Base, a layer-to-blockchain developed by Coinbase, has seen an enormous surge in complete worth locked (TVL) over the previous 24 hours following necessary integration.

Amidst the altering US regulatory winds, President Trump's pro-cryptic angle stimulates daring actions amongst gamers within the sector.

Base TVL will rise by 20% as Binance.us provides assist

Base TVL has elevated by $557 million, in keeping with information from Defillama. It has moved from $2.77 billion on Thursday to $3.335 billion on the time of writing, a 20% surge within the final 24 hours.

Base TVL. Supply: Defilama

The surge in TVL suggests a rise within the quantity of property which have been stained, locked or deposited on the bottom blockchain. The next TVL signifies a rise in person exercise, belief, and adoption, and customers commit capital to the protocol.

In the meantime, the surge follows a notable announcement from Binance.us, the American Arm of Binance Alternate, the world's largest crypto buying and selling platform by Quantity Metric.

In accordance with the announcement, Binance.us now helps Base. Allows USDC (USD Coin) Stablecoin transfers for Ethereum (ETH) and Circle on Layer-2 networks.

“We stay up for announce that Binance.us helps the bottom! Beginning immediately, we will deposit and withdraw Ethereum (ETH) and USDC by way of the bottom,” learn an excerpt from the announcement.

The trade emphasised that extra property are collaborating in Binance.us on the bottom community and displaying curiosity in growing integrations. In the meantime, utilizing Base's blockchain, customers can instantly deposit ETH and USDC with Binance.us and withdraw.

Within the case of exchanges, this integration could improve accessibility. Particularly, Binance.US customers can work together with the Base ecosystem with out filling their property via Ethereum's mainnet. That is amongst issues that Ethereum's mainnet will likely be sluggish and expensive.

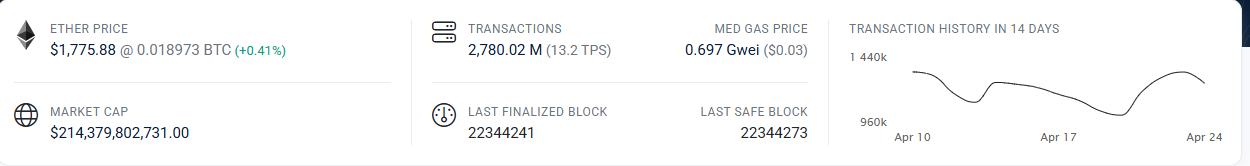

As an L2 scaling resolution, the bottom gives quicker Low-cost transactions in comparison with Ethereum's mainnet. Etherscan information reveals that Ethereum's transaction throughput is roughly 13.2 TPS. This may result in community congestion and excessive fuel costs throughout peak durations.

Ethereum TP. Supply: Etherscan

In the meantime, base course of transactions are chained off and bundled them earlier than submitting to Ethereum. This technique gives excessive throughput, considerably decrease charges and is cost-effective for customers.

Subsequently, the combination permits Binance.us customers to maneuver ETH and USDC and are based mostly on Defi exercise at some price.

In the meantime, the event comes just some months after Binance.US resumed USD deposits and withdrawals by way of financial institution switch after a two-year hiatus.

Binance.US suspended USD deposits and withdrawal companies in 2023 following the well-known SEC lawsuit and rising regulatory strain. However as political rhetoric has shifted to cryptography, the trade seems to be taking daring steps.

“Now that we've survived, our aim is to assist codes thrive and empower all Individuals with freedom of selection,” mentioned Norman Reed, interim CEO of Binance.us.

That coincides with latest developments from the Kraken Alternate. As reported by Beincrypto, the US-based trade lists BNB in a transfer marking the strategic change in US crypto exchanges, probably signaling the adoption of broader tokens inside the nation.