The charts once more ugly on Thursday after US markets loved a brief, suffocating aid on Wednesday.

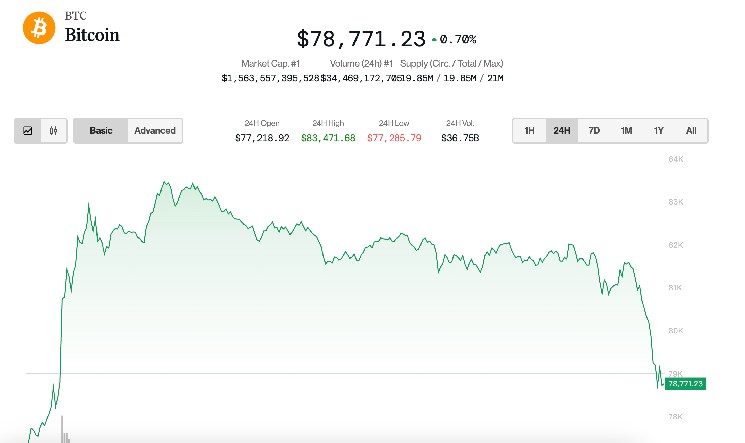

Bitcoin (BTC), which rose greater than 8% the day prior to this, fell beneath $80,000 once more on Thursday, at round 4%. The decline in Bitcoin got here together with a brand new plunge within the Nasdaq. That is 5.5% decrease, following yesterday's 12% rally, as merchants admire President Donald Trump's subsequent step in his tariff coverage.

Crypto inventory was additionally a success. MicroStrategy (MSTR) fell by 11.2%, whereas Coinbase (Coin) and Marathon Digital (Mara) fell by 8.1% and 9.3%, respectively.

With the session already falling sharply, the sale of the shares escalated after tweets revolved that White Home officers confirmed that China's whole tariff fee is now 145%, reasonably than 125%, as President Trump mentioned yesterday.

Particulars of the chief order particulars the “mutual” tariff charges skyrocketed from 84% to 125% in a single day. When mixed with the prevailing 20% tariffs on fentanyl-related merchandise, the overall fee reaches 145%.

China mentioned it might reduce down on American movie imports and strengthen the commerce struggle between the 2 international locations with a view to assault Trump's first tariffs.

In the meantime, gold has risen 3%, reaching a brand new all-time excessive of $3,168. The DXY index, which measures the US greenback towards a basket of international forex, fell beneath 101, successfully reversed the complete November rally, falling 9% from its January excessive.

Political indicted atmosphere

“The macro outlook is just not safe,” mentioned Kirill Kretov, senior professional at Coinpanel at Crypto Buying and selling Automation Platform. “It's a politically charged atmosphere, and headlines have the facility to reshape feelings nearly immediately.”

“A key swing issue proper now could be commerce coverage,” Kretov provides, including that the Trump administration's ever-changing tariff coverage provides to considerations about inflation. “Escalation on this entrance will complicate the Fed's decision-making and doubtlessly derail the present market narrative,” he mentioned.