Actual World Property (RWAS) tokenization is accelerating elementary change in international finance as US finance, shares, commodities and personal credit primarily based on blockchain are poised for exponential development this 12 months, based on a report from market maker Kilock and Centrifuge of Tokenization Platform.

KeyRock and Centrifugal Evaluation: Tokenized RWA can seize 10% of the Stablecoin market by the top of the 12 months

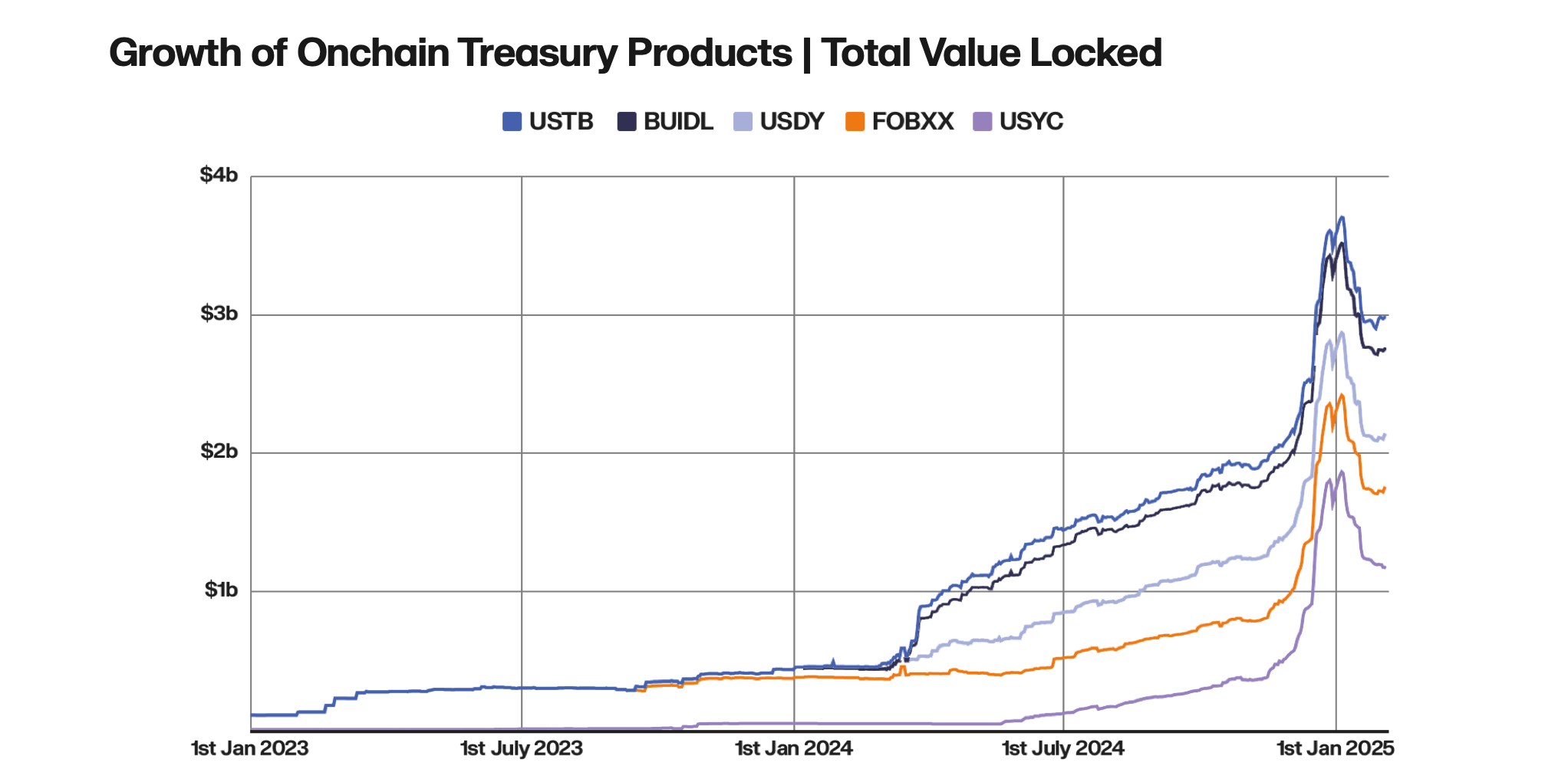

In response to two corporations, the tokenized US Treasury Division has elevated by 415% year-on-year, driving stablecoin house owners and institutional adoption in search of yields. Keylocks and centrifuges undertaking that if tokenized merchandise account for 10% of the $210 billion stubcoin market, the sector might attain $28 billion. “The tokenized Treasury expects to evolve from area of interest innovation to the core infrastructure part of worldwide digital finance,” the report stated.

The evaluation explains that tokenized shares are behind at $15 million TVL, however are dealing with a pivotal 2025 as regulatory readability grows. The backed funds and the ONDO international market enable unauthorized entry to tokenized S&P 500 Change-Traded Funds (ETFs) and company shares.

“The democratization of refined monetary instruments by means of non-Kyc guarantees that unauthorized protocols will unlock indicators of potential for undeveloped markets from beforehand unserved areas and teams.”

The report highlights that merchandise like Gold are combating the liquidity hole regardless of $1.2 billion in tokenized provide, however artificial platforms like Ostium Labs intention to seize speculative demand. Private credit score is main at a $12.2 billion TVL as Centrifuge's in-facility pool reduces securitization prices by 97%.

The regulatory hurdles persist, particularly for shares, however KeyRock and centrifuges observe that bipartisan US legislation and European frameworks like MICA have eased the trail. The report predicts that whole tokenized RWAS might attain $50 billion within the bull case in 2025, pushed by institutional consumption and important distributed monetary (DEFI) integration.

“The motion envisages restructuring international finance by democratizing entry, selling elevated effectivity and rising transparency throughout asset lessons,” explains the tokenized RWA evaluation. “As a substitute of a sluggish fee pipeline, the market operates on blockchain rails with near-hour funds and verifiable possession information, decreasing counterparty dangers and back-office friction.”

The tokenized Treasury, KeyRock and Centrifuge Place 2025, which modernizes colonies and modernizes non-public credit score democratization entry, is as an inflection level for the blockchain's $30 billion to $500 billion breakthrough.