Actions in March intensive exchanges have slowed total, following the traits all through Q1. The coded derivatives remained extra resilient, shrinkage decreased, and the moon ended.

In March, centralized buying and selling of all crypto belongings slowed down, following the general development of dropping quantity all through Q1. By-product buying and selling was extra resilient, with solely 5% contracted.

The central alternate introduced world visitors primarily from crypto-friendly areas. The March outflow displays bearishness and outflow from the Korean and US markets. Binance's visitors and exercise displays sturdy ranges of curiosity from different world markets.

Regardless of inflow from whales and gross sales stress for Bitcoin (BTC) and gross sales stress for Ethereum (ETH) and Solana (SOL), Spot Buying and selling misplaced 16.6%. Additionally, spot exchanges featured much less liquidity within the type of stability, however many of the extra liquidity nonetheless helps spinoff buying and selling.

In March, all central exchanges have decreased, complete stability Sinks from 48B or increased tokens of 45B.

US-based merchants drive alternate outflows of spot volumes and crypto derivatives

Lack of momentum has primarily affected three exchanges – crypto.com (down 43.9%), bibit (down 52.6%), and Bitfinex (down 31.1%). A portion of the spot buying and selling visitors moved to HTX, with quantity rising by 29.4% for the month.

By-product alternate actions returned to Kraken, which rose 28.3% in March. Site visitors traveled from crypto.com and misplaced 39.3% of the spinoff exercise. Each Crypto.com and Coinbase misplaced visitors, informing us of the US dealer's outflow. However, the US-based market is Q1 of 2025.

Transportation to the Crypto alternate has dropped by 3% previously month. Trade actions in spot and derivatives markets are additionally not sorted primarily based on market makers or bots. A number of the extra dramatic buying and selling spikes could possibly be irregular or intentional bot-driven transactions.

The alternate additionally separated itself primarily based on native visitors inflows. Vinanence noticed comparatively small outflows whereas buying transportation from India, Vietnam and South Korea. In the meantime, Coinbase displays the lack of confidence amongst US merchants making an attempt to get rid of the consequences of the US presidential election.

The outflow of spot merchants can also be attracting consideration within the DEX market. At the moment, the decentralized market accounts for round 10% of CEX spot buying and selling. However, the unstable market introduced alternatives for harmful, decentralized betting. In March and early April, excessive lipids was one of many busiest dexes Every day quantity.

Binance holds probably the most vibrant asset flows

Binance was one of the vital energetic asset flows. CEX is likely one of the main venues for spinoff buying and selling and sees a few of the greatest liquidation of day by day life.

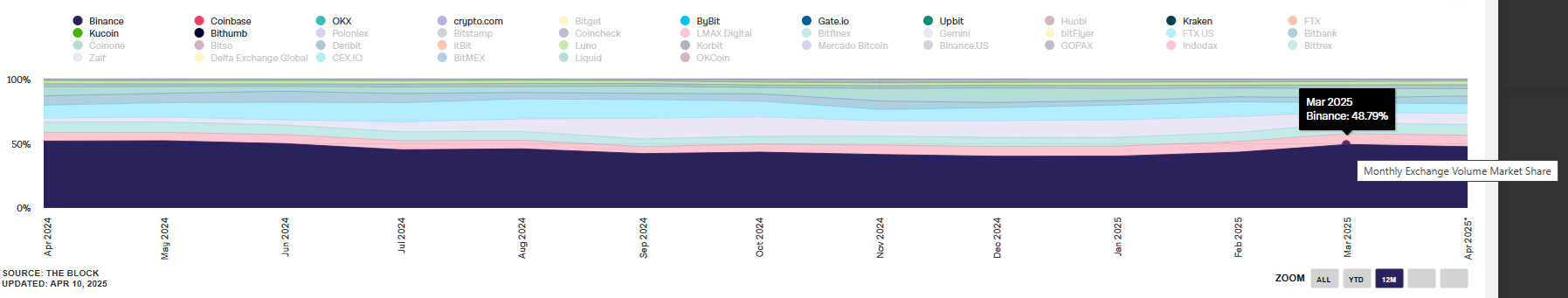

Primarily based on the open place, Binance stays a proxy for your complete spinoff, Futures Market. CEX can also be a benchmark for spot volumes. 29.5% Marketwide, together with small and area of interest exchanges. Within the case of spot quantity, Binance was the chief. information By New Shedge.

Binance has remained a frontrunner within the central alternate of each spot derivatives and crypto derivatives actions. |Supply: IntotheBlock

CEX additionally noticed probably the most vibrant inflow of BTC, ETH and Stablecoins. This alternate has a extra constant stability with a strong provide of cash and tokens. In March, Binance noticed a internet spill in BTC, however is now regaining the stability accessible.

Regardless of ongoing actions, March was the slowest month ever. Binance managed all different exchanges when it comes to buying and selling quantity, however total exercise continued to say no in efficiency in January and February.