Bitcoin has been added to the latest rebound collection after seeing yet one more bounce previously day. Right here's what On-Chain Information says concerning whether or not BTC goes wherever with them:

Bitcoin Realised Revenue/Loss Price Shedding Gentle on the Large Dynamics

In its newest weekly report, on-chain analytics agency GlassNode discusses latest developments in Bitcoin's realized revenue/loss ratio.

The metric measures the ratio of revenue to losses realized by the proprietor or all the handle, because the title already suggests.

This indicator works by wanting on the transaction historical past of every coin bought on the community and discovering the value transferred previous to this sale. If this earlier gross sales worth is decrease than the newest spot worth for the token, then the metric consists of it underneath revenue quantity.

The overall revenue realized by means of the sale of cash is assumed to be equal to the distinction between the 2 costs. The indicator calculates this worth for all cash belonging to revenue quantity and takes the overall sum to find out the scale of revenue realizations that happen throughout the blockchain.

Equally, the realized revenue/loss price finds the overall quantity of loss realized by referring to the gross sales of the alternative kind of coin (i.e., tokens the place the final transaction worth is increased than the present spot worth). Subsequent, a ratio between the 2 totals is required to estimate the web state of affairs of the sector.

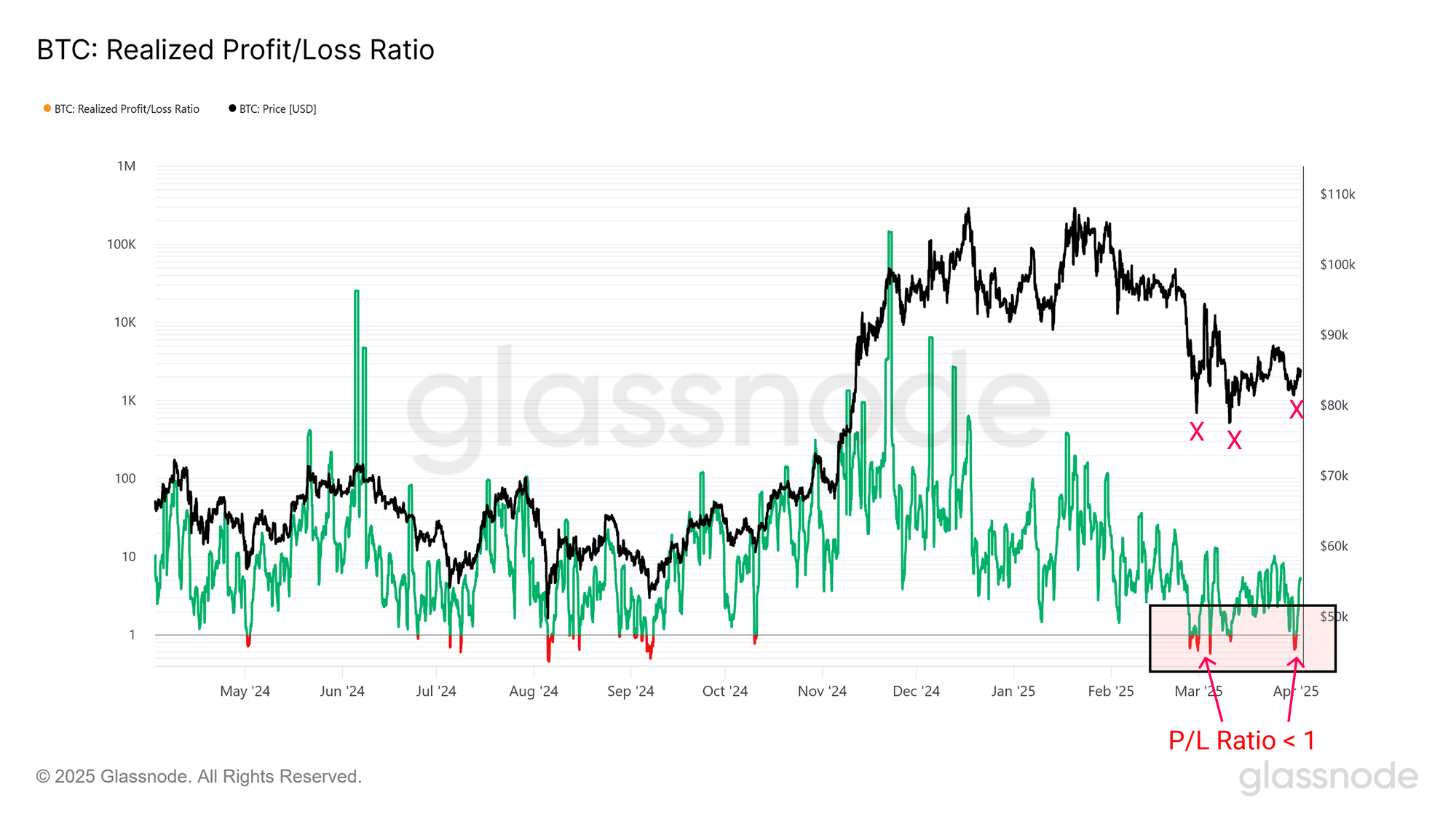

Over the previous few months, Bitcoin has gone by means of a bearish worth motion section. Following the realised revenue/loss ratio, what the investor's buying and selling conduct was throughout this era is as follows:

Because the analytics firm highlights within the charts, the indicator noticed a dip underneath one mark throughout every latest latest of BTC. The values for this area correspond to that lowering losses is extra dominant than gaining income.

“This imbalance normally signifies vendor fatigue to the extent that the destructive momentum fades away as vendor strain is absorbed,” GlassNode explains. Due to this, give up tends to assist the BTC arrive on the native backside.

From the graph, we will see that cryptocurrencies benefited from this impact in the course of the latest burst of loss realizations.

Nevertheless, these Bitcoin rebounds haven’t been maintained up to now. Will they in the end culminate within the return of correct bullish momentum, or are they solely cat bounces useless alongside the best way? To handle the query, the analytics firm mentions the long-term view of the revenue/loss ratio realized.

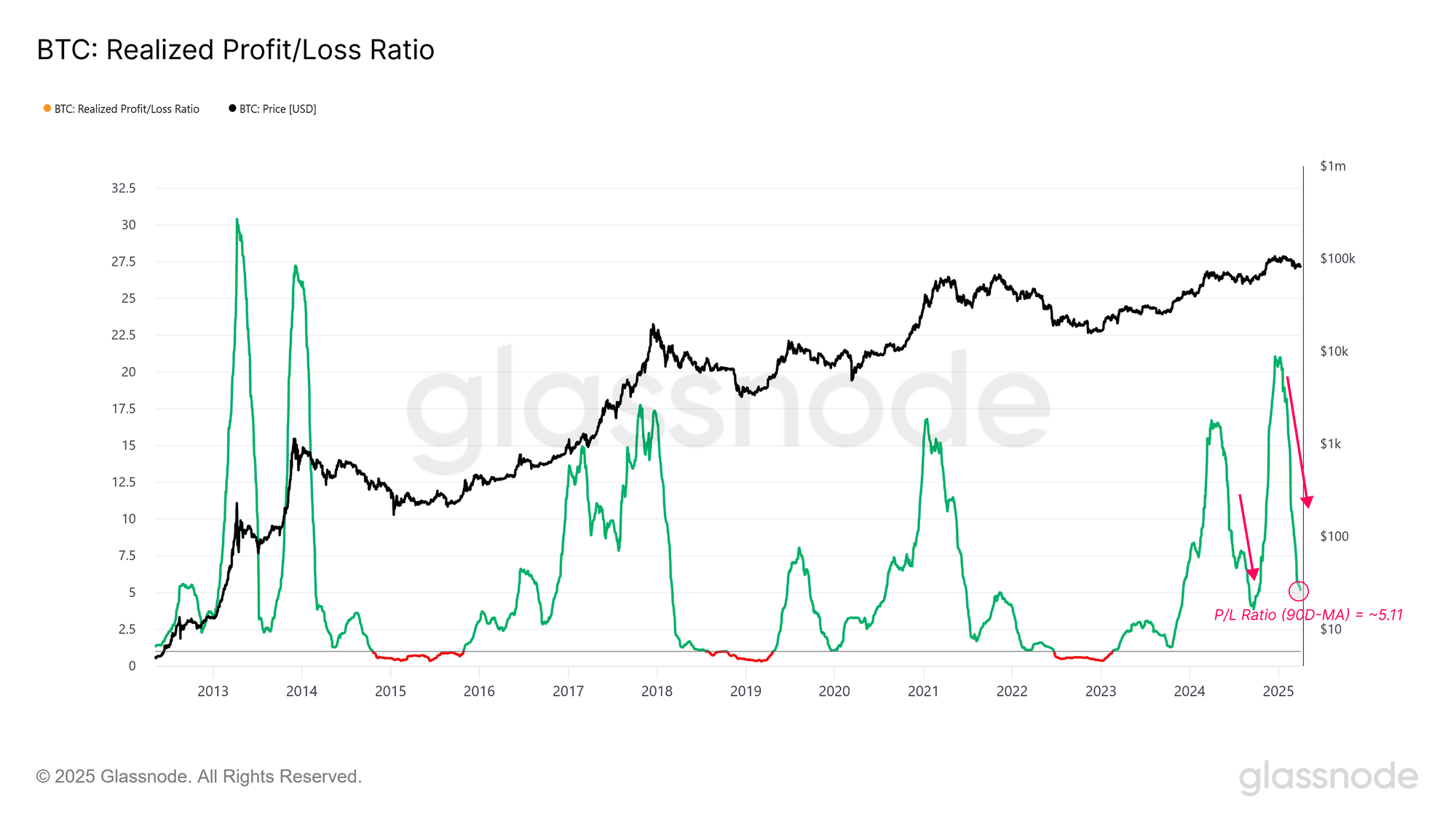

As proven within the chart above, the 90-day easy shifting common (SMA) of Bitcoin realised revenue/loss price has been declining sharply lately regardless of a bounce in revenue realisation within the short-term view.

“These quick, profit-driven spikes can’t reverse the broader decline, and macro photographs typically counsel that liquidity is lowering and traders' profitability is deteriorating,” GlassNode mentioned.

So, whether or not Bitcoin has witnessed a shift to bullish momentum with its latest rebounds, the reply is at first look no, at the least when it comes to realised revenue/loss charges.

BTC worth

On the time of writing, Bitcoin has traded round $83,600 within the final seven days, a virtually 2% drop.

Dall-E, Glassnode.com featured photographs, tradingView.com charts