BITCOIN has lately triggered a variety of certain workout routines, with costs rose from $ 83,000 to $ 86,000. Curiously, Burak Kesmeci, a well-liked encryption analyst, has confirmed the vital worth degree of brief -term measures.

Help of 82,800, the place is the resistance -Bitcoin at 92,000?

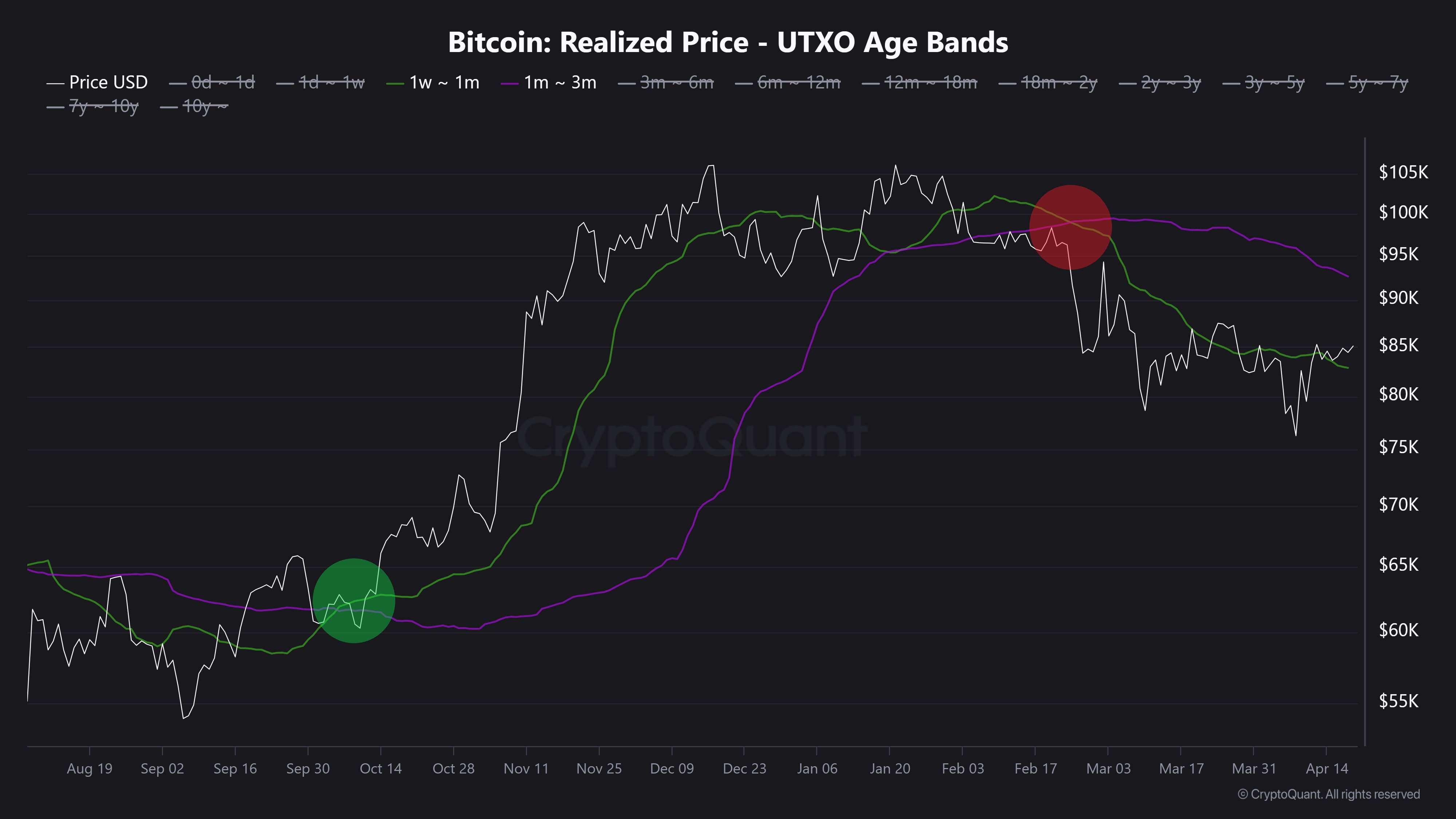

In X's new put up, Kesmeci shared an fascinating chain evaluation of Bitcoin Market. Utilizing brief -term investor prices, analysts have confirmed two main costs, that are vital for Bitcoin's subsequent main motion..

First, Burak Kesmeci focuses on the common value of latest merchants over the previous 1-4 weeks, which will be essentially the most responsive to cost fluctuations. The value of those merchants is at present $ 82,800, and lots of consumers are nonetheless gaining revenue and type brief -term help that signifies that they’ll defend this degree right into a psychological layer.

Kesmeci additionally emphasizes the value of $ 92,000, which information the common value of BTC holders for 1-3 months. This worth vary has emerged as an vital resistance space as a result of buyers could possibly escape the market as soon as they’re out of the market. As well as, the value degree of $ 92,000 is represented by a wide range of technical indicators.

The interplay between these two ranges is vital. Traditionally, the short-term power of BTC tends to start when the latest value requirements of buyers exceed the price of 1-3 BTC holders than 1-4 weeks (1-4 weeks). These shift alerts have elevated their belief and willingness to buy at the next degree, which regularly fuels wider rally with gasoline.

However within the present market, there’s a dynamic factor. At present, BITCOIN is buying and selling about 85,000 individuals, which is lower than $ 92,000 in 1-3 months in comparison with the common of $ 82,800 of 1-4 weeks. As well as, over the previous two months, the extent of requirements has been hesitant or decreased to replicate the aggressive buy of latest members.

Particularly, Kesmeci says that BTC should surge greater than $ 92,000 to verify the sturdy optimum driving power for the value reversal.

Bitcoin ETFS Off -Highway 1,725 BTC

In different information, ALI Martinez stated that Bitcoin ETF had withdrawn of 1,725 Bitcoin with $ 149.2 million final week. This improvement exhibits excessive ranges of destructive emotions amongst institutional buyers and provides market uncertainty to the BTC market.

In the meantime, Bitcoin is buying and selling at $ 85,249 final day with a worth fluctuation of 0.89%. Premier Cryptocurrency additionally displays 0.58% loss within the weekly chart and 1.06% in month-to-month charts.

Purposeful picture of Adobe Inventory, TradingView chart

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We help the strict sourcing normal and every web page is diligent within the prime expertise specialists and the seasoned editor's staff. This course of ensures the integrity, relevance and worth of the reader's content material.