Amidst international financial volatility, the US has as soon as once more circumvented defaults and raised its debt cap to make sure authorities operations proceed easily.

The US debt cap is a authorized restrict on how a lot the federal authorities can borrow to fulfill its monetary obligations, corresponding to pension funds, social welfare applications corresponding to Social Safety and Medicare, and advantages on authorities bonds.

Enhance in US debt cap

Elevating the debt cap usually causes intense debate between Congress and the White Home. Negotiations over spending and budgets are normally long-term sophisticated.

US debt. Supply: PGPF

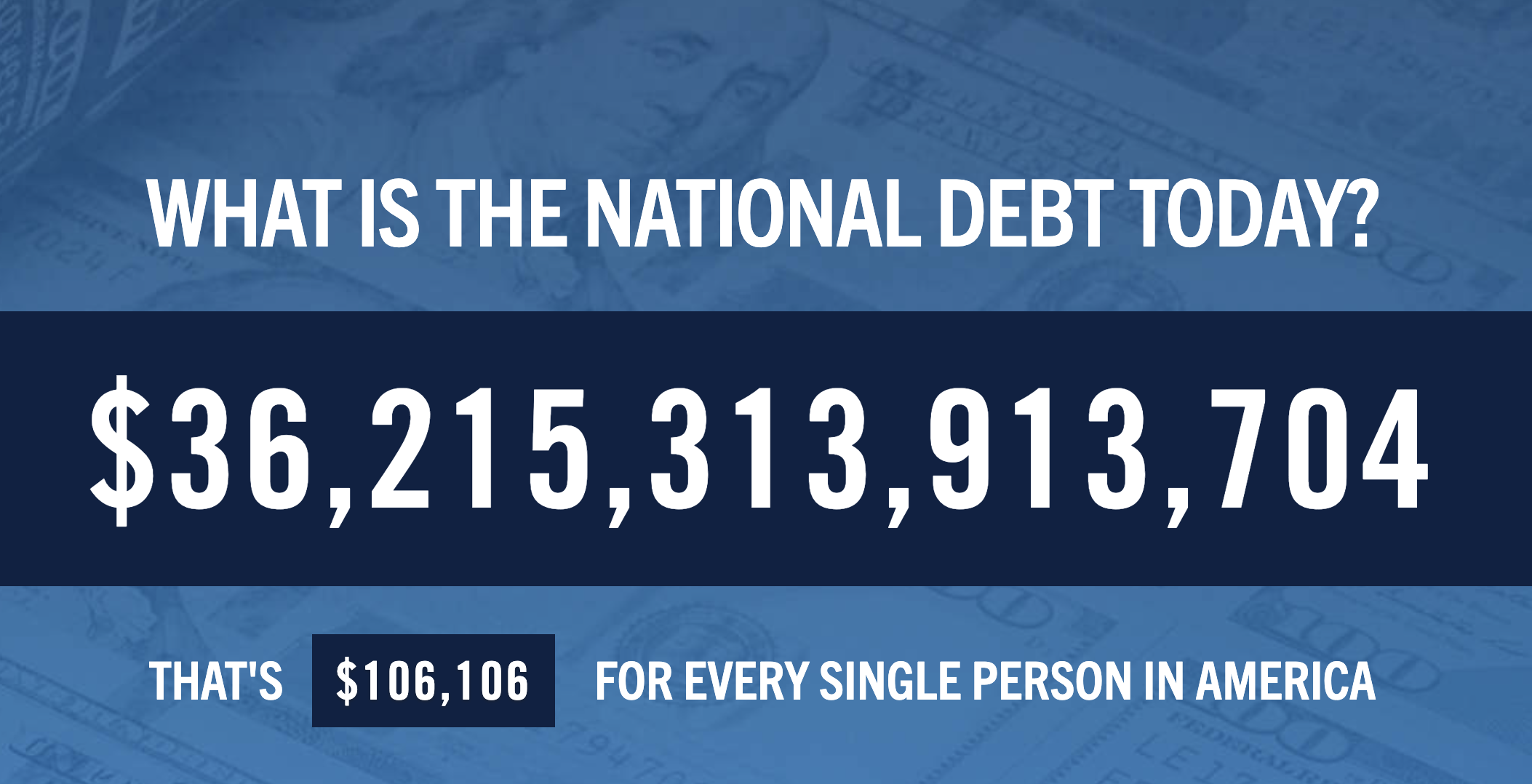

In keeping with information from the Senate Joint Financial Committee (JEC), US nationwide debt was over $36.2 trillion as of April 2025. This marks a big improve from $22 trillion in March 2019, highlighting the speedy escalation of nationwide debt lately.

Traditionally, it isn’t unusual to boost debt caps. In keeping with NPR, since 1960, Congress has acted 78 occasions to extend the definition of a 29x debt cap beneath Republicans and 29x the Democrats' presidential definition of a brief extension or modification, in keeping with the NPR. This displays the repetitive want to regulate caps to keep up authorities functioning, but in addition raises questions in regards to the long-term sustainability of US fiscal coverage.

Below President Donald Trump's administration, daring financial insurance policies have been carried out, together with utilizing tariff revenues to serve debt. Trump has imposed a 125% tariff on Chinese language merchandise, prompting a retaliatory 84% tariff from China within the US. Imported.

Consequently, the Chinese language Yuan (CNY) reached its lowest degree in 18 years, with the USD/CNY ranking reaching 7.394. The unique depreciation escalates commerce tensions and ripple results throughout the cryptocurrency market.

Affect on cryptography

A rise in US debt caps has a multifaceted influence on the crypto market within the brief and long run.

Elevating the debt cap will assist the US keep away from defaulting and stop a possible international monetary disaster. This usually reassures buyers and will increase confidence in shares and conventional monetary markets just like the US Treasury. Consequently, the demand for secure at-home belongings like Bitcoin (normally thought of a hedge between financial uncertainties) is declining.

Historic tendencies help this. Bitcoin costs have skyrocketed as buyers worry US defaults, corresponding to 2021, throughout previous debt cap crises. Nonetheless, the rise within the cap eased the strain, prompting some buyers to return capital to conventional belongings. This might trigger downward worth strain on Bitcoin and different altcoins.

Furthermore, weaker ex-people from US coverage might drive capital from China to cryptocurrency and supply a constructive driving drive for the market.

Continuingly growing the debt cap permits the US authorities to borrow extra to fund spending, usually resulting in a rise in printing cash or issuance of monetary obligations. This course of expands cash provide, fuels inflation, and undermines the worth of the US greenback.

Cryptocurrencies, particularly Bitcoin, are sometimes thought of “inflation hedges” attributable to their mounted provide and decentralized nature. Traders are more and more counting on different belongings to keep up their wealth because the greenback weakens. Bitcoin, also known as “digital gold,” has confirmed its resilience amid previous financial instability.

A rise in US debt caps has a posh influence on cryptocurrency. Within the brief time period, as belief in conventional markets will increase, it might scale back the demand for secure haven belongings like Bitcoin.

However in the long term, mountaineering of sustained debt caps can promote inflation, weaken the greenback, and place cryptocurrencies as a compelling hedge and different asset class.