Bitcoin's current value motion exhibits some indicators concerning the indicators. Crypto King is unable to interrupt via main resistance ranges and is weak to additional reductions.

As Bitcoin approaches testing its $80,000 help stage, there’s a risk of a crossover of loss of life, growing bearish emotions out there.

Bitcoin traders are skeptical

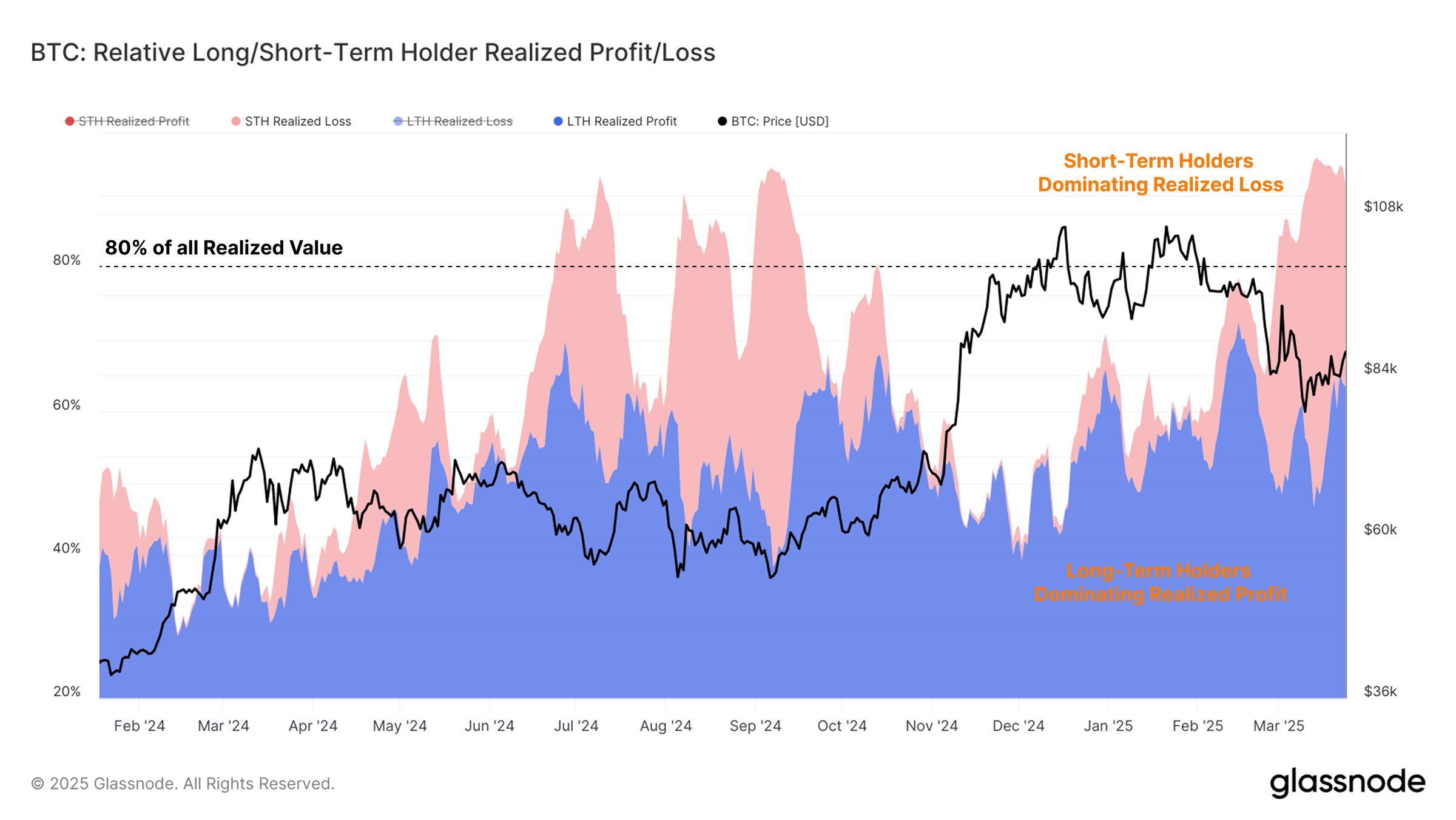

Quick time period holders (STHs) who buy at a better value are primarily accountable for continued losses. These traders are actively specializing in losses in response to the unstable market circumstances of Bitcoin, reflecting an unpredictable atmosphere that has made it troublesome for brand new traders to navigate.

In the meantime, long-term holders (LTHS) proceed to appreciate income and profit from market growth. Nevertheless, present market circumstances point out a stagnation of recent capital inflows, with LTH income being offset by STH losses. This weakens demand and resistance, indicating a possible slowdown in value momentum.

Sustaining bullishness out there sometimes requires constant capital inflows, however now the market seems to lack that important help. Total sentiment displays a impartial perspective, with each revenue and loss realization in steadiness.

Bitcoin has achieved income/loss. Supply: GlassNode

The momentum of the Crypto King macro exhibits indicators of extra bear strain, significantly with exponential shifting averages (EMA). The 200-day EMA is lower than 3% from crossing the 50-day EMA, leading to a cross of loss of life. This technical sample has traditionally proven a serious revision of costs, indicating the potential finish of Bitcoin's 18-month golden cross.

As EMA approaches this key level, merchants and traders look carefully on the indicators of correction. The worry of a cross of loss of life brings additional concern about Bitcoin's value stability. If the 50-day EMA falls beneath the 200-day EMA, it may set off extra divestment and strengthen the market's bearish sentiment.

The Bitcoin loss of life cross is approaching. Supply: TradingView

Is BTC costs ready for additional discount?

Bitcoin is presently buying and selling at $82,248, approaching a serious psychological help stage of $80,000. Regardless of breakout makes an attempt, Bitcoin was unable to maneuver past the two-month widening downward wedge sample. This sample means that Bitcoin may very well be getting ready to additional decline.

If the downward momentum lasts, Bitcoin may fall via a help stage of $80,000, bringing it nearer to $76,741. This situation strengthens the bearish outlook, significantly contemplating the shortage of technical metrics and powerful buying help. Failures beneath these ranges could point out deeper corrections as they could be potential additional reductions.

Bitcoin value evaluation. Supply: TradingView

Nevertheless, this short-term bearish paper may very well be invalidated if Bitcoin's value may regain $82,761 in help. If Bitcoin breaks via the $85,000 barrier, it may escape from the present sample and point out a possible inversion. A robust rally above $86,822 suggests a reopening of bullish traits and negates the bearish momentum that presently dominates the market.