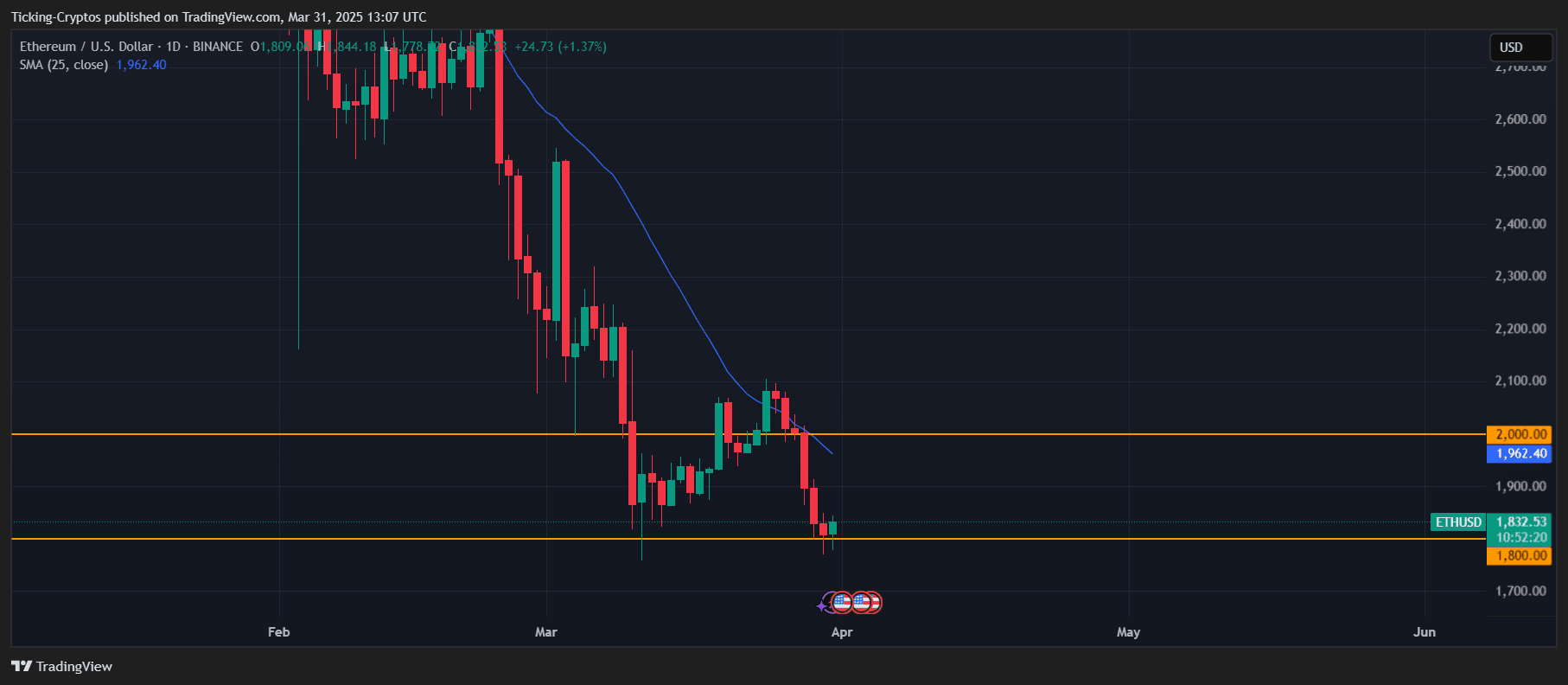

Vital $1,800 Help: Ethereum's Final Line of Protection

The $1,800 value stage is a really robust assist space for Ethereum. This psychological and technical stage has traditionally served as a vital battlefield between bulls and bears. ETH costs are presently in danger at this threshold, so merchants are breathless seeking to see how the market breaks.

ETH/USD 1-Day Chart – TradingView

Technical analysts level out that $1,800 in assist has been held a number of instances throughout earlier market droop. Nevertheless, the present fierceness of gross sales stress raises critical questions on whether or not this vital stage will proceed to be held within the face of wider market weak spot.

Ethereum value forecast: Rebound or additional descent?

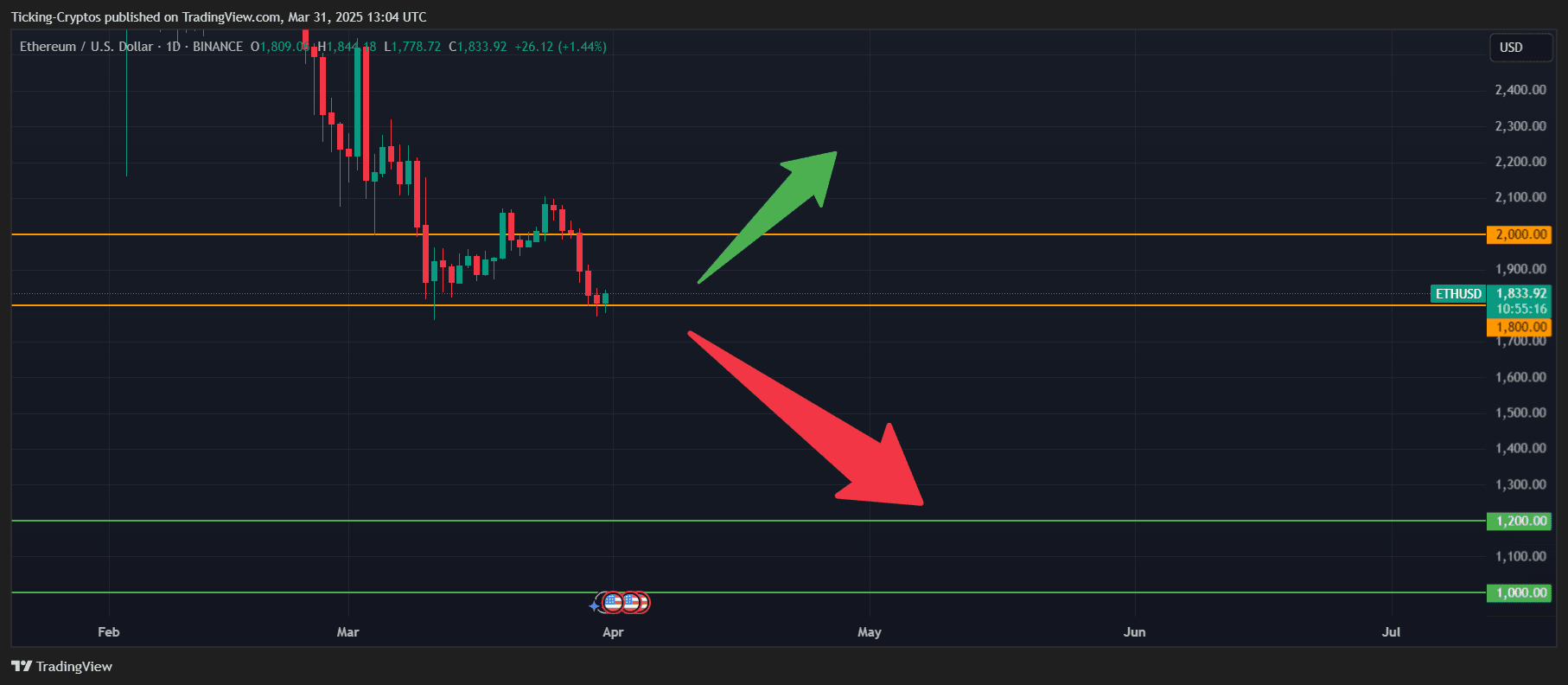

Two totally different situations are rising for the worth motion of Ethereum within the close to future.

Situation 1: ETH Worth Rebounds from $1,800

If Ethereum might rebound from its present value of $1,800, then the ETH value may very well be anticipated to regain the psychologically important $2,000. This represents a modest 10% restoration, doubtlessly indicating that the worst selloffs are behind us.

A compelling transfer above $2,000 might additional strengthen purchaser confidence and result in extra advantages, however important resistance is anticipated within the $2,200-$2,400 vary primarily based on earlier value actions.

Situation 2: ETH Costs are beneath assist

Most of the time, it features a vital assist stage violation of $1,800. You may count on Ethereum to crash even additional to $1,400, particularly if the vendor pushes the worth to underneath $1,750 and closes day by day candles with ETH beneath $1,600.

On this bearish state of affairs, the subsequent main assist zone is between $1,000 and $1,200, which isn’t seen from earlier Crypto Winter depths. Analysts consider this state of affairs is unlikely to be lower than rebound, however cautious threat administration means that traders want to arrange for this chance.

ETH/USD 1-Day Chart – TradingView

Find out how to Shield Your ETH Funding Now

The crash to $1,000 represents a lesser Ethereum value forecast state of affairs, however accountable traders have to take precautions. Organising a cease loss order just under $1,750 gives safety towards catastrophic losses if a assist stage of $1,800 fails.

For these with a long-term perspective on the potential value of Ethereum, this present weak spot could symbolize a chance for accumulation, however it’s only potential for capital to afford to lose and implement acceptable threat administration methods.