The Federal Reserve referred to as for dangerous investments in shares and actual property on Friday, dropping the warning a day after loosening the grip on the crypto guidelines.

The Fed's monetary stability report stated asset costs stay “outstanding” regardless of some markets hit earlier this month.

“Even after the current decline in inventory costs, costs stay increased than analysts' earnings forecasts, and are adjusting slowly than market costs,” the report additionally revealed that Treasury yields keep over all maturities, near the best stage anybody has seen since 2008.

The Federal Reserve additionally identified that it might use the market as a significant challenge, saying the dangers of funding nonetheless look like critical. The report overlaying the market state of affairs by way of April eleventh stated the funding market remained robust by way of a tough patch in early April, however that didn't imply that all the pieces went nicely.

The central financial institution famous that the losses within the truthful worth of fixed-rate property remained “substantial” for some banks, and that these losses are extremely delicate to modifications in rates of interest.

The Federal Reserve leverages asset costs, liabilities and troubles

The Monetary Stability Report solved how unhealthy issues might be seen in 4 bigger areas. Beginning with an asset valuation, he stated the Federal Reserve stays costly in comparison with revenues after the sale in April.

The Treasury yields remained stubbornly excessive, and spreading between company bonds and funds remained reasonable. It had accrued by the tip of March and worsened in April, however the buying and selling was nonetheless working.

On the actual property aspect, house costs remained excessive, and family worth ratios hovered close to file peaks. The business actual property index, tailor-made to inflation, confirmed some indications of leveling, however the Fed warned that the necessity for refinance might rapidly trigger issues.

The debt didn't look that good. Enterprise and family debt as a share of GDP fell to its lowest level in 20 years. Nevertheless, enterprise leverage stays excessive and personal margin buying and selling continues to rise.

Supply: Federal Reserve System

Family debt was tamed in comparison with current historical past. Most mortgages have fastened rates of interest, low revenue margins, and total debt service ratios are a bit of higher than earlier than the pandemic. Nonetheless, the Fed has flagged a rise in bank card and automotive mortgage delinquency, particularly for individuals with non-prime credit score scores and low incomes.

In terms of leverage, the Federal Reserve stated banks nonetheless look wholesome and capital ranges are above the regulatory minimal. Nevertheless, losses on fixed-rate property continued to assault some banks strongly. Some banks, insurance coverage corporations and securitization shops additionally continued to pile up on business actual property.

The Fed stated financial institution lending to banks to monetary corporations continues to climb thanks to raised monitoring strategies. Hedge fund leverage is nearing the best stage of the previous decade, with largely extra funded. Some leveraged buyers have begun dumping positions to cowl margin calls throughout volatility in April.

The Federal Reserve is flagging on financing threat and ongoing market vulnerabilities

The Federal Reserve stated the danger of funding has slipped to reasonable ranges over the previous yr however has not disappeared. Liabilities like operational cash stay close to historic median and nonetheless pose long-term threats. Banks have lowered their reliance on uninsured deposits for the reason that 2022 and 2023 highs.

Prime Cash Market Funds appeared good, however different money automobiles with the identical threat proceed to develop. Bonds and mortgage funds noticed a bigger than traditional outflow throughout market stress in early April, holding property that might change illiquidity beneath strain.

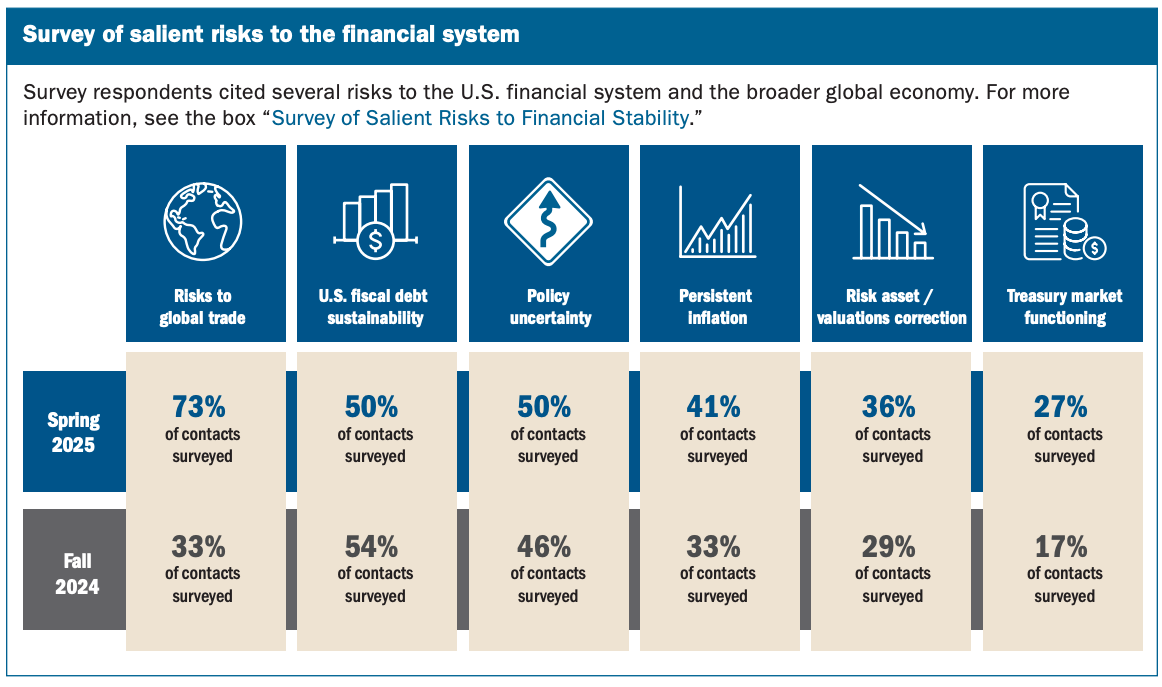

The Monetary Stability Report additionally states that world commerce dangers, debt issues and inflation are exacerbated. “Many respondents cited sustained inflation and correction within the asset market as a big threat,” including that almost all suggestions was collected previous to April 2nd.

Only a day earlier than it blasted shares and actual property, the Federal Reserve repeated years of crypto restrictions. I eliminated the earlier guidelines that instructed the financial institution to get pre-approval earlier than doing something with crypto. In an announcement Thursday, the Federal Reserve stated, “These actions will be certain that board expectations are alongside evolving dangers, additional supporting innovation within the banking system.”