Ethereum costs had been in a troublesome vary this week as bystander traders remained on the sidelines this week, and the outflow of funds buying and selling on the change rose.

Ethereum (ETH) was buying and selling at $1,580 on Friday. It rose 14% from this month's lowest level.

Ethereum continues to face growing competitors, notably with Layer 2 networks corresponding to Base and arbitrum (ARB). Different layer-1 networks, corresponding to SUI (SUI) and Solana (SOL), proceed to achieve market share in industries corresponding to decentralized finance and gaming.

Most significantly, Spot Ethereum ETF continues to circulate property this yr. These funds raised zero inflows on Thursday following a seven-day straight internet outflow.

You may prefer it too: Bitcoin costs are nonetheless bullish, with long-term charts exhibiting

They’ve now skilled spills for eight consecutive weeks, bringing cumulative internet spills to $2.24 billion.

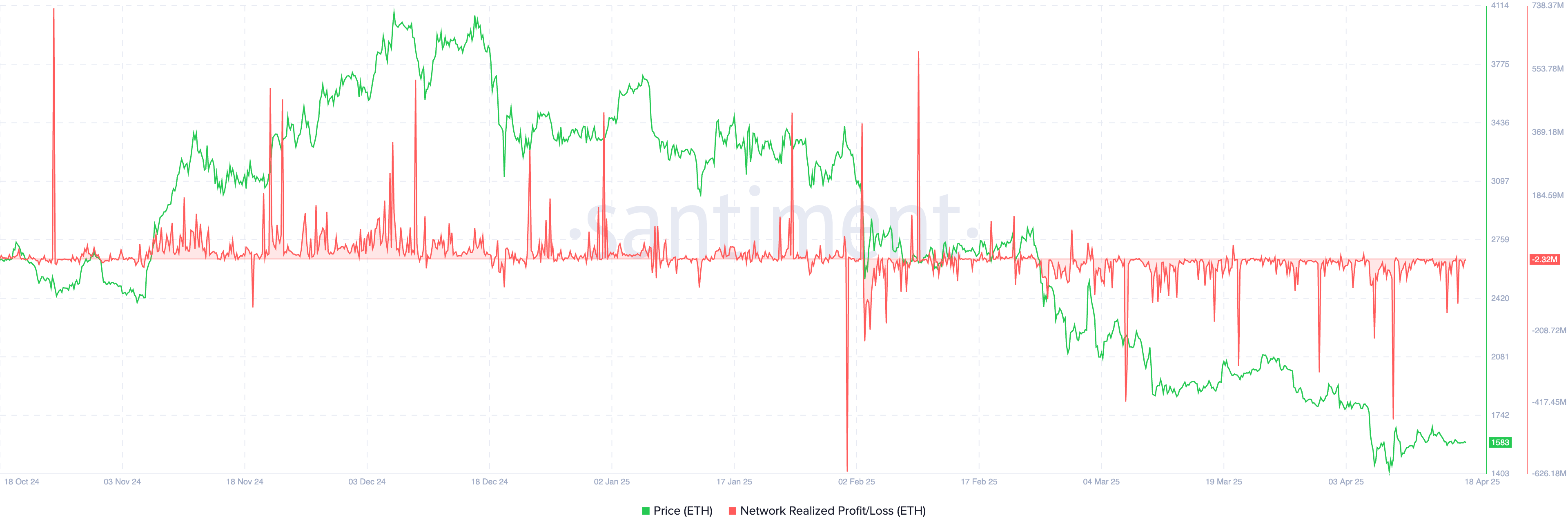

Additional knowledge reveals that some Ethereum traders are starting to give up by promoting at a lack of their holdings. The chart under reveals that the earnings/losses acknowledged by the community stay in purple for a while. This metric measures the online revenue or lack of all cash which have been moved on the blockchain.

ETH NRP knowledge | Supply: Santiment

Ethereum value expertise evaluation

ETH Worth Chart | Supply: crypto.information

The day by day chart reveals that Ethereum stays in a robust bearish downtrend after peaking at $4,100 final yr. We proceed to commerce key help ranges under $2,140 for each the 50-day and 200-day exponential transferring averages. This help is price noting as a result of it was a triple-top sample neckline on the weekly chart.

On the optimistic aspect, Ethereum shaped a bullish divergence sample as the 2 strains of the MACD continued to rise. Moreover, the relative energy index is barely above the downtrend line.

The coin additionally shaped an enormous falling wedge sample containing two descending and converging development strains. As these strains method convergence, there’s a chance of a robust bullish breakout within the quick time period. If this occurs, the following degree to look at is $2,140, the bottom swing in August and September final yr. This goal is about 35% above the present degree.

You may prefer it too: Solana costs are steady and prices leap on prime of the principle help as lively addresses