Ethereum suffers from very low market exercise, and its costs present minimal volatility.

This stagnant behaviour will increase the probability that sellers will push cryptocurrency beneath its key assist stage of $1.5,000 over the following few weeks.

By Shayan

Every day Charts

Ethereum continues to surpass the long-standing psychological and structural stage of vital $1.5K assist areas which were held since January 2023. Nevertheless, the market is at the moment displaying very low exercise, with costs consolidating in a relaxed, lateral path. This volatility and lack of momentum suggests a state of uncertainty by which neither consumers nor sellers exhibit benefits.

These circumstances typically precede vital strikes because the market builds vitality ready for brand spanking new provide or demand. From a technical standpoint, bearish sentiment dominates present value motion. If up to date gross sales stress happens, a crucial break beneath the $1.5,000 mark might set off the cascade in direction of the $1.1K stage.

Nonetheless, a short-term corrective retracement right into a $1.8,000 resistance zone stays doable earlier than the vendor acquires one other try and violate the $1.5,000 assist. The upcoming days are essential as value motion at this stage are prone to decide the path of Ethereum's subsequent main development.

4-hour chart

The rigorous integration of Ethereum is clearly seen within the four-hour time-frame. Presently, the value is locked at $1.6k between $1.5,000 assist and the higher boundary of descending channels, reflecting the equilibrium market. This stability suggests hesitation from each consumers and sellers.

Breakouts from this slim vary are essential. If Ethereum violates the $1.6K restrict, a short-term rebound to $1.8k could possibly be achieved.

Conversely, breakdowns beneath the $1.5,000 stage are prone to trigger a big downward motion, doubtlessly driving costs to the mid-term $1.1,000.

By Shayan

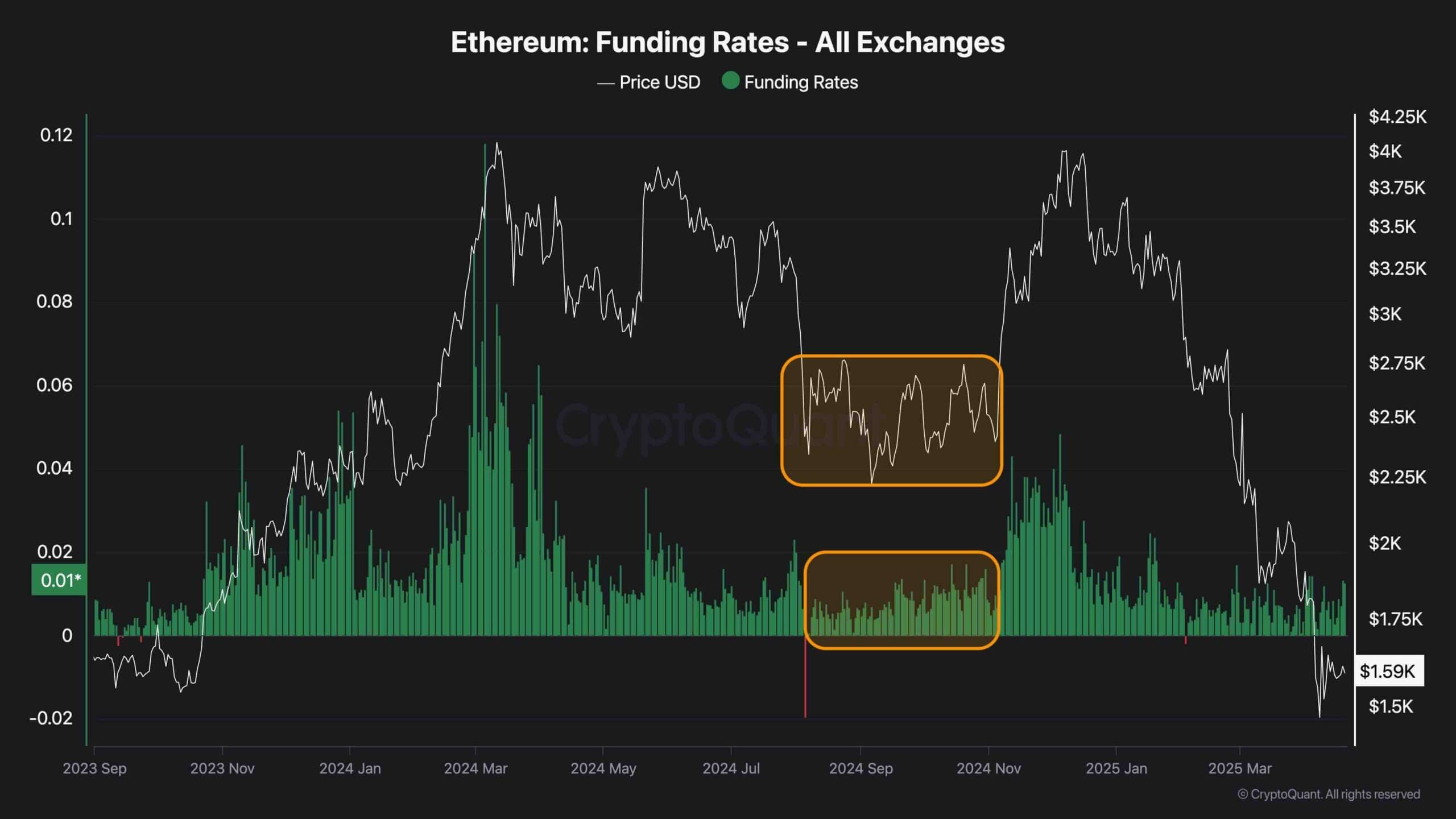

Funding fee indicators function vital indicators of sentiment within the futures market. Analyzing current behaviors gives vital perception into the potential for Ethereum's subsequent transfer. Particularly, each costs and funding charges mirror patterns noticed through the September-November 2024 interval. It is a stage characterised by long-term integration and deep revisions that finally precede a powerful bullish gathering.

This market scenario typically displays a sensible cash accumulation, as knowledgeable buyers make the most of panic-driven gross sales and widespread distribution amongst retail contributors. Presently, funding charges have fallen to close zero and are consolidated, suggesting that the market might as soon as once more enter the buildup section.

Nevertheless, it is very important word that additional drawbacks are nonetheless doable at such phases. Costs can drop earlier than significant rebounds happen, offering an much more enticing stage for accumulation by long-term buyers.