The well-known Ethereum whales are betting on their latest ETH worth restoration. On-chain analyst @ai_9684xtpa reported through X that the whale borrowed 4,000 ETH (value round $7.25 million) from the credit score lending platform Aave. Analysts identified that the whales borrowed this ETH particularly to open up new brief positions, giving them a cautious or bearish outlook.

“The $ETH band has made a revenue of USD 1.029 million since 04.13” can be very sturdy. I'm not going to get near ETH once more! Are you able to get the whole lot that belongs to him this time?

After borrowing 04.22-04.25 cash to a brief ETH, he misplaced $382,000 11 hours in the past, and he once more lended 4,000 ETH from Aave, shortened it to $1,808.62, value $7.25 million

Pockets tackle https://t.co/copoovctzc

This text is by #gateio |…https://t.co/5u3cpk5fja pic.twitter.com/hyalcixu1l

— Ai U (@ai_9684xtpa) April 26, 2025

Whale rocky latest offers: losses following revenue

This isn’t the primary main transfer for whales lately. They’ve been actively swinging buying and selling ETH since mid-April. Earlier transactions reportedly resulted in additional than $1 million in income. Nevertheless, their luck appeared to have modified between April twenty second and twenty fifth.

In the meantime, the whales shorted the ETH, however had been kicked out when costs rose and compelled to purchase again larger. This has resulted in a complete lack of round $382,000 in latest shorts. Now regardless of these losses, they're making one other massive brief guess

Information present that the common brief worth for the whales was $1,731 and its closing worth reached $1,778.70, culminating with a realised lack of $14.23 million from the earlier 8,000 ETH place.

Associated: What does the Ethereum whales know that we don't try this?

How did ETH costs reply to this time?

Regardless of these actions, Ethereum traded larger throughout the newest periods, buying and selling for round $1,806 after registering a achieve of 1.85% every day. CoinMarketCap information elevated the market capitalization enhance of Ethereum to $21.805 billion, with each day buying and selling quantity rising by 5.05% to $15.8 billion. The community's circulating provide remained steady at ETH of 172 million, in keeping with the whole provide figures.

Supply: CoinMarketCap

The market-to-market cap ratio of 6.95% was referring to energetic buying and selling phrases. Through the session, ETH immersed $1,773 earlier than buying stress pushed the value as much as practically $1,820, indicating a unstable however strengthened market surroundings.

Which trade circulate tells you about ETH provide

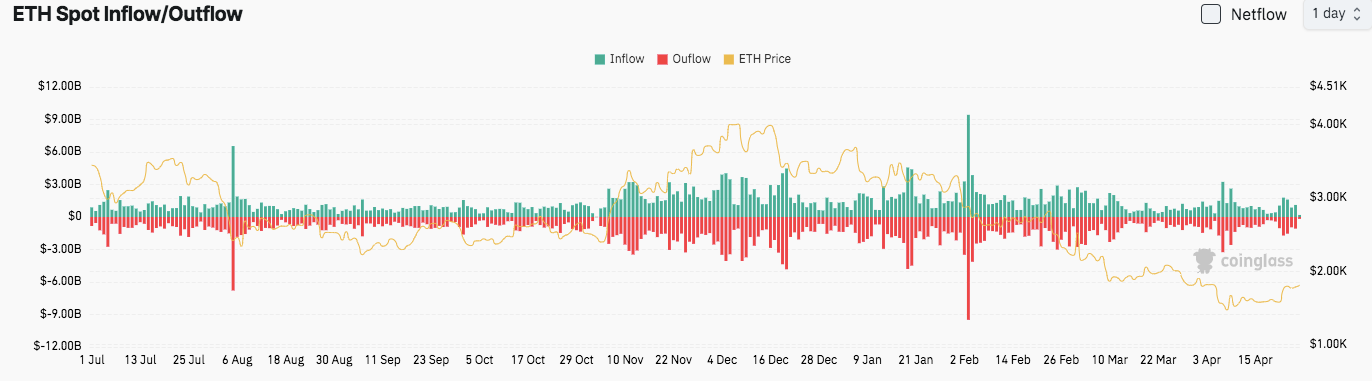

Wanting on the wider on-chain information offers extra context. Current Coinglass figures present that Ethereum that has flowed into the trade has been virtually balanced just lately. This isn’t the case in late 2023/early 2024, when extra ETHs had been persistently leaving the trade (usually thought-about bullish and implies a low provide accessible on the market).

Supply: Coinglass

Presently, flows are balanced close to the $1,800 worth degree, which raises doubts about whether or not gross sales stress from exchanges will rise once more if costs attempt to rise a lot.

Associated: Whales purchase $588,000 value of Ethereum amid market panic: an ideal alternative?

Are extra customers concerned in Ethereum Community?

In the meantime, it seems that consumer exercise on Ethereum is choosing up. The encrypted information confirmed the revival of the energetic tackle in Ethereum.

After a interval of fluctuating exercise between mid-2022 and early 2024, the variety of energetic addresses will once more climb. Nevertheless, historic information confirmed that the surge in consumer engagement stays unchanged to a sustained worth rise, leaving the affect of this pattern uncertainly.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version just isn’t responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.