Ethereum is approaching a key breakout from the triangular sample, with the Bulls being attentive to the $2,000 mark.

For $1,623, Ethereum registered an intraday restoration of 1.60% on the time of writing. This bullish comeback is on the verge of eliminating Sunday's 2.8% drop from the $1,650 mark. Ethereum restoration introduced it to the vertices of the triangle sample.

As we enhance broader market sentiment, the probability of Ethereum's breakouts is steadily rising. Does this push ETH in the direction of a psychological $2,000 degree?

Ethereum's Restoration Rally approaches a key breakout, with the Bulls focusing on $2,000

On the 4-hour worth chart, the bullish turnaround from the current $1,418 degree exhibits a serious restoration for Ethereum. The excessive formation of Ethereum has created an area help pattern line.

The overhead resistance, almost $1,675, is in line with a Fibonacci degree of 38.2%, highlighting the highest of the ascending triangle sample. The long-standing trendline of resistance additionally creates symmetrical triangle patterns on the 4-hour chart.

Technical indicators additionally present bullish tendencies. The supertrend indicator means that the upward pattern is shifting, reflecting a powerful bullish momentum because the four-hour RSI exceeds the mid-term mark. These metrics preserve Ethereum's optimistic outlook.

As Ethereum approaches the triangle's vertices, worth motion merchants count on excessive instantaneous actions in each instructions. In response to Fibonacci ranges, a bullish breakout might goal a Fibonacci degree of 78.6% at $1,948.

This will increase the possibilities that Ethereum will attain a psychological degree of $2,000. Nevertheless, a possible breakdown might doubtlessly retest the $1,418 help degree.

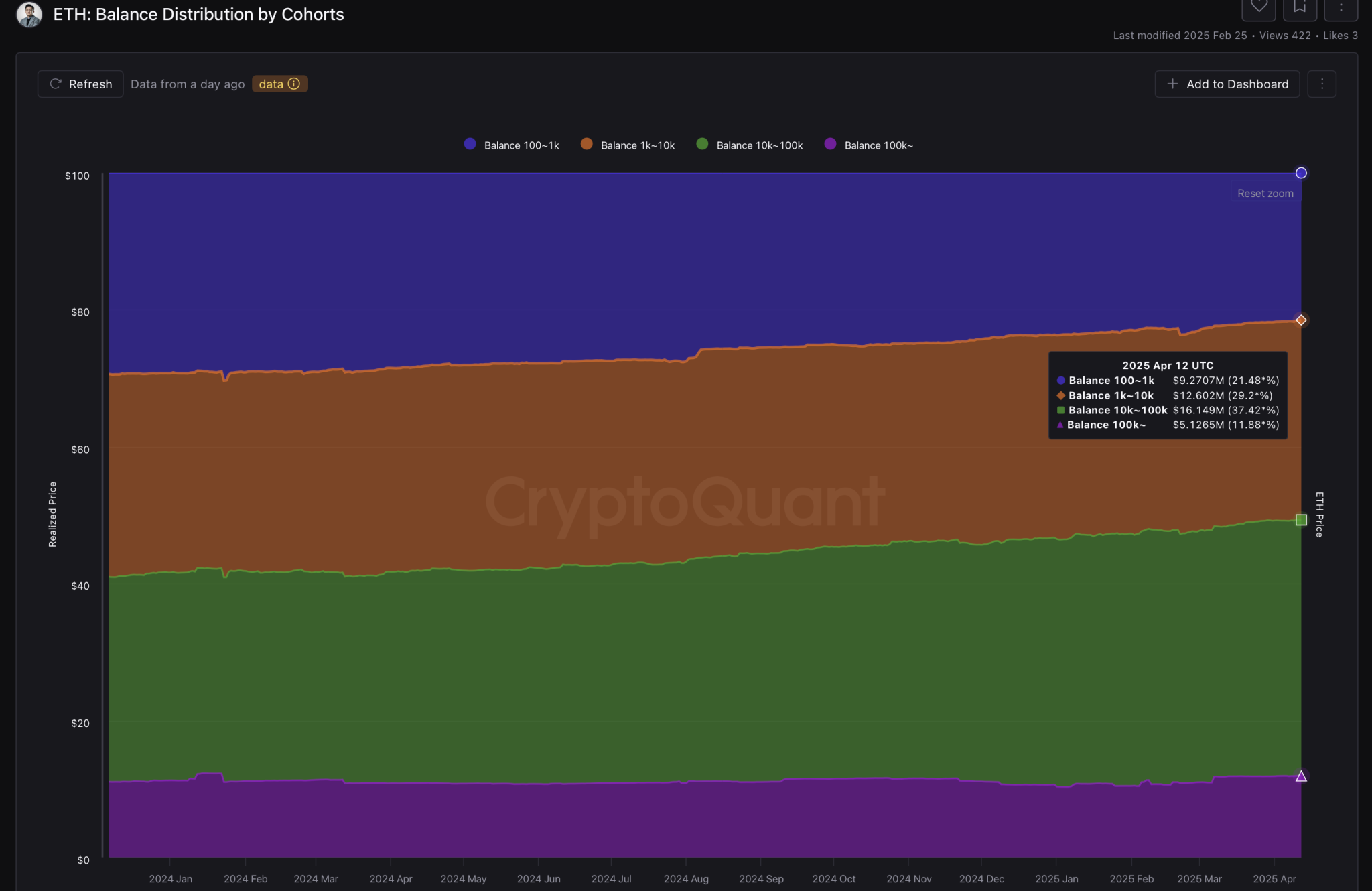

The stability of cohorts holding 10k-100k ETH is a brand new hit

Ethereum trades at comparatively low ranges, which implies massive buyers are rising their accumulation. In response to Cryptoquant, the stability distribution of Ethereum by cohort signifies important development in massive holdings.

Over the previous yr, the holding stability of 10,000-100,000 ETH has elevated from 29.64% to 37.42%. The stability of wallets, which holds over 100,000 ETH, rose to 11.88% from 11% a yr in the past.

In the meantime, the retail section has lowered holdings, with pockets balances lowering ETH of 100-1,000 from 29.47% to 21.48%.

However, sturdy help from massive buyers means that prolonged gatherings may very well be on the horizon.

ETH stability distribution by cohort

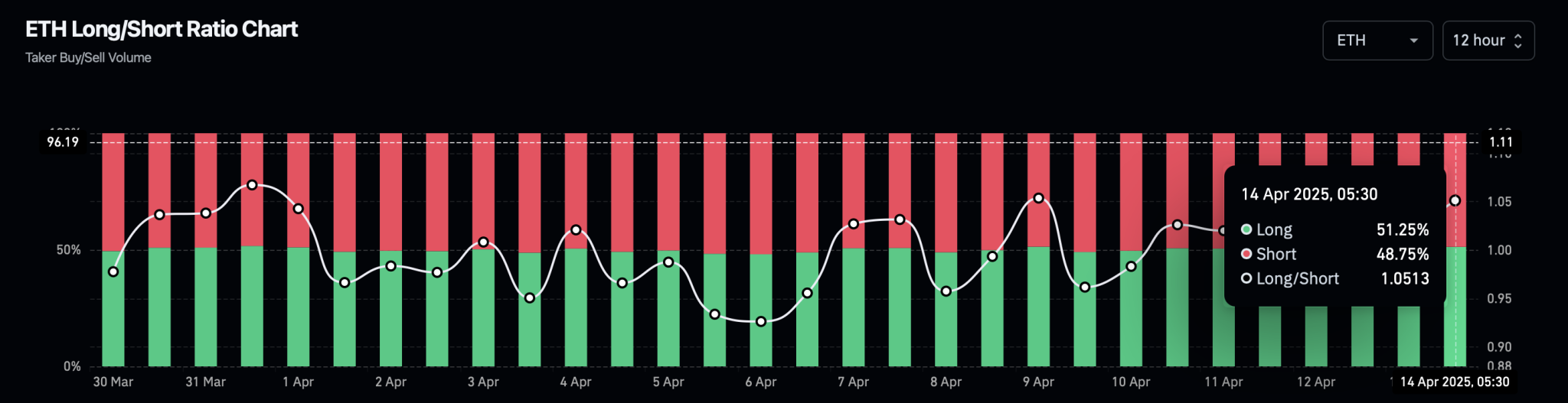

Crypto Merchants Go Longer to Ethereum

As Ethereum approaches a possible breakout rally, bullish sentiment within the derivatives market has elevated considerably. Ethereum's lengthy place has skyrocketed to 51.25%, rising its long-term ratio to 1.0513.

Ethereum's public rate of interest is secure at almost $17.94 billion, however the funding fee jumped to 0.0060%. A optimistic funding fee and an extended place enhance will inform Ethereum's optimism.

Ethereum Longshort Ratio Chart