In line with Crypto Rover, funding firm BlackRock has bought $54 million price of Ethereum (ETH). The transaction serves as a significant institutional approval from the world's largest asset managers, creating short-term market modifications and strengthening ETH's enchantment to institutional buyers.

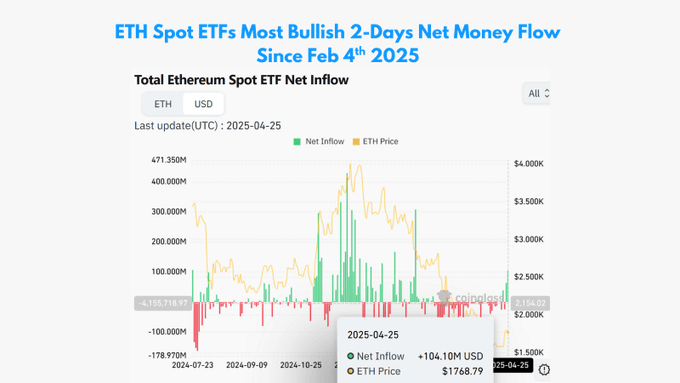

The surge in spots in Ethereum ETF inflow coincides with altering US regulatory reforms. Analysts see this shift as an indication of optimism. Spot Ethereum ETF inflows proceed to extend, with buying and selling volumes rising sharply consistent with the constructive week of ETF inflows that haven’t been seen since February. Market individuals are monitoring Ethereum's capability to keep up a important assist space of $1,800 and set up a large market restoration.

Ethereum buying and selling exercise and market indicators shall be strengthened

Ethereum (ETH) traded at $1,807.19 at press, indicating day by day market progress of 1.38%. The asset's market capitalization reaches $21.816 billion, with 24-hour buying and selling quantity reaching $17.08 billion, with a excessive progress fee of 29.95%. This surge in exercise usually signifies a surge in ahead volatility, warnings for bulls and bears.

Associated: Ethereum Whale borrows 4,000 ETH at Aave to begin a brand new brief place

Ethereum's short-term outlook depends on its capability to carry greater than $1,800. If this assist is achieved, additional testing shall be doable for $1,830, and maybe $1,850. However, if there’s a important break beneath $1,790, ETH could possibly be uncovered to additional draw back danger to $1,760 or $1,720.

The strategic timing of Blackrock amid political change

The BlackRock acquisition exhibits rising curiosity from institutional buyers in buying Ethereum-based funding merchandise. SOSOValue knowledge exhibits the primary constructive pattern since February, Spot Ethereum ETFS, which recorded a web influx of $157.1 million the earlier week, hitting $104.1 million on Friday.

sauce: Coinglass

BlackRock's ETHA merchandise recorded an inflow of $54.43 million, surpassing Feth's efficiency from Constancy and Grayscale's Ethe's efficiency. And extra about President Trump's mushy rhetoric on Chinese language tariffs and the appointment of crypto-friendly determine Paul Atkins, because the SEC chairman has considerably improved sentiment amongst institutional buyers.

Associated: The Ethereum Whale stacks 449k eth in at some point, however holds a $1,895 resistance firmly

The brand new SEC chair Atkins has adopted a supportive strategy to digital property and plans to develop “rational and focused” regulatory tips. The political shift in direction of encryption-friendly rules creates excessive expectations for the SEC's SPOTETF approval and its staking capabilities.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version just isn’t responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.