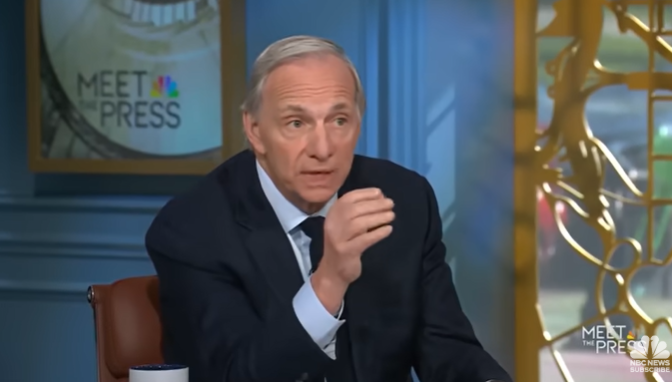

“We're at a important level proper now, we're very near a recession, and we're anxious about one thing worse than a recession if this isn't managed properly.”

He speaks to Ray Dalio, founding father of the Bridgewater Funding Administration firm. In an interview with CNBC, he expressed concern Political tensions derived from the “customs conflict” President Donald Trump has begun.

As reported by Cryptonotics, the US president had introduced mutual tariffs on a number of nations.

Nonetheless, Trump has ordered a 90-day tariff break on a number of nations, besides China, to boost rates of interest, which is now at 125%. In response, Chinese language authorities raised tariffs.

“We’re transitioning from multilateralism, a world order that’s primarily from the USA, to a one-sided world order with nice battle,” Dario stated.

On this regard, the billionaire must be made clear that he simply printed a letter explaining it. These transformations are pushed by 5 interconnected forces: Unsustainable world debt ranges, inner political polarization, the top of the US-led geopolitical order, excessive local weather occasions, technological advances.

With regard to the extent of world debt, Dario believes there’s a structural imbalance between economies such because the US, which depend on credit score to help consumption.

For him, the world is shifting right into a stage of jisrovariation and distrust below a system that “must be transformed in a harmful means”, which may have a profound impression on the capital market.

For that reason, he requested the US Congress to scale back the federal deficit of three% of GDP. As a result of “in any other case there will probably be these different points, whereas there will probably be debt provide and demand points, which is able to worsen as a standard recession.”

In different phrases, what’s in danger Greenback hegemony as a world reserve foreign moneywhich may trigger a collapse of the bond market and add to inner and exterior disputes. This blow will have an effect on the financial system with extra pressure than the exit of the 1971 Gold Commonplace or the monetary disaster of 2008.

Dario warns that each one these components may come collectively in an entire storm if emergency measures aren’t taken. Unsustainable world debt, uncontrolled fiscal deficit, distrust of the greenback as a reserve foreign money, and fragmented geopolitical order can result in a decline in demand for American treasured debt, forcing rates of interest to rise and earn credit score. This can cease consumption and funding and instantly have an effect on financial exercise.

And whereas the financial recession already means a long-term decline in progress, the rise in unemployment and decrease output are much more excessive within the state of affairs Dario explains. The potential of a world monetary collapse with systemic reliability and deeper penalties than earlier crises.

Within the midst of an unsure financial panorama and rising world tensions, questions come up as to which alternate options can defend buyers from deeper monetary collapses.

Extra conventional buyers are leaning in direction of property which are much less uncovered to market fluctuations, reminiscent of treasure bonds, however others are watching Bitcoin (BTC) is an alternative choice to conventional monetary techniques.

Earlier than persevering with, it is very important observe that in its 16 years of existence, the foreign money created by Nakamoto At by no means surpassed the recession formally declared in the USA. That progress occurred within the context of financial enlargement and versatile financial coverage, situations that help their appreciation.

The truth that Bitcoin has by no means confronted a declared recession raises an essential query.

Earlier than this state of affairs, BTC could behave in a different way than conventional property.

In occasions of financial uncertainty, reminiscent of these related to recessions, confidence in gold tends to be erosed as a consequence of insurance policies carried out by central banks, reminiscent of the quantity of gold in massive quantities and rates of interest.

These measures, seen in previous crises such because the Nice Recession of 2008 and the Pandemic of 2020, create mistrust between buyers and residents, opening up house for alternate options reminiscent of BTC.

Not like Fíat cash, which may be issued inorganic and unlimitedly to fulfill authorities wants, digital property have restricted emissions at 21 million models, and that emissions are lowered each 4 years by halving. This can be a issue that has a optimistic impression on medium and long-term costs.

Moreover, it can’t be operated by banks or governments. Subsequently, it’s a extra resistant different to financial selections that have an effect on conventional property.

For that reason, many buyers They take into account BTC to be “digital gold” due to its similarity to treasured metals. Nonetheless, it is very important observe that, as it’s thought of a majority of threat property, its costs normally fall right into a deprived financial context.

Even BlackRock, the world's largest asset supervisor, considers BTC to be “a novel and various asset.” The corporate exhibits that its traits are nonetheless adopted early in comparison with the danger that conventional property can’t be mitigated, particularly during times of excessive geopolitical and financial uncertainty, however that traits can flip into protection.

(TagstoTranslate)US (T)Traders (T)Newest Traders