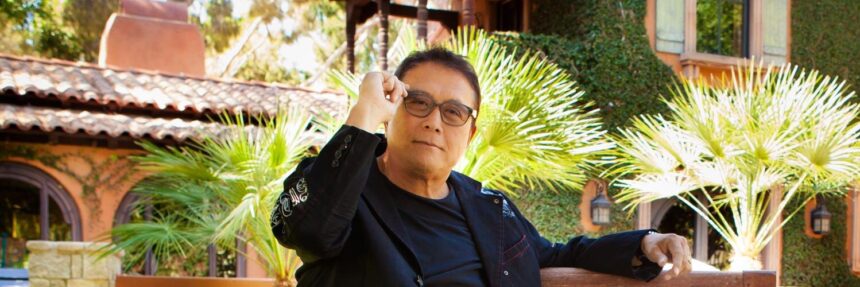

Robert Kiyosaki, writer of the well-known monetary self-help e book Padrelico, the Poor Father, spoke of optimism about sure property. That is the second valuable metallic of silver, which is a bigger capital letter.

It additionally maintains bullish expectations for gold and Bitcoin (BTC), however monetary gurus argues that silver is “essentially the most fascinating funding of right this moment.”. That is listed in a brand new publication on Social Community X on Tuesday, April 1st.

For Hisazaki, the silver value is about to be photographed within the present financial state of affairs. Partly, he awards this to his value, exhibiting a serious underestimation by way of gold and bitcoin.

La Plata cites greater than $32 (USD), 60% beneath the earlier most reached 14 years in the past in 2011. This was 49 USD.

As an alternative, gold marked a brand new historic most value of over USD 3,165 per ounce. And whereas Bitcoin is a revision interval, he has registered a brand new file of USD 109,000 this 12 months. It was precisely two months in the past. These performances They present a powerful distinction to silver.

“I count on Silver will double its worth this 12 months, reaching not less than 70 US {dollars} per ounce,” Kiyosaki mentioned earlier than the panorama. Moreover, he revealed that regardless of already having a major quantity of this asset, he made a brand new buy for his bullish predictions.

These feedback come within the midst of a wave of recent imports into imports within the US, which is ready up by President Donald Trump. Such measures have generated tariff retaliation from numerous international locations, releasing the nation's fears of better inflation and recession. In consequence, cash is often shot, reaching financial uncertainty.

“You don't must be wealthy to spend money on silver,” Kiyosaki says.

For monetary specialists, “The very best information is that you just don't must be wealthy to spend money on silver.” Because of the low value, “nearly everybody on the earth can afford to purchase not less than a ounce,” he added.

Nevertheless, it ought to be famous that silver costs and gold are often measured in ounces, however are additionally traded in small models. Subsequently, you don’t want to purchase a ounce equal to twenty-eight grams to get these metals.

For instance, some merchants can solely get 1 gram. Nevertheless, in case you are not shopping for in bodily kind, you need to think about that it’s a by-product and never a direct funding within the asset.

In line with right this moment's costs, 1 gram of silver is quoted at 1,2 USD, Golden USD 110which is sort of excessive, and the previous is far simpler to entry.

Evaluating, Bitcoin purchases are even simpler to entryas a result of it’s divided into Satoshu. This time period refers back to the smallest unit is equal to 0.0000001 BTC. That is decrease than the penny.

Satoshi is value it right now at 0.00082, as Bitcoin is presently quoting USD 81,000. In contrast to valuable metals, this lively just isn’t bodily, however digital, and as Cryptopedia explains, it’s attainable to cherish it in your personal custody pockets.

The costs of gold, silver and Bitcoin is not going to rise. fíat cash loses worth

The well-known author makes his bullish projections, primarily primarily based on that reality These property lack decentralized mining and providein contrast to fíat cash. The costs of gold, silver and bitcoin can then profit from elevated purchases, as a result of easy provide and demand legal guidelines.

“I desire to avoid wasting silver over faux banknotes,” he mentioned, as he often does, his criticism of his Worry Monetary System. This refers to a rise in Fíat currencies such because the greenback, and the lack of worth because of the free resolution to serve the federal government.

“At all times do not forget that gold, silver and bitcoin costs aren't going to rise. It appears to rise, however that's as a result of the buying energy of faux paper is absolutely diminishing,” he emphasised that. He subsequently reveals within the e book “The Father of Poor Father Rico,” he asserted that the saver (of Worry cash) was the loser.

To place it in perspective, it’s attainable to look at the next graph exhibiting the lack of buying energy that the greenback had within the final century.

This makes Kiyosaki recommend it Those that keep money, whether or not concrete or digital, will lose their buying energy Over time as a result of inflation and devaluation as a result of impressions. “Don't be a loser, besides gold, silver and bitcoin,” the specialists reached the height.

In line with the writer, these three property symbolize a greater approach to shield long-term worth in an setting the place Worry's cash continues to lose worth. However not all his followers agree with this concept.

“For those who perceive Bitcoin, I wouldn't suggest gold or silver,” says followers

A wide range of individuals thanked and praised Kiyosaki's predictions, which owns over 2.7 million followers on X, however raised questions concerning the upward speculation.

“For those who perceive Bitcoin, you wouldn't suggest gold or silver,” a follower replied to his publication. That is one thing that resonates amongst totally different lovers of this asset. Digital, uncommon and decentralized, providing the benefit that valuable metals can not matchease of resistance to relocation or confiscation.

Moreover, Bitcoin's broadcasts are lower by half each 4 years at an occasion known as Halving, driving its rise within the face of demand. For this, the occasion all the time attracted a wave of recent purchases that introduced costs to new data the next 12 months, as the next graphs showcased.

And for even decrease market capitalization (provides extra volatility), The upward development in Bitcoin has grown considerably all through historical past. For reference, from the most recent bear market funds in 2022, Bitcoin has recorded a 400% enhance, with 93% gold and 72% silver.

This set of things makes Bitcoin generally known as “digital gold” and even “one of the best model” than valuable metals equivalent to worth reserves. That is even supposing within the quick time period it’s often traded as a dangerous asset equivalent to an motion, and is often correlated with US baggage.

“Bitcoin surpasses gold, silver and every thing else,” the enthusiastic individuals in query mentioned earlier than Kiyosaki's message. He additionally criticized him for not mentioning that “everybody can afford it.”

Nonetheless, in one other publication, Kiyosaki reiterated that he’s presently seeing higher alternatives for silver and Bitcoin purchases, in addition to his scarcity and cheaper price efficiency. The usage of this metallic differs on the industrial degree, and forecasts most demand.

Is it essentially the most worthwhile silver than gold or bitcoin? “I say sure,” mentioned a preferred monetary advisor. “As a result of there is a rise in use in photo voltaic panels, digital autos, computer systems, digital merchandise, weapons techniques, medicines and water purification, there is a rise in demand for silver,” he mentioned.

I’ll element that, With these actions, the provision of gold and bitcoin is not going to lower, however the silver will accomplish that. “And greater than something, it's the most cost effective foreign money in comparison with each,” he argued if you wish to purchase a whole unit of that typical accounting scale (OUNCE).

“Silver is beneficial, its costs stay low for many years and retains them inexpensive for the trade,” he added. In his opinion, that is an over-market operation and subsequently could possibly be valued on the new historic most value in 2025.

however That's why he loses his long-term binding perception in bitcoin and gold.an asset that has not been fed up with suggestions as an funding in recent times.

After all, you will need to notice that predictions will not be met with anybody.

(tagstotranslate)bitcoin(btc)