It is a section of the 0xResearch publication. Subscribe to learn the complete version.

ETH is buying and selling for from $1,600 as we speak.

Can I pump ETH once more? Wen Moon?

To get to the center of this straightforward query, you want an inevitable detour to the boring and technical weeds (DAs) of knowledge availability.

The ELI5 description of knowledge availability is storage charges or bandwidth sources. All chains (L1 and L2) should work, however the primary provider is L1.

Here’s a tough line of ideas:

- What’s the destiny of ETH as an asset?

- This depends upon how properly Ethereum can generate the payment.

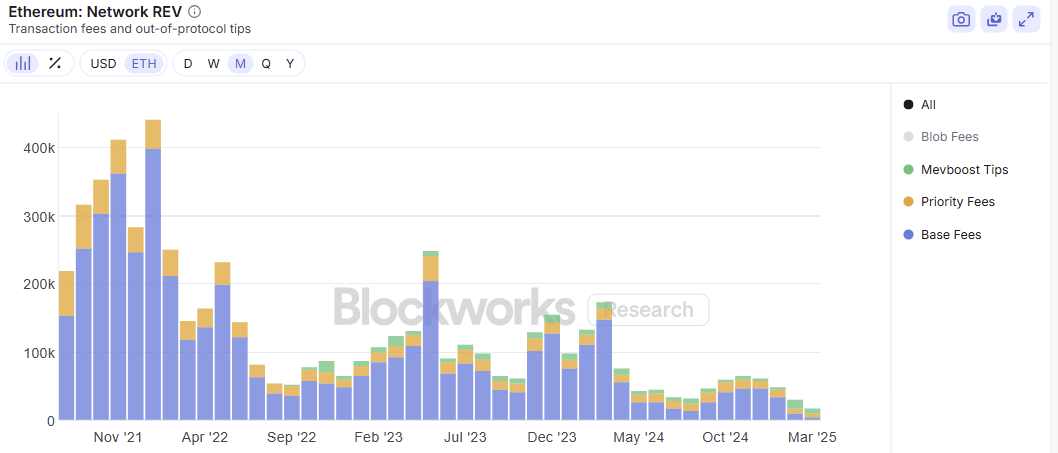

- Ethereum generates charges in three most important methods: execution, MEV, and knowledge availability.

- Following the intent of the roll-up-centered roadmap, execution charges (aka congestion charges) are largely given to L2.

- MEV charges are compressed with higher analysis. An increasing number of wallets and apps are discovering higher methods to maintain MEVs and return them to customers. The next chart of Ethereum's Rev (precise financial worth) excluding BLOB charges is a tough proxy for the way Ethereum's MEVs circulation over time.

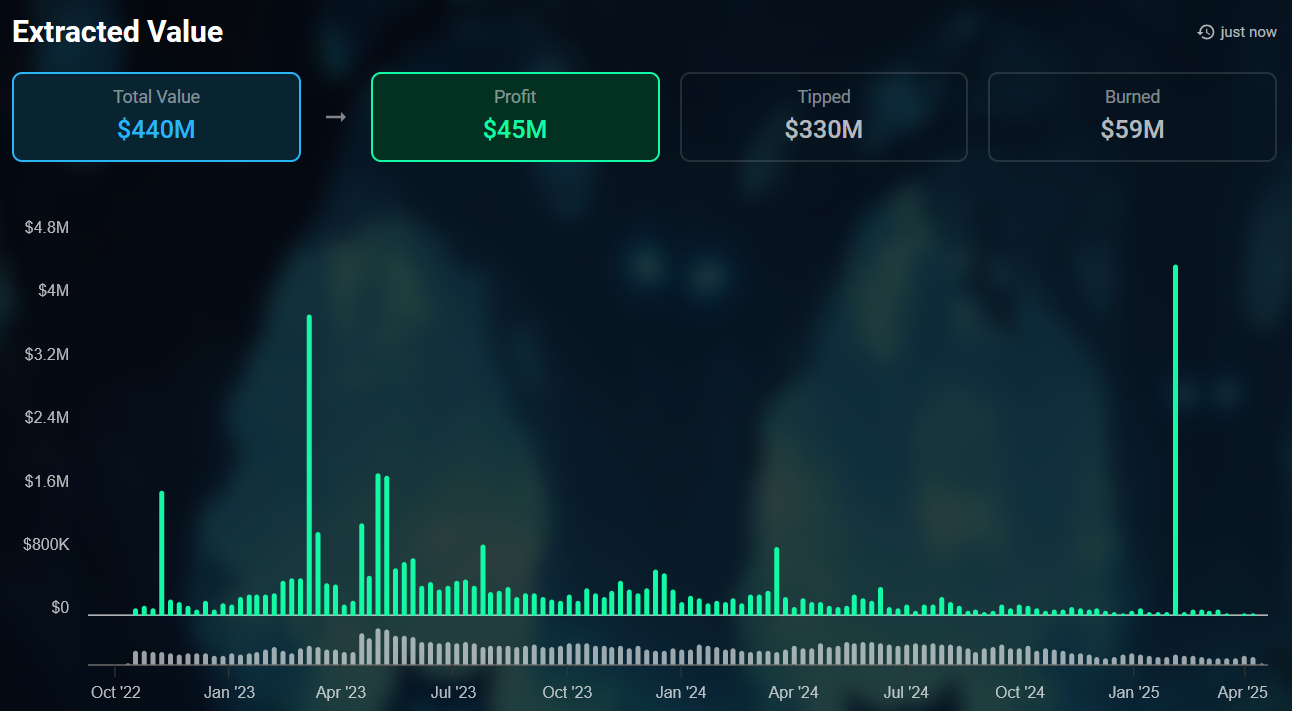

One other technique to see the downtrend of MEV is the decreased extracted worth of sandwich assaults. That is primarily as a result of elevated quantity of Ethereum personal transaction order flows not passing via public reminiscence.

Supply: libmev

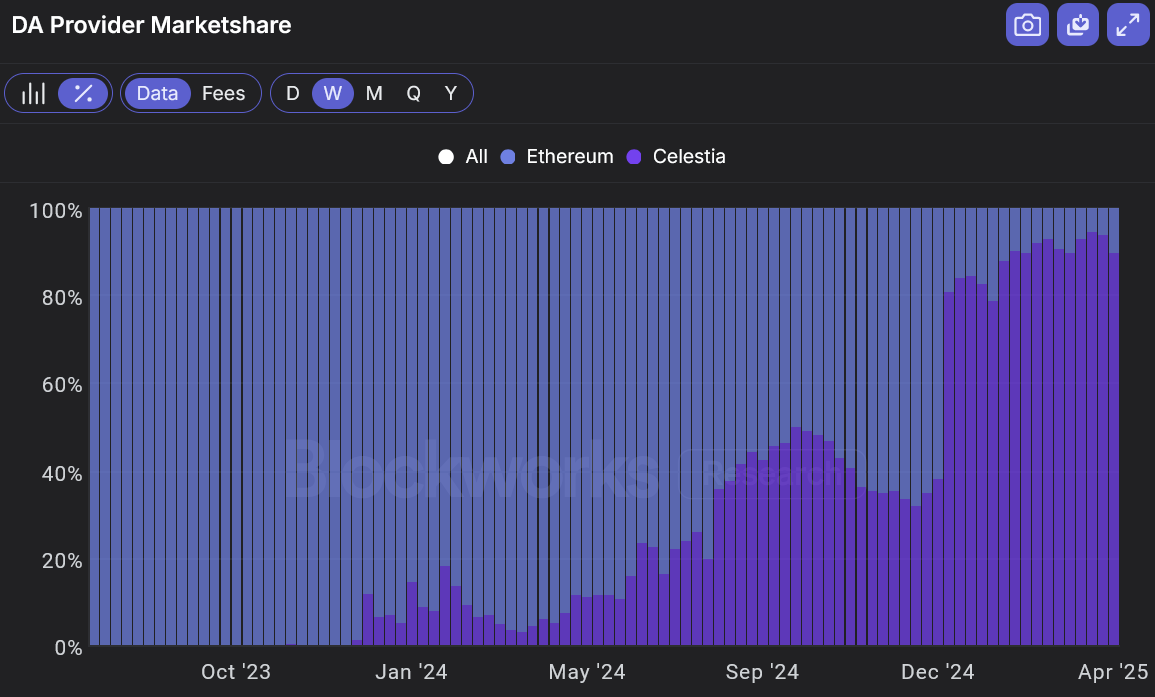

- As extra rollups are launched, all chains want DA charges, so ETH's ultimate values stay.

This has due to this fact established that knowledge availability charges are important for Ethereum's success.

That's not simply my opinion. It's the specific place of main Ethereum researchers like Justin Drake. When he locations it on the most recent Ethereum Basis Reddit AMA, the DA is “the one supply of sustainable circulation for L1S” and never a payment for execution or MEVs.

(I believe it is a simplification. There are efforts to scale L1 and entice institutional capital to L1, however put that apart for now.)

So let's check out how a lot Ethereum will make from as we speak's DA.

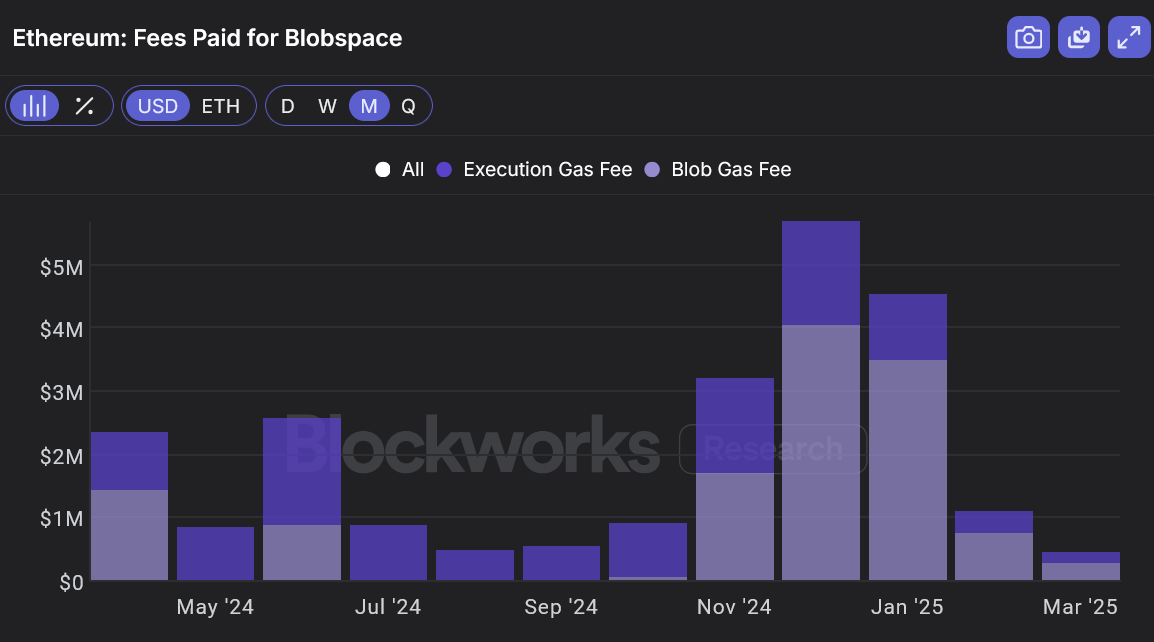

Sadly, it's not that a lot. For the reason that institution of EIP-4844 in March 2024, Ethereum has generated a complete of $26 million in charges.

Reaching that payment degree is a perform of each demand (roll-up) and provide (Ethereum L1 DA capability).

Let's assume that Ethereum had enough consumer demand as we speak. Nonetheless, Ethereum lacks provide.

EIP-4844 launched blobs to the DA capability of Ethereum in March 2024. BLOB capability is roughly 384 kb or roughly 32 kb/s per slot.

Within the context, various DA layers like Celestia at the moment have round 182% bigger 8MB blocks. (Celestia is making ready for the 128 MB block.)

Sure, the BLOB capability is increasing, but it surely's sluggish. The DA capability is ready to broaden from three blobs to 6 blobs subsequent month with the Pectra Exhausting Fork. The ultimate plan is to broaden the blob capability to 48-72 with the Fusaka Exhausting Fork afterwards, however who is aware of when it should occur.

Now let's check out the DA market.

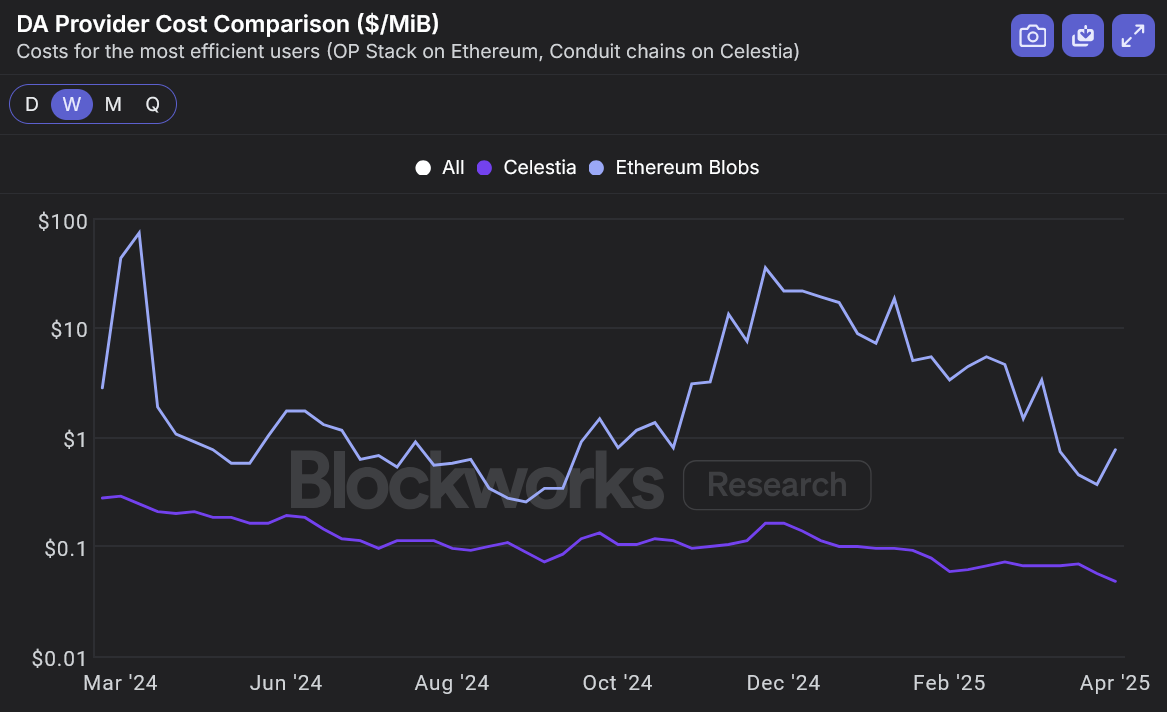

Even worse information. It's a extremely aggressive market. There are Celestia, Eigenda and Avail.