Following a notable surge, Ethereum started to lose momentum because it approached a crucial zone of resistance of round $1.8,000. Nonetheless, the emergence of bearish divergence suggests potential short-term corrective integration earlier than the following bullish continuation.

Technical Evaluation

Every day Charts

Following a current vital value rise, launched by sturdy buy stress at a crucial $1.5,000 assist degree, ETH has reached a crucial zone of resistance of almost $1.8,000. This upward displacement creates a good worth hole, emphasizing the presence of sensible cash on the client aspect. Nevertheless, the $1.8k area is in line with earlier order blocks, that are more likely to be filled with provide, making it a formidable barrier.

In consequence, Ethereum is anticipated to enter a short lived integration part, with minor modifications more likely to comply with earlier than the following main transfer. If the client violates this resistance, the following goal will likely be a crucial degree of $2.2,000.

4-hour chart

Within the decrease timeframe, the shift in ETH bull market construction was confirmed after a breakout that surpassed the descending channel for a number of months, leading to a powerful surge in the direction of the 1.8K resistance zone. This degree coincides with earlier necessary swinglows and reinforces their significance. Nevertheless, momentum stopped when this crucial threshold was reached, and costs entered a low risky integration part.

On the similar time, a bearish divergence between costs and RSI indicators seems, suggesting the potential of short-term corrective actions. In consequence, an expanded integration or minor pullback is anticipated previous to bullish breakout makes an attempt.

On-Chain Evaluation

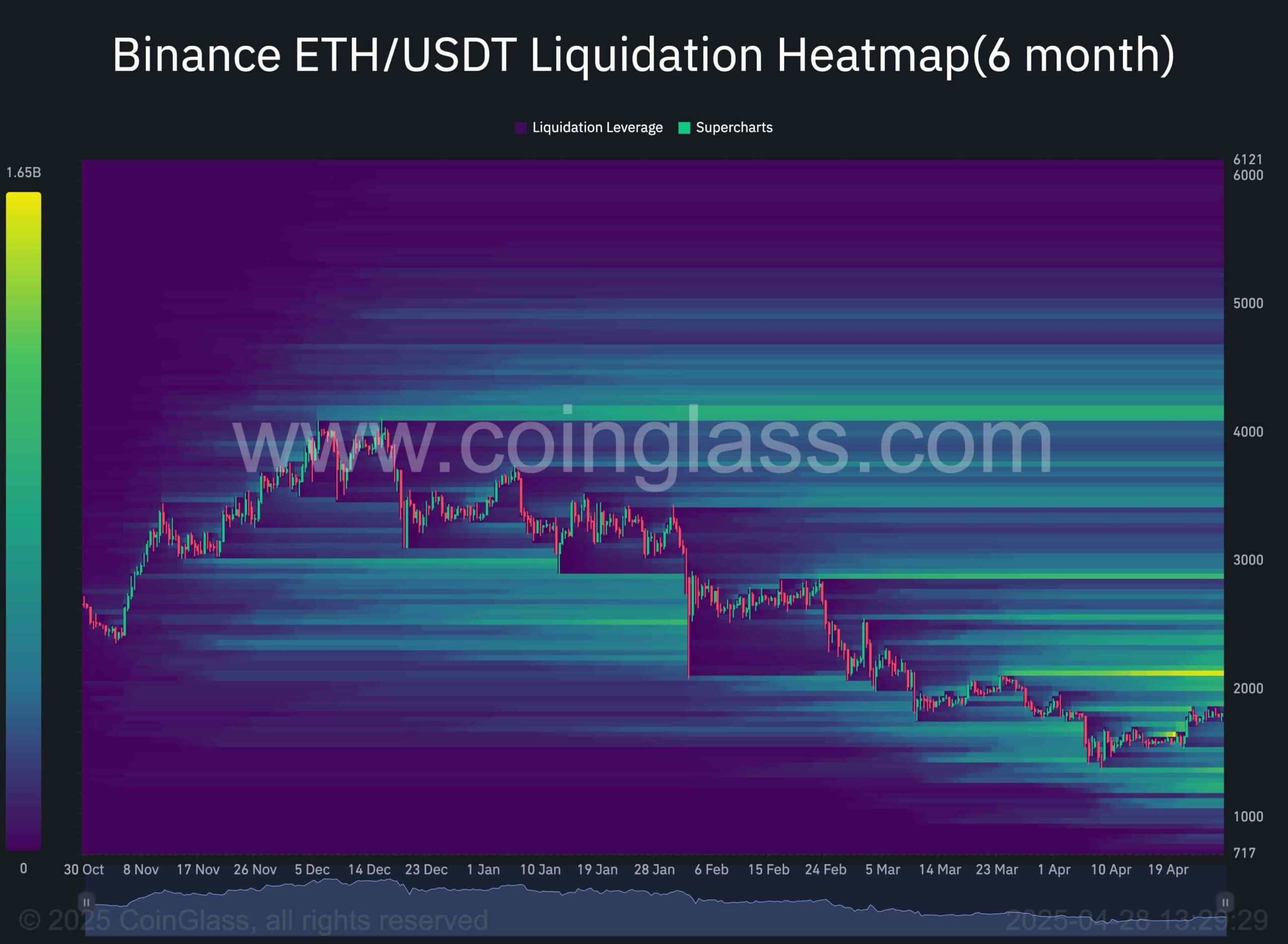

The Binance Clearing Heatmap continues to offer invaluable perception into Ethereum's present market construction and potential future value actions. Fluidity zones clustered round key psychological ranges typically are likely to act as magnets and entice costs as market members attempt to trigger cease losses and liquidation.

Following current vital downtrends, a major focus of liquidation ranges fashioned simply above the earlier swing of Ethereum round the important thing $2K mark. Traditionally, in periods of restoration or bullish sentiment, the market is drawn to such liquidity pockets. Institutional gamers and sensible cash members try to misuse sellers trapped by inflicting compelled liquidation.

At present, Ethereum's value motion reveals development in energy that has efficiently rebounded from a significant assist space of $1.5,000, rebounding key know-how ranges. If property proceed to have upward momentum and enter a $2,000 liquidity cluster, a cascade of quick liquidation might be unlocked. This injects further volatility, amplifies the acquisition stress, and quickly pushes Ethereum in the direction of the following crucial zone of resistance, near $2.5,000.