Ethereum (eth)the world's second largest cryptocurrency, is caught up in a world sell-off crossfire attributable to the tensions of the tariff conflict. With President Trump's aggressive tariff measures Shaking the worldwide market, crypto once more proves it’s unimmunized to macroeconomic disruption. With ETH beneath the important stage, merchants are dashing to evaluate the losses and ask essential questions. How low will Ethereum be in April this yr?

Ethereum's intimate evaluation of every day and hourly charts gives perception into how susceptible the property have turn out to be and whether or not reversals are doable within the close to future.

Ethereum value forecast: What’s your every day chart about Ethereum developments?

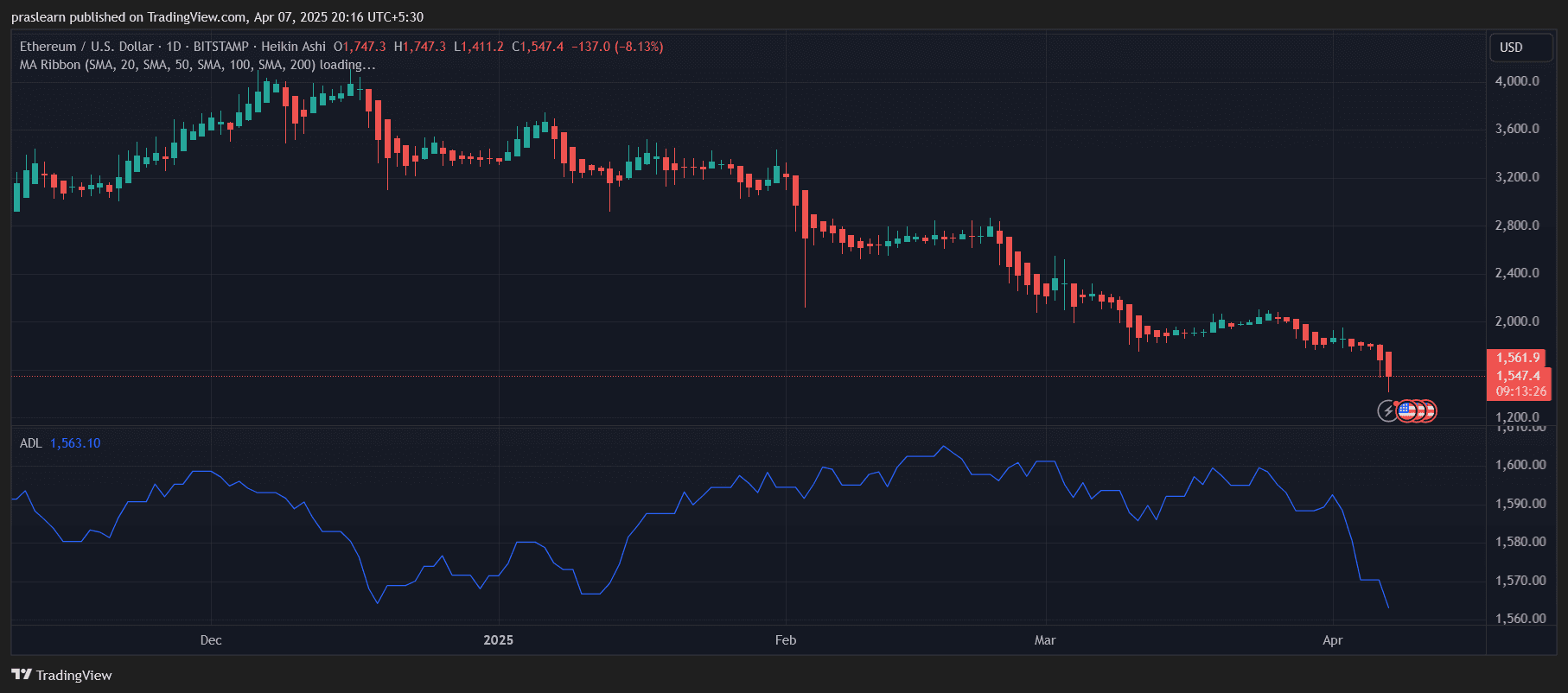

eth/usd every day charts – TradingView

Ethereum's every day charts reveal accelerating steep downward developments. The hikin reed candle has lengthy physique purple bars printed with little or no core on the high. It's an indication of robust bearish momentum. Eth Worth concluded its newest session at round $1,547 per day. The transfer follows the times of dropping for a number of days in a row, not solely fixing, but in addition deeper breakdowns.

Property are effectively beneath all vital transferring averages. Though the complete MA ribbon knowledge was not loaded, it’s clear from the construction and value motion that Ethereum is normally beneath the 200-day SMA. This normally serves as a important stage of assist for long-term buyers. Breaking that line is a purple flag of a traditionally prolonged bearish interval.

Accumulation/Distribution Strains (ADLs) are added to your worries. We’re ensuring that Good Cash hasn't stepped in to purchase this dip. With out accumulation, Ethereum is unlikely to set a significant reversal within the coming days.

Can an hourly chart give the Bulls hope?

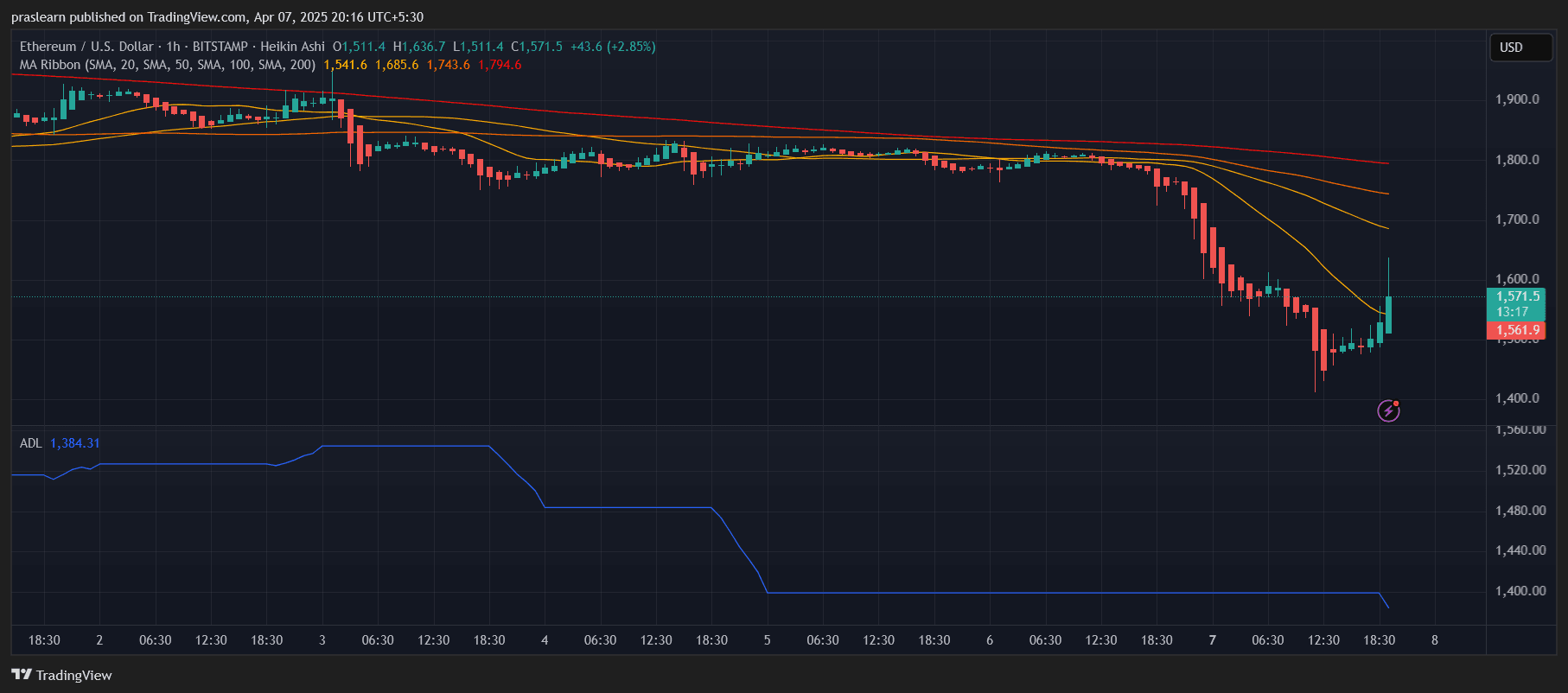

ETH/USD 1 hour chart – TradingView

On the hourly chart, Ethereum has proven a slight bounce from its current low of practically $1,411 on the time of writing, returning to $1,571. Whereas this may increasingly seem to be a bullish response, the rebound comes after an prolonged downward cascade and is beneath all main transferring averages, together with SMAs of 20, 50, 100 and 200. The $1,794 $200 SMA is especially distant, displaying how far costs are rising.

The hikin ash candles within the hourly time-frame have turned inexperienced, however not too long ago they haven’t had a robust upward momentum. Current candle spikes counsel that you simply get shorter or advantages moderately than reversing the precise development. The ADL right here exhibits that even shorter time frames don’t present precise accumulation.

In brief, hourly charts provide a short lived suspension of gross sales moderately than a dependable indication of bullish restoration.

The place are the principle assist and resistance ranges for Ethereum?

Ethereum's subsequent main assist stage is $1,400, supported by the most recent decline. If this stage breaks once more underneath stronger gross sales stress, the following goal might be close to $1,320 and $1,200, which beforehand served as demand within the 2022-2023 Bear market.

The benefit is that Ethereum ought to accumulate $1,685 (50 SMAs on the hourly chart) to neutralize short-term developments. Nonetheless, the true change in momentum happens above $1,800, the place 200 SMA and key resistance converge. With out these ranges breaking, the meeting stays suspicious and susceptible to fast rejection.

What does the chart indicator inform us?

Shifting Common: ETH costs are beneath all main transferring averages for each time frames. The downward nature of SMA strengthens the bearish momentum. This alignment normally precedes the additional downsides until it’s disabled by a quantity collateral breakout.

Hikin Reed Candle: Day by day candles are very bearish, with hourly candles displaying bouncing, however lack of consistency and quantity weakening bullish interpretations. The bull must see a smaller, increased, decrease candle to see a reversal that has not but shaped.

ADL (Accumulation/Distribution Line): ADLs on each charts are one of the annoying indicators. The ADL decline amid falling costs means that whales and establishments are leaving unhealthy information for bullish continuation, with no accumulation.

Ethereum value forecast: How low will it’s in April?

With a bearish momentum persevering with and a $1,400 break, Ethereum costs might be raised to $1,200 or $1,000 in April. This marks a whole yield motion and creates a probably long-term backside.

Nonetheless, if ETH begins steadily regaining $1,685-$1,700 above $1,500, the short-term aid rally might put rallies between $1,800-$1,850 on the desk. Nonetheless, with out robust volumes and rising ADL, even such rallies are susceptible to rejection.

Is Ethereum heading for a deeper collapse?

Ethereum is at a important time. The drawbacks are very actual as its long-term developments have damaged, services have been confirmed and macro headwinds have been intensifying as a result of tariff conflict. Quick-term bounces might provide hope, however the broader developments clearly stay bearish until a quantity inversion sample seems.

So how low will Ethereum be in April? If the $1,400 stage isn’t retained, then $1,200-$1,000 is the true risk.