Import taxes attain 46% and miners are dealing with tightness in each prices and financing as capital flows via ETFs into low-risk Bitcoin publicity.

Based on a brand new Bitwise report, US Bitcoin (BTC) miners face two main challenges directly.

Within the report, Bitwise's analysis director André Dragosch and analysis analyst Ayush Tripathi observe that with an estimated 40% of the worldwide hash fee run by American mining corporations, the business is “dealing with a 24-46% tax on imported mining in Vietnam, Thailand and Malaysia.” These tariffs come when the miners' primary profitability metric, hashprice, is at a “historical past low,” reads the report.

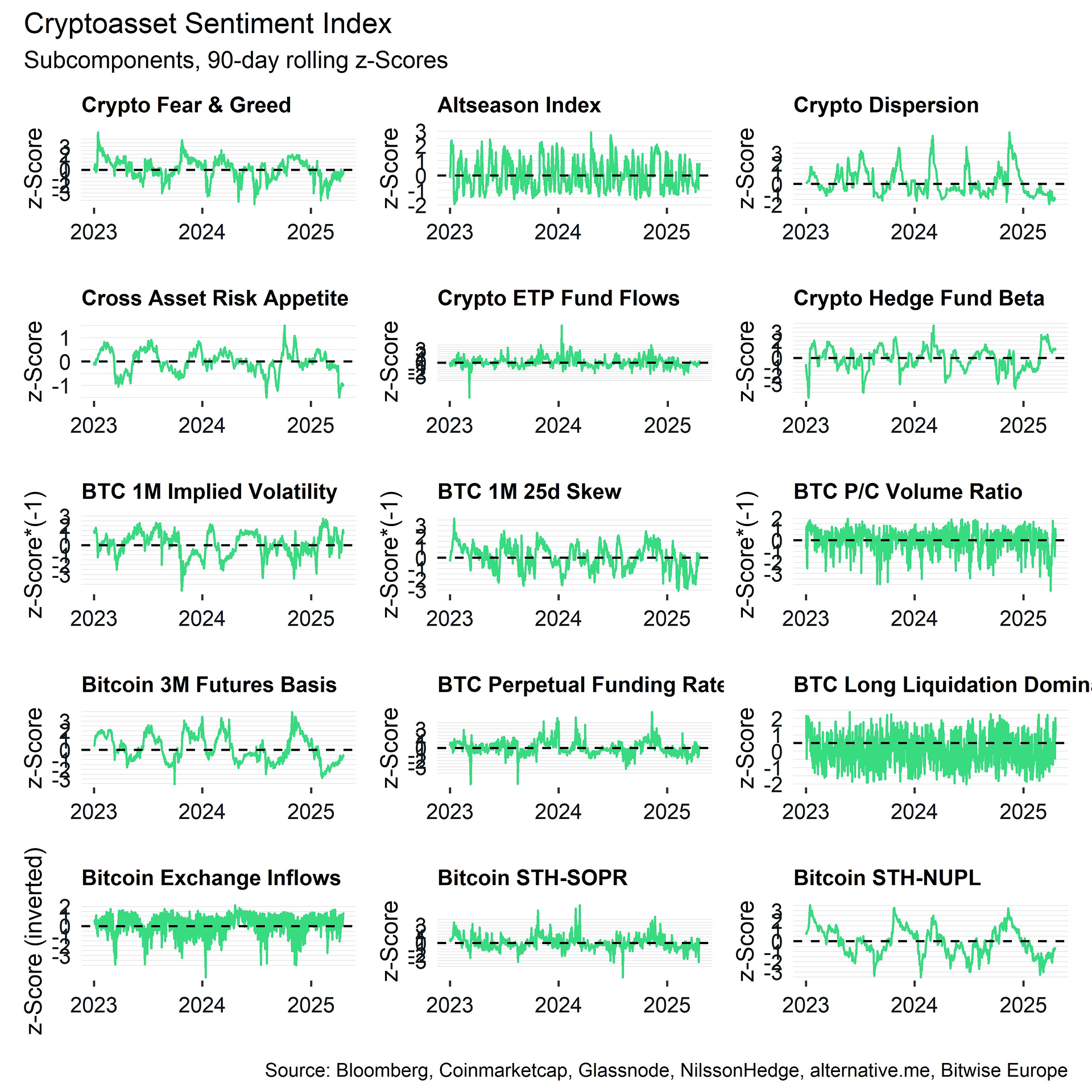

Crypto's Emotion Index | Supply: Bitwise

You would possibly prefer it too: Bitcoin hashrate hits hit excessive amid miners' gross sales

Investor curiosity can be shifting away from miners. Based on analysts, the Ministry of Company Treasury, together with the demand for Spot Crypto Alternate-Tradeds Funds, Technique and Metaplanet Assocling Investor, “at present we face fierce competitors within the capital,” Bitcoin Miner stated.

“These corporations can accumulate BTC utilizing low-cost inventory issuance or convertible obligations, offering traders with fast publicity to cost will increase with out dangers in mining operations, which requires them to fund heavy upfront capital expenditures, navigate unsure regulatory topography, and look ahead to investments to attend months or years.

Bitwise

Nonetheless, some corporations are adapting to new phrases. For instance, Bitmain-backed Crypto Miner Bitfufu is contemplating a redirect machine to Ethiopia, whereas Bitdeer prioritizes Norway and Bhutan.

Two US registered miners, Riot and Cleanspark, absorbed the results of early tariffs by accelerating shipments earlier than shipments. But regardless of these efforts, the outlook stays troublesome as miners clearly “have extra ache.”

learn extra: Bitcoin Minor Hive Digital inventory jumps 2% when finishing a 100 MW web site in Paraguay