BlackRock, the world's largest asset supervisor, made an excellent greater transfer by buying $240 million value of Bitcoin. This strategic acquisition marks a powerful restoration with BTC costs bounced from 85.3K to present stage of 94.3K. Many merchants and analysts imagine they’re gaining momentum Bitcoin worth forecast If the pattern continues, $10,000,000, might quickly develop into a actuality.

BlackRock doubles with Bitcoin

In one of the vital spectacular Bitcoin information this week, BlackRock confirmed its $240 million new Bitcoin purchases. The transfer strengthens our long-term conviction in BTC as a key asset in our diversified portfolio, notably after the profitable launch of the Bitcoin ETF earlier this yr.

Institutional confidence led by BlackRock and different monetary giants continues to function a strong spine for Bitcoin's ongoing rally. Every main buy signifies to the broader market that belongings are now not fringed investments, however mainstream monetary devices.

BTC costs might be rebound strongly

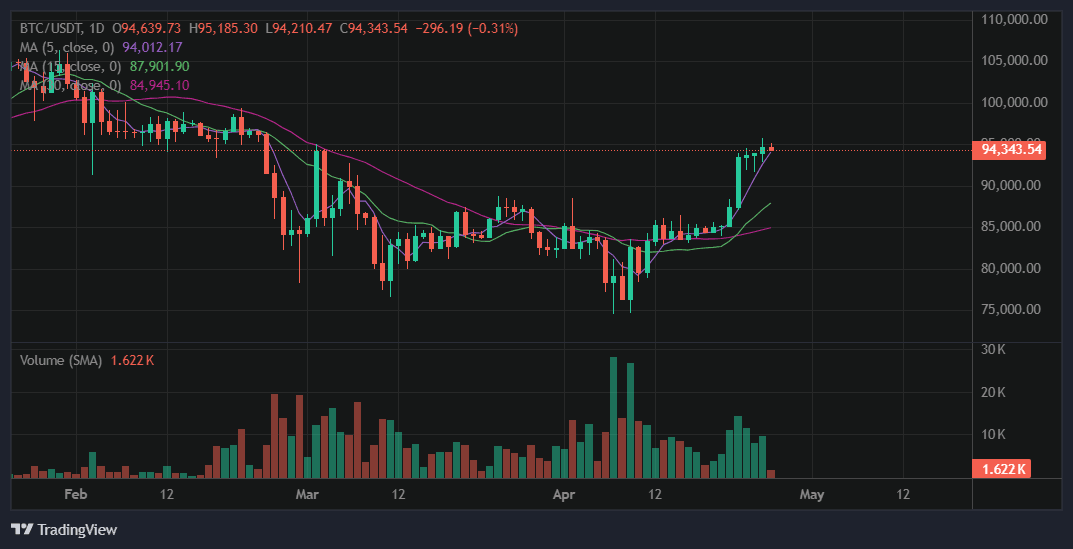

After immersing in $85.3k throughout a interval of market uncertainty, Bitcoin confirmed responsive resilience. The worth of the BTC returned to 94.3k inside days, spurring each the establishment's purchases and up to date retail income.

The present trajectory means that bullish momentum will not be solely intact, but additionally strengthened. Historic traits present that new all-time highs usually comply with when Bitcoin rebounds from main dips with robust quantity and institutional help.

BTC/USDT 1 day chart, TradingView Above BitGet

Is $100,000 Bitcoin proper there?

Given the present setup, the $100,000 Bitcoin worth prediction is now not a distant dream. Momentum metrics and pattern patterns recommend that BTC might shortly break previous the six-man determine, particularly if shopping for strain continues on the present tempo.

A number of elements might speed up the transfer to $10,000:

- Institutional accumulation: Steady purchases by giants like BlackRock add a gradual demand.

- ETF Circulation: Bitcoin ETFs are seeing an rising inflow and are providing further help.

- Optimistic feelings: Market sentiment stays bullish and merchants are hoping for a breakout.

- Macro Circumstances: Inflation considerations and international uncertainty proceed to direct buyers in the direction of Bitcoin as a hedge.

If BTC costs stay on an upward trajectory, the psychological $100k barrier might act not as a resistance however as a magnet that raises the worth.

Bitcoin Worth Prediction: Bitcoin Subsequent Transfer

As BlackRock provides one other $240 million value of Bitcoin to its holdings, confidence in BTC's long-term worth proposition continues to be strengthened. The present rebound is 85.3K to 94.3K$94.3K, highlighting the market's resilience and setting the stage for the anticipated push to $10,000.

Quick-term volatility is at all times attainable, however the broader pattern stays bullish. For now, the trail to bitcoin to 6 numbers will not be solely attainable, however it’s inevitable if momentum applies.