Bitcoin (BTC) surpassed the $90,000 mark for the primary time since March fifth. The newest surge continued with a pointy rise in ADX, the formation of bullish aspect clouds, and an increase in favor of EMA alignment.

Market sentiment is in favor of bulls as they hit extra strain than gross sales actions and ETF inflows at three months. If resistance is violated, BTC can pave the way in which for $100,000, reinforcing its position as a hedge amid wider market uncertainty.

Bitcoin Bulls regain management because it indicators ADX to reinforce the uptrend

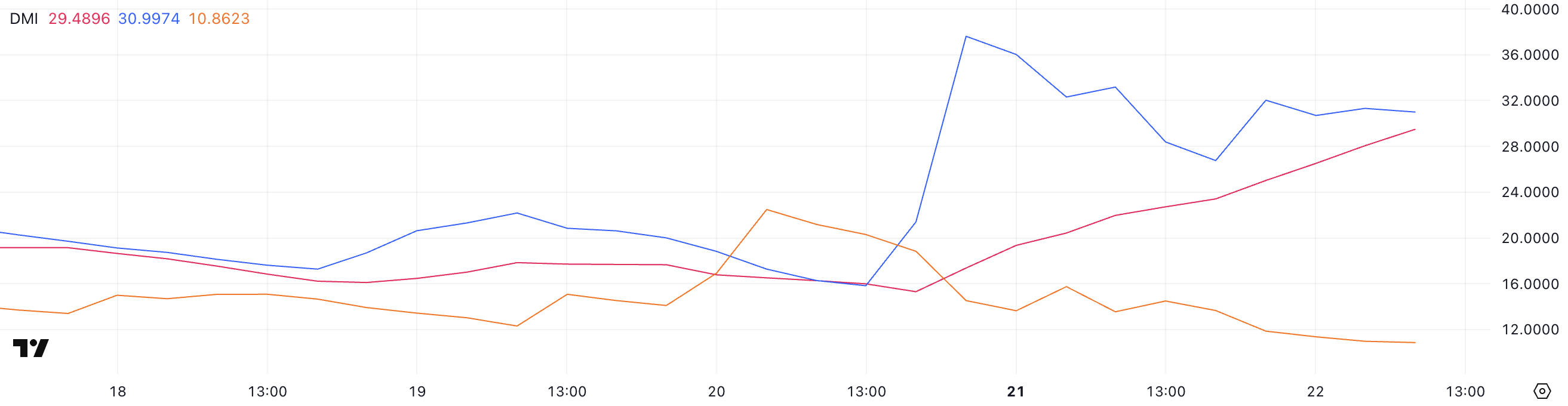

Bitcoin's Directional Movement Index (DMI) exhibits a big change in momentum, with ADX rising from simply 15.3 from 29.3.

ADX or imply directional index measures the depth of a pattern whatever the course. Measurements beneath 20 point out weak or horizontal markets, whereas values above 25 point out sturdy tendencies.

With the ADX approaching 30, the present motion has gained traction and we’re seeing a extra clear directional pattern in place.

BTC DMI. Supply: TradingView.

Wanting deeper into the DMI element, the +DI (optimistic directional indicator) is presently 30.99, barely decrease than the 37.61 peak yesterday, however virtually doubled from 15.82 two days in the past.

This means that it has eased barely over the previous 24 hours throughout the current surge in strain. In the meantime, the -DI (detrimental directional indicator) immediately fell from 22.48 to 10.86, indicating a transparent weakening of gross sales strain.

The mix of highly effective ADX and excessive +DI vs reduction-DI signifies that Bull is presently in management. If the pattern is established, Bitcoin can proceed its upward trajectory within the quick time period.

Bitcoin tendencies are enhanced with clear bullish momentum indicators

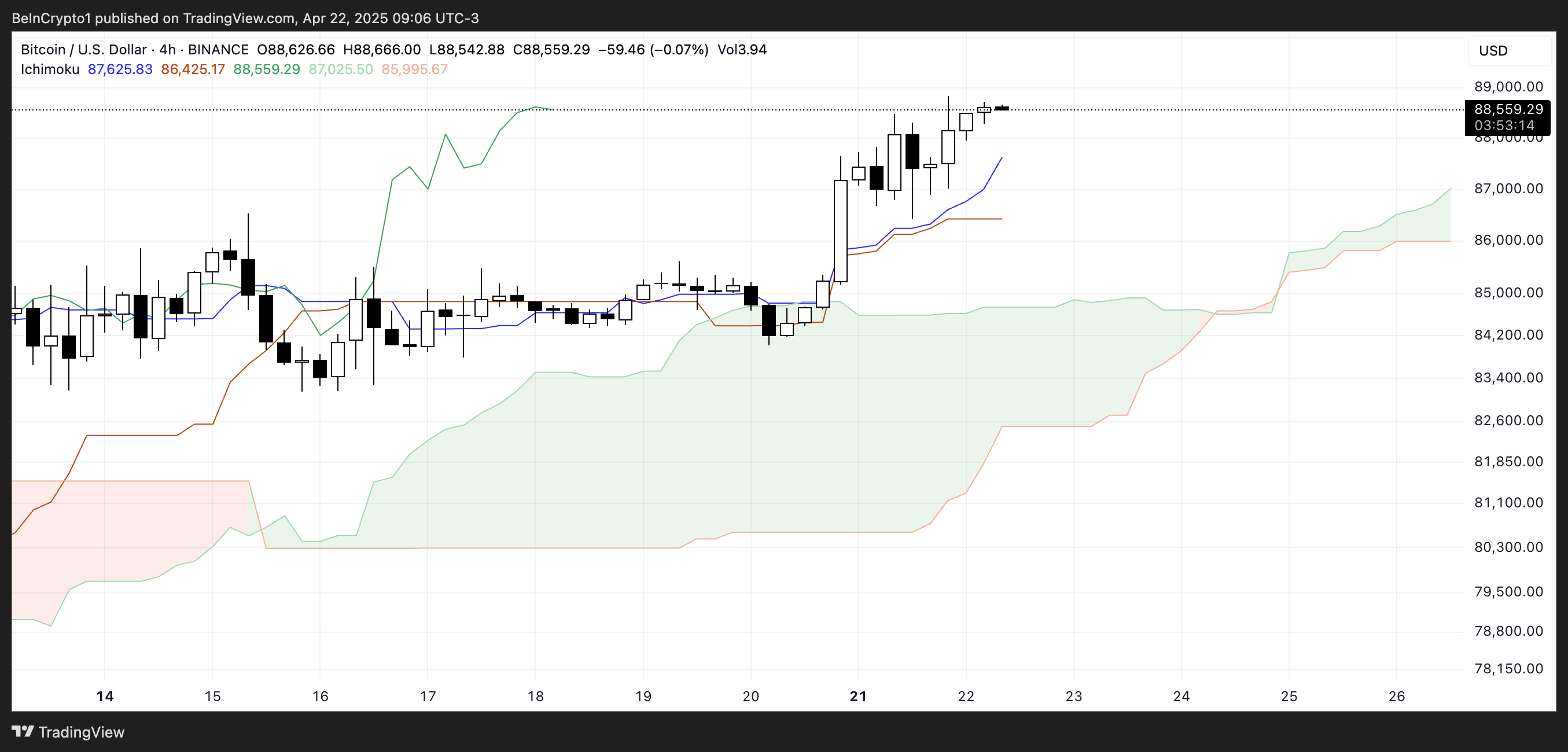

Bitcoin's Ichimoku Cloud Chart exhibits a transparent bullish sign. Worth motion is way outweighing the spider (cloud), exhibiting sturdy upward momentum.

The cloud itself turns from purple to inexperienced, indicating a transition from bearish to bullish feelings.

The Tenkan-Sen (blue line) stays above the Kijun-Sen (Crimson Line) and enhances the short-term bullish bias. The hole between them continues to widen and is an indication of accelerating momentum.

btc icchimoku cloud. Supply: TradingView.

Moreover, Future Cloud (Senkou Span a and b) corners upwards. This means that bullish tendencies might persist if present circumstances are true.

The Chikou span (inexperienced lag line) is positioned above value candles and clouds to verify pattern integrity by way of delay.

Collectively, these components discuss with wholesome uptrends, however there aren’t any instant indicators of reversal until a robust breakdown seems below the Tenkan-Sen or the cloud.

As bullish momentum builds, there shall be a brand new breakout in Bitcoin's eyes

Bitcoin's EMA line is bullish, with the short-term common positioned above the long-term ones exhibiting sturdy upward momentum.

Bitcoin's value is approaching a big stage of resistance at $92,920. Escape above this zone and you may open the door for much more income.

If strain will get stronger you might attain a possible objective of $96,484as Bitcoin ETF has registered its largest internet influx in three months.

The present construction means that the Bulls are in management so long as the extent of help is revered and upward momentum stays sustained.

In response to Tracy Jin, COO of Crypto Change MEXC, Bitcoin's current efficiency has revived its label as “Digital Gold.”

“Bitcoin's current power within the face of market-wide volatility is reviving its long-term place as 'digital gold'. As US shares return to their tariff-era lows and the greenback plunges into the three-year Nadir, the flexibility to publish Bitcoin income is reshaping buyers' perceptions. ” Jin informed beincrypto.

BTC value evaluation. Supply: TradingView.

Nevertheless, if the pattern loses power and a reversal happens, Bitcoin might face a short-term pullback in the direction of help at $88,800.

Rests beneath this stage weaken the construction and improve the possibilities of deeper correction. The subsequent necessary areas are $86,532 and $83,133.