The primary quarter outcomes for Bitcoin (BTC) miners may very well be upset as day by day mining profitability measures have additional declined and commerce tariffs have heaviered markets, asset supervisor Coinshares (CS) mentioned in a weblog submit Friday.

“The Q2 outcomes may point out degradation as tariffs on imported mine rigs vary from 24% (Malaysia) to 54% (China),” wrote an analyst led by James Butterfill.

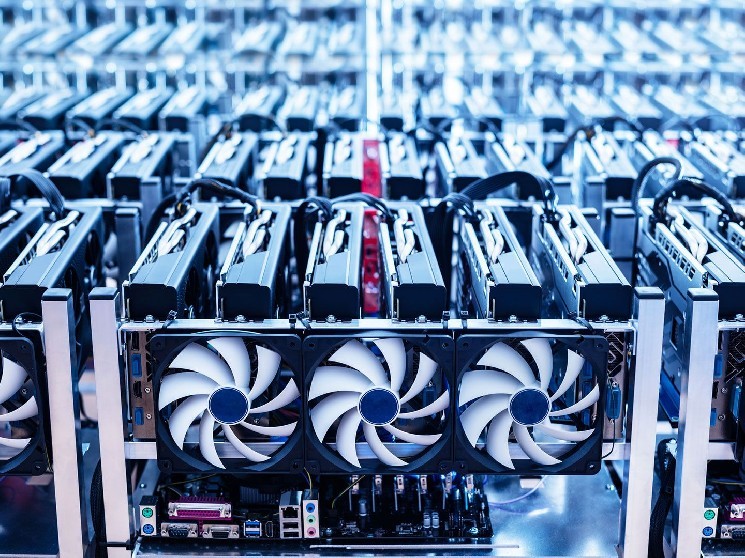

Bitcoin miners counting on older or much less environment friendly rigs face greater publicity to those tariffs, in line with the report.

The writer wrote that Core Scientific (CORZ) “is extra insulating because it strikes to HPC,” including that Bitdeer (BTDR), which makes its personal rig, may put margin stress on gross sales exterior the US.

The asset supervisor predicts that the Bitcoin community hash fee will attain 1 Zettahash per second (Zh/s) by July and a couple of Zh/s by early 2027.

The outlook for Hashpris isn’t significantly constructive.

The asset supervisor mannequin exhibits that “a gradual construction discount, with costs prone to stay within the $35-$50 per day vary till the 2028 Harving Cycle.”

Asset Supervisor Grayscale mentioned in a analysis report earlier this month that tariffs and commerce tensions may very well be constructive about Bitcoin adoption within the medium time period.

learn extra: Bitcoin miners with HPC publicity have low efficiency within the first two weeks of April: JPMorgan