Ethereum continues to face stress following a $2,100 regional refusal, testing low demand zones with costs under key help ranges.

Technical Evaluation

By Edris Dalakshi

Every day Charts

Within the each day time-frame, ETH stays firmly within the bearish construction, persistently printing low highs and low lows. The $2,200 regional refusal and subsequent breakdown under the $1,900 {dollars} have reestablished bearish momentum, with costs heading round $1,600 to the subsequent main demand zone.

The 200-day shifting common has additionally turned barely downward, far surpassing worth motion, and strengthening long-term bearish bias. Moreover, RSIs are hovering close to unsold areas, however there are few indications of inversion, supplied they don’t have bullish divergence or adjustments in momentum. Except ETH regains $2,200 with sturdy confidence, resistance is stored to a minimal.

4-hour chart

The 4-hour chart checks for a breakdown of up-channels that help earlier restoration makes an attempt in ETH. The value has not been held above the $1,900 degree that served as a help through the integration and is now crushed at almost $1,800.

A clear refusal and sharp sale beginning at $2,100 recommend that the customer rapidly misplaced momentum and the vendor stepped in with power. Though RSI is at present positioned in deep gross sales territory, there may be little proof of Dip Buinging's curiosity because it doesn’t type a robust bouncing or bullish construction. For now, ETH seems weak and even when short-term bounce happens, it may shut at $1,900 until a stronger purchaser intervenes.

Emotional evaluation

By Edris Dalakshi

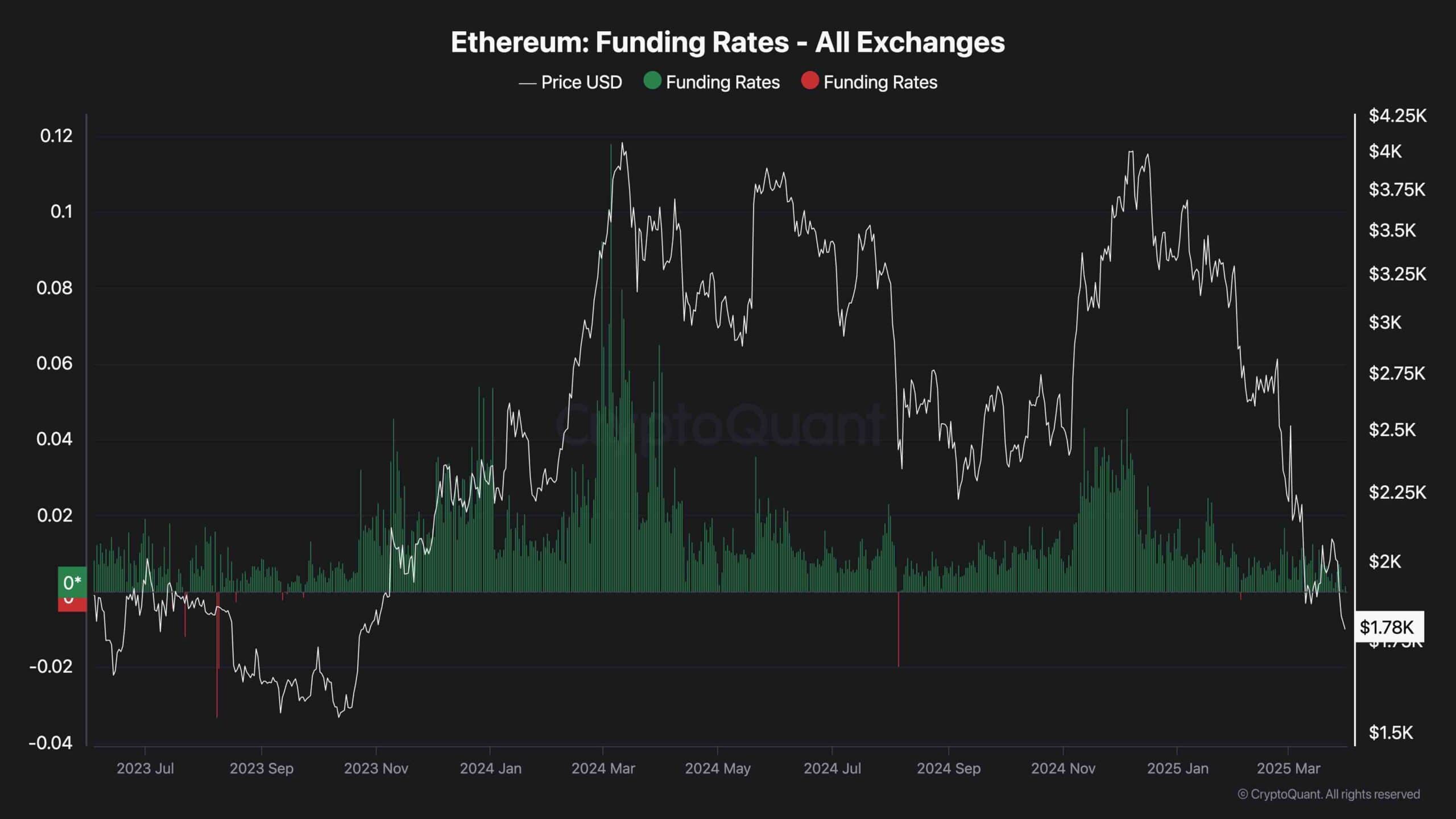

Funding fee

Ethereum's funding fee throughout all main exchanges is reversed neutrally or barely negatively, indicating a big decline in aggressive lengthy positions. This transformation means that merchants are extra defensive and fewer prepared to chase the wrong way up, normally coinciding with cooling intervals or steady damaging drift.

Impartial funding may cut back the chance of a liquidation cascade, but additionally reveals a insecurity in a robust bullish reversal. Emotions stay cautious and the market may proceed to be below stress until there’s a optimistic revival of funds coupled with regaining key technical ranges.