Bitcoin Bull Market continues to stability with a variety of costs within the final three months. Regardless of the suitable value rebound in April, premiere cryptocurrency nonetheless lacks optimistic market elements and has not expressed its robust intention to renew bull rally. Nevertheless, encryption analyst AXEL Adler JR. emphasised promising improvement that exhibits the opportunity of a serious rise in Bitcoin.

Bitcoin lengthy -term holders are attempting to cease gross sales strain.

In a current put up about X, Adler Jr. has shared essential updates within the Bitcoin lengthy -term holder (LTH), which could be fairly optimistic for a wider BTC market.

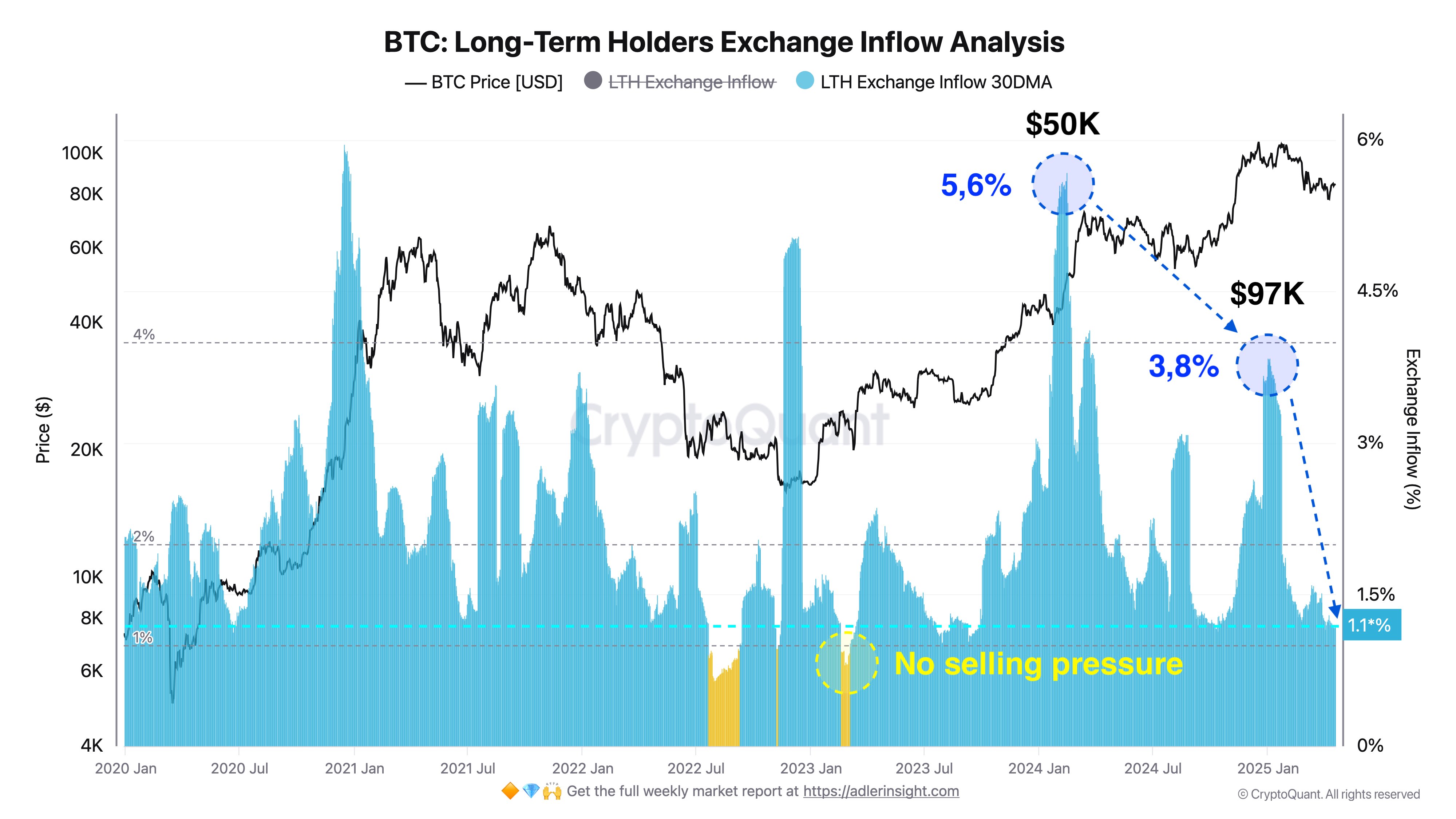

The well-known analyst reported that the low -end strain of lengthy -term holders, that’s, LTH holdings, recorded the bottom level at 1.1percentlast yr. This improvement signifies that Bitcoin LTH is now selecting to keep up belongings relatively than gaining revenue.

Adler explains that extra reductions to 1.0percentof those LTH Trade will sign the absence of the entire gross sales strain. Specifically, this improvement can create a powerful optimistic momentum within the BTC market by encouraging new market entry and steady accumulation.

Importantly, Alder emphasised that almost all of Bitcoin LTH has entered the market with a mean of $ 25,000. Since then, Cryptoquant recorded the very best gross sales strain of $ 50,000 in early 2024 and three.8percentfrom $ 97,000 in early 2025.

In line with ADLER, these two circumstances point out the primary earnings of lengthy -term holders to terminate the market. Subsequently, there might be little promoting strain from this cohort of BTC buyers. Lengthy -term holders are at present controlling 77.5percentof Bitcoin in circulation, supporting buildings.

BTC value define

On the time of writing, Bitcoin elevated 0.36% final day and traded at $ 85,226 final week with a lack of 0.02%. BTC solely displays steady market integration as a result of BTC continues to have problem in reaching persuasive value reimbursement past $ 86,000.

However, the efficiency of the asset in month-to-month chat is now mirrored within the revenue of 1.97%, and the market correction is suspended, displaying a possible pattern reversal. However, BTC wants a powerful market catalyst to ignite sustainable value rally. With the market cap of $ 1.67, Bitcoin is ranked as the biggest digital asset that controls 62.9percentof the encryption market.

The principle picture of Adobe Inventory, the chart of TradingView

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We help the strict sourcing normal and every web page is diligent within the high expertise specialists and the seasoned editor's group. This course of ensures the integrity, relevance and worth of the reader's content material.