- Capmoney has adopted the ChainLink worth feed to stabilize COSD and supply stay pricing knowledge on the Defi platform.

- Chainlink Oracle for distributed verification in sustaining COSD greenback stability and automatic good contract capabilities.

- Linked tokens proceed to say no as whales offload the token, however turn into much less lively addresses and damaging the market.

Capmoney has revealed that it’s going to use Ethereum's ChainLink Worth Feeds to realize Stablecoin Peg into US {dollars}. Adjusted for cross-border funds and remittances, Stablecoin goals to offer constant pricing knowledge and improved safety in a distributed monetary (DEFI) atmosphere.

. @capmoney_ is consolidating the built-in chain hyperlink worth feed into @ethereum to energy its distributed curiosity CUSD stablecoin.https://t.co/w1qnpktgzw

CUSD is absolutely secured and backed by breaking property, so we use ChainLink to supply a stronger assure: Stablecoin Minting and…pic.twitter.com/z7qagsrivt.

– ChainLink (@ChainLink) April 17, 2025

At the moment, ChainLink's worth provide is widespread as a result of it isn’t decentralized and due to this fact the sport isn’t doable. Extract knowledge from over 20 CEXS and DEXS aggregators and merge knowledge utilizing quantity weighted averages. These costs are additional verified by consensus by different events often known as safety audit nodes.

In reality, CUSD good contracts would require a brand new worth renewal interval when the market adjustments or it’s due. The Oracle node collects and processes pricing info from the exterior atmosphere, excludes outliers, and reviews the outcomes. With chain hyperlink knowledge pooled and the averages uncovered on-chain, CUSD stays safely glued and reachable even within the occasion of volatility or excessive masses.

The Defi utility expands as CUSD acquires new options

Through the use of the ChainLink infrastructure, CUSD introduces itself to combine throughout quite a few Defi platforms. Agricultural methods that depend on automated market makers, lending platforms, and dependable pricing knowledge can now be built-in with CUSD.

ChainLink's programmable Oracle permits actual occasions to generate good contract transactions. Capmoney plans to optimize the settlement and alter collateral necessities, additional increasing the potential use instances for CUSD.

Integration not solely offers operational stability, but in addition advantages CUSD by setting benchmarks that different Stablecoin publishers on Ethereum ought to comply with.

ChainLink faces strain regardless of strategic adoption

Nonetheless, Hyperlink, a local token for ChainLink, was unable to keep up an upward trajectory even in collaboration with Capmoney. The hyperlink is at present at $12.15, displaying a each day drop and comparatively bearish from the height of round $30.86 recorded in December.

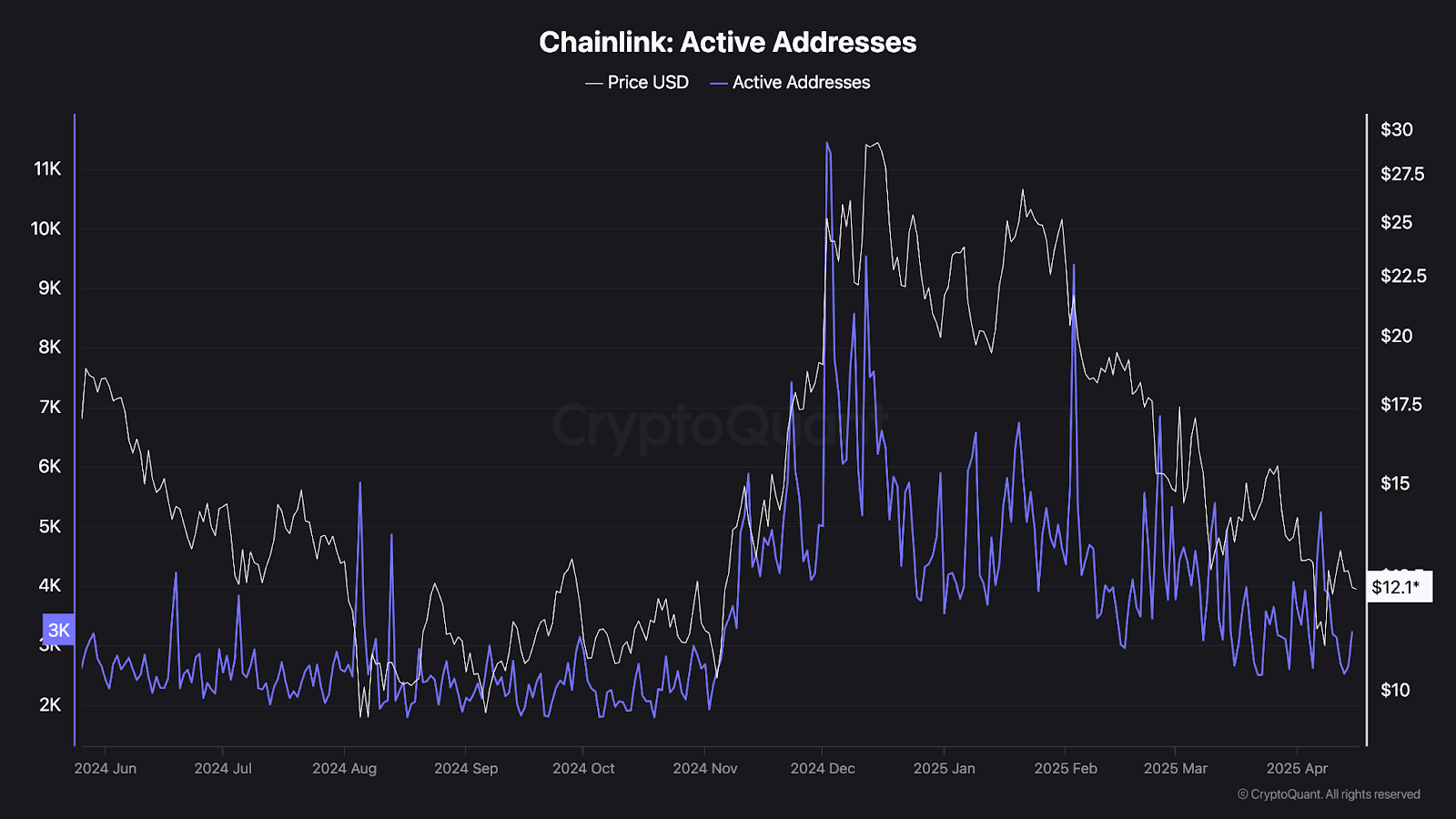

Nonetheless, the Onchain indicator reveals a detrimental pattern within the basis. Cryptoquant reveals that ChainLink's lively addresses have dropped to round 3,200 this week, 72% lower than the 11,400 recorded in December.

Supply: Cryptoquant

Lively handle metrics that monitor the variety of completely different wallets concerned in linked tokens may enhance when costs are made. An extra decline means lowering person curiosity and lowering belief in prospects.

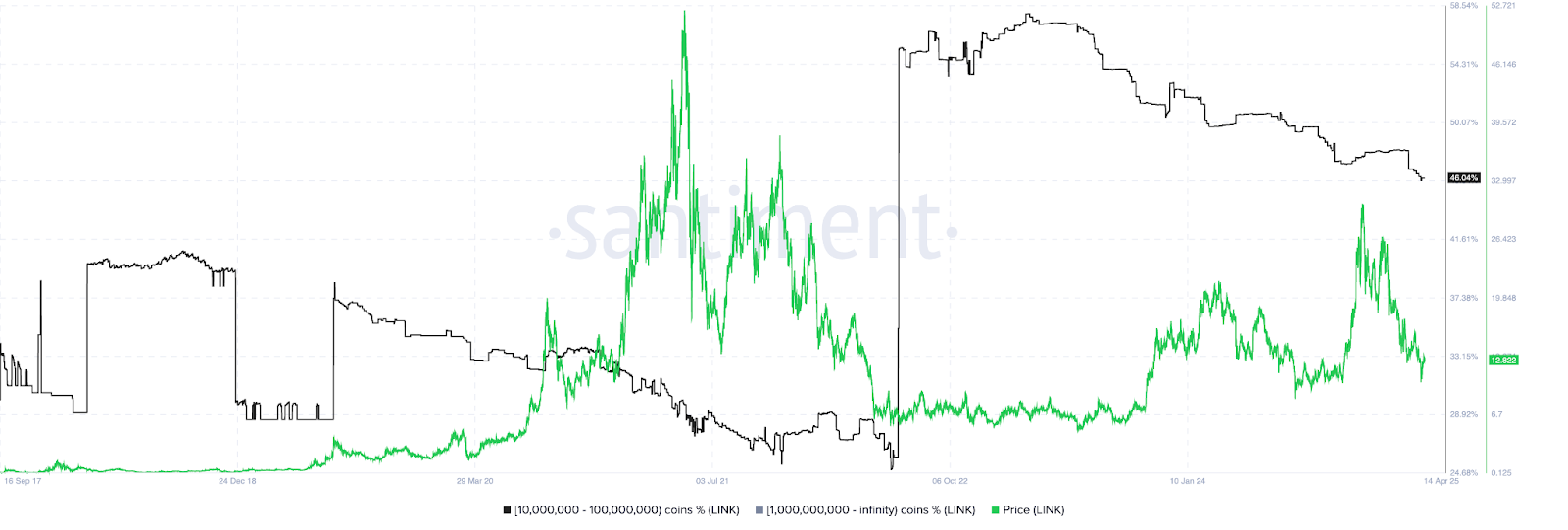

Santiment additionally reveals that bigger holders are additionally beginning to promote extra. Many giant addresses, starting from 10 million to 100 million hyperlinks, are on sale from February to mid-April. These wallets at present have 46% of all linked tokens circulating. This places the decrease strain on changing into frequent on this whale group as a consequence of exit exercise.

Supply: Santiment

The hyperlink is near the $10 assist degree. It’s anticipated to fall beneath this degree, which is able to end in extra losses if the bearish momentum persists. Merchants are at present awaiting constructive alerts that might stimulate the will for customers and enormous whales to work together with the platform.